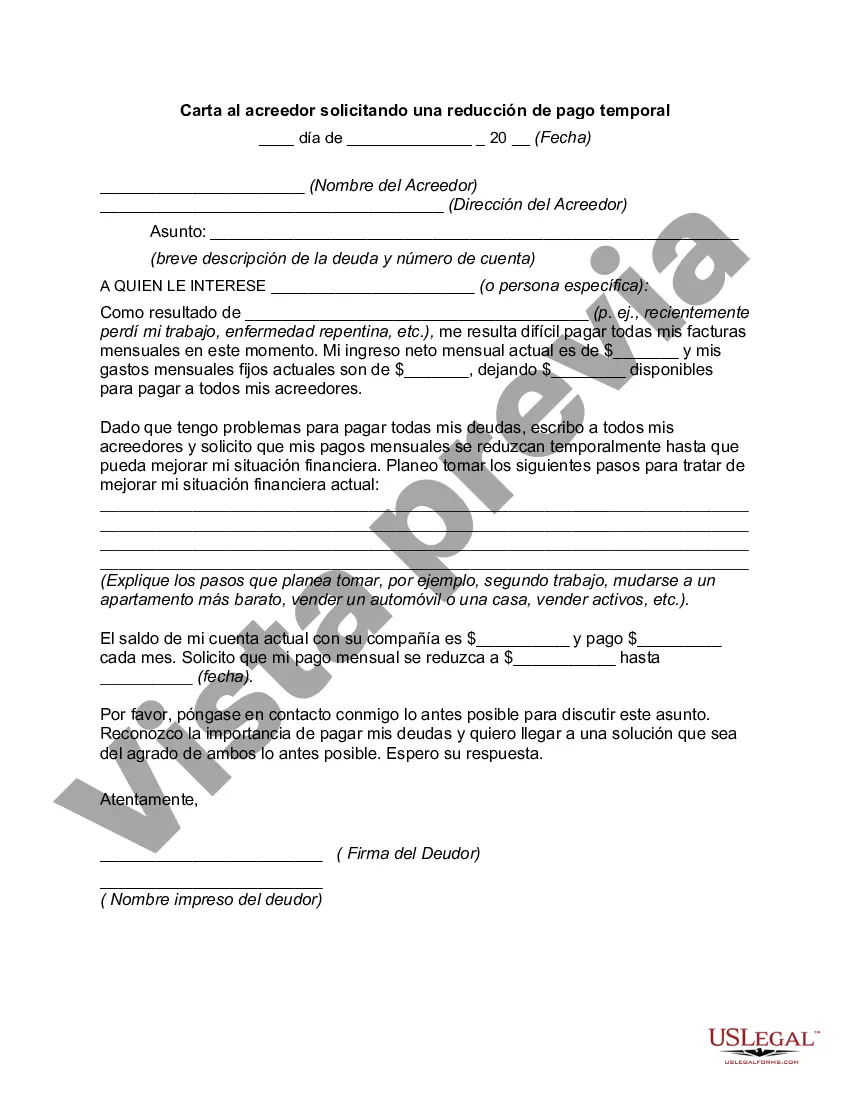

Title: Understanding the Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction Introduction: The Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction is a formal written request sent by borrowers in the state of Oklahoma to their creditors seeking a temporary reduction in their scheduled loan repayment amount. With the aim of alleviating financial hardships faced by borrowers, this letter outlines the specific details of the request, including reasons for financial hardship and proposed payment reduction plans. Types of Oklahoma Letters to Creditor Requesting a Temporary Payment Reduction: 1. Mortgage Payment Reduction Request Letter: This type of letter is specific to individuals struggling to meet their mortgage payment obligations due to unforeseen circumstances such as job loss, medical emergencies, or other financial difficulties. It highlights the need for a temporary payment reduction to ensure continued homeownership and avoid foreclosure. 2. Auto Loan Payment Reduction Request Letter: This letter is applicable to borrowers experiencing financial strain and difficulty in making timely payments towards their auto loans or leases. It presents a compelling case for temporary payment reduction, emphasizing the importance of maintaining the vehicle for work, family, or essential transportation needs. 3. Personal Loan Payment Reduction Request Letter: This specific letter addresses borrowers seeking a temporary reduction in payments for personal loans, including student loans, personal lines of credit, or other forms of unsecured loans. It emphasizes the reasons for financial hardship and presents a repayment proposal outlining the requested reduced payment plan. Content of an Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction: 1. Introduction: a. Address and contact details of the borrower and creditor. b. Primary objective of the letter: requesting a temporary payment reduction. 2. Body: a. Explanation of financial hardship faced: i. Job loss, reduction in income, or unexpected expenses. ii. Relevant supporting documentation, if necessary. b. Statement of intent to honor financial obligations: i. Assurance of the borrower's commitment to paying off the loan. ii. Explanation of how temporary relief will enable a faster return to regular payments. c. Proposed reduced payment plan: i. Clearly state the requested reduced payment amount. ii. Suggest a timeline for the temporary arrangement. iii. Highlight any potential impact on outstanding interest or principal payments. d. Supporting evidence: i. Additional documents substantiating the borrower's financial situation (if applicable). ii. Previous payment history (to demonstrate prior reliability). 3. Conclusion: a. Express gratitude for the creditor's consideration and understanding. b. Provide contact information for any further correspondence. c. Request written confirmation of the temporary payment reduction agreement. Closing: The Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction is a vital tool for borrowers to communicate their financial hardships and seek temporary relief from creditors. By employing appropriate keywords and addressing specific loan types, borrowers can construct a compelling case for their payment reduction request, increasing the chances of a favorable response from creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Oklahoma Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

Have you been within a placement the place you need to have papers for possibly organization or person purposes just about every working day? There are a variety of legal file web templates available online, but locating ones you can rely isn`t easy. US Legal Forms offers 1000s of form web templates, like the Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction, which can be published in order to meet state and federal specifications.

When you are already informed about US Legal Forms site and possess an account, merely log in. Afterward, you can download the Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction template.

Should you not offer an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Discover the form you require and ensure it is for your appropriate metropolis/state.

- Take advantage of the Review option to review the shape.

- Read the description to actually have chosen the proper form.

- In the event the form isn`t what you are seeking, make use of the Look for area to find the form that meets your needs and specifications.

- Once you discover the appropriate form, simply click Get now.

- Opt for the rates prepare you want, submit the necessary information and facts to create your bank account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Choose a practical paper structure and download your version.

Find each of the file web templates you may have purchased in the My Forms food list. You can aquire a extra version of Oklahoma Letter to Creditor Requesting a Temporary Payment Reduction whenever, if necessary. Just click on the necessary form to download or produce the file template.

Use US Legal Forms, the most considerable variety of legal forms, in order to save time as well as steer clear of faults. The service offers skillfully created legal file web templates which can be used for a selection of purposes. Make an account on US Legal Forms and initiate making your lifestyle easier.