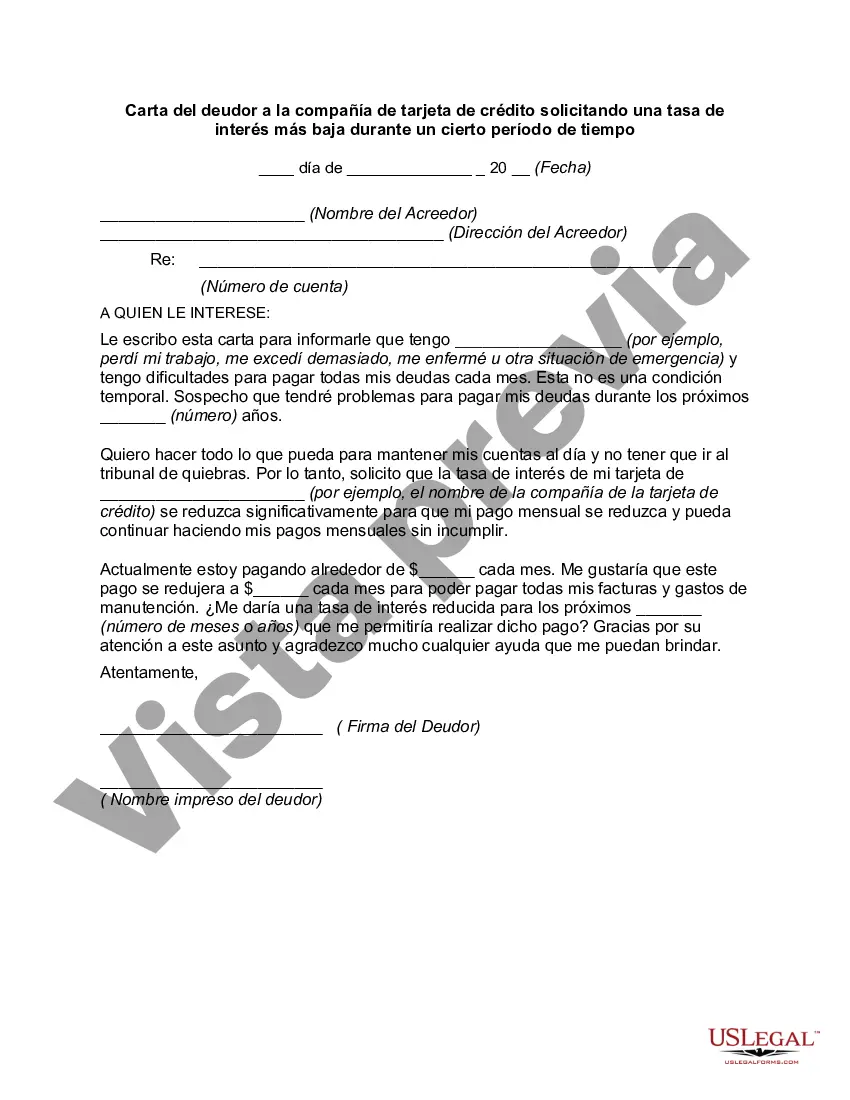

Title: Applying for an Oklahoma Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time Introduction: In this article, we will provide a detailed description of what an Oklahoma Letter from Debtor to Credit Card Company is, and how to effectively request a lower interest rate for a specific period of time. This article aims to provide valuable information to individuals residing in Oklahoma who are seeking financial relief and better interest rates on their credit card balances. 1. Understanding an Oklahoma Letter from Debtor to Credit Card Company: An Oklahoma Letter from Debtor to Credit Card Company is a formal written document submitted by a credit card holder residing in the state of Oklahoma. It allows the debtor to request a reduction in their credit card's interest rate for a specific period, potentially providing them with financial relief. 2. Importance of Lowering Interest Rates: Lowering interest rates can have a significant impact on a debtor's financial situation. By reducing the interest burden, individuals can pay off their credit card debt more quickly and save money in the process. Lower interest rates can also help individuals regain control over their finances and create a more solid financial foundation. 3. Elements to Include in The Letter: When drafting an Oklahoma Letter from Debtor to Credit Card Company requesting a lower interest rate, certain key elements should be included. These elements are: a) Introduction and identification: Address the credit card company directly, stating the account holder's name, account number, and contact information. b) Subject and purpose: Clearly state the purpose of the letter, which is to request a lower interest rate for a specific period of time. c) Explanation and justification: Provide a clear explanation of the reasons for seeking a lower interest rate, such as financial hardships or high-interest charges compared to other credit card providers. Include details like income changes, unexpected expenses, or other factors affecting your ability to pay off the debt. d) Proposal for lower interest rate: Suggest a specific reduced interest rate and the desired duration for this lower rate. Be reasonable and ensure it aligns with your financial capabilities. e) Supporting documentation: Include any supporting documents, such as bank statements, pay stubs, or official documentation, to strengthen your case and provide evidence of your financial situation. f) Closing and contact information: Conclude the letter professionally, expressing appreciation for their consideration and providing your contact details for further discussion. 4. Types of Oklahoma Letters from Debtor to Credit Card Company: While the general structure of the letter remains the same, specific variations may include: a) Financial hardship variation: This type of letter highlights the individual's financial difficulties, such as job loss, medical emergencies, or unexpected expenses, emphasizing the need for a lower interest rate to maintain manageable debt payments during challenging times. b) Competitive interest rate variation: This type of letter expresses awareness of lower interest rates offered by other credit card providers, aiming to negotiate a competitive interest rate with the current credit card company to prevent switching to a more favorable alternative. Conclusion: Writing an Oklahoma Letter from Debtor to Credit Card Company requesting a lower interest rate requires careful consideration, honest justification, and a well-presented proposal. By following the outlined structure and including relevant supporting documentation, individuals can significantly increase their chances of securing a lower interest rate for a predetermined period. It is vital to remember to remain professional throughout the process and express gratitude for the credit card company's consideration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Carta del deudor a la compañía de tarjeta de crédito solicitando una tasa de interés más baja durante un cierto período de tiempo - Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Oklahoma Carta Del Deudor A La Compañía De Tarjeta De Crédito Solicitando Una Tasa De Interés Más Baja Durante Un Cierto Período De Tiempo?

Choosing the best legitimate file template can be a battle. Naturally, there are a lot of themes accessible on the Internet, but how would you discover the legitimate form you need? Take advantage of the US Legal Forms internet site. The assistance offers 1000s of themes, such as the Oklahoma Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, that can be used for business and personal needs. Each of the forms are checked by pros and meet up with federal and state requirements.

When you are previously listed, log in to your account and click on the Obtain switch to obtain the Oklahoma Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Use your account to look through the legitimate forms you might have acquired formerly. Proceed to the My Forms tab of your account and obtain an additional copy in the file you need.

When you are a fresh customer of US Legal Forms, listed below are basic instructions for you to follow:

- First, make certain you have selected the proper form for your personal metropolis/county. You are able to examine the shape using the Review switch and look at the shape explanation to make sure it will be the best for you.

- In case the form is not going to meet up with your needs, use the Seach industry to discover the appropriate form.

- When you are positive that the shape is suitable, click on the Buy now switch to obtain the form.

- Opt for the prices prepare you desire and enter in the essential information and facts. Design your account and pay money for an order utilizing your PayPal account or bank card.

- Select the data file file format and obtain the legitimate file template to your system.

- Total, modify and produce and signal the obtained Oklahoma Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms is definitely the largest local library of legitimate forms in which you can see different file themes. Take advantage of the company to obtain skillfully-created files that follow state requirements.