Oklahoma Employee Lending Agreement is a legal document that outlines the terms and conditions under which an employer provides financial assistance or loans to its employees. This agreement governs the borrowing and repayment process, ensuring that both parties are protected and that the loan is handled responsibly. The primary purpose of an Oklahoma Employee Lending Agreement is to establish clear guidelines regarding the loan amount, interest rate, repayment schedule, and any other relevant terms. It is crucial for employers and employees to reach a mutual understanding and agreement on these aspects to avoid any misunderstandings or disputes in the future. There can be different types of Oklahoma Employee Lending Agreements applicable depending on the specific circumstances and the purpose of the loan. Some common types include: 1. Personal loans: Employers may offer personal loans to employees to cover unexpected expenses, medical bills, or other urgent financial needs. These loans are typically interest-bearing and can be repaid in installments over a predetermined period. 2. Educational loans: Certain employers may provide financial assistance to employees for education-related expenses, such as tuition fees, books, or certification programs. The Oklahoma Employee Lending Agreement for educational loans may include provisions for repayment arrangements or possible forgiveness based on tenure or performance. 3. Relocation loans: In cases where employees are required to relocate for work purposes, employers may offer relocation loans to help cover expenses such as moving costs, rent deposits, or temporary housing. The agreement would outline how and when the loan would be repaid, potentially through salary deductions or other arrangements. 4. Employee purchase programs: Some companies provide their employees with the opportunity to purchase certain goods or services at discounted rates through financing options. An Oklahoma Employee Lending Agreement for such programs would define the terms of the loan, including interest rates, repayment periods, and any applicable fees. Regardless of the type of Oklahoma Employee Lending Agreement, it is essential that all relevant details are clearly stated and agreed upon by both the employer and employee. It is advisable for both parties to consult legal professionals to ensure compliance with local employment laws and to protect their rights and interests.

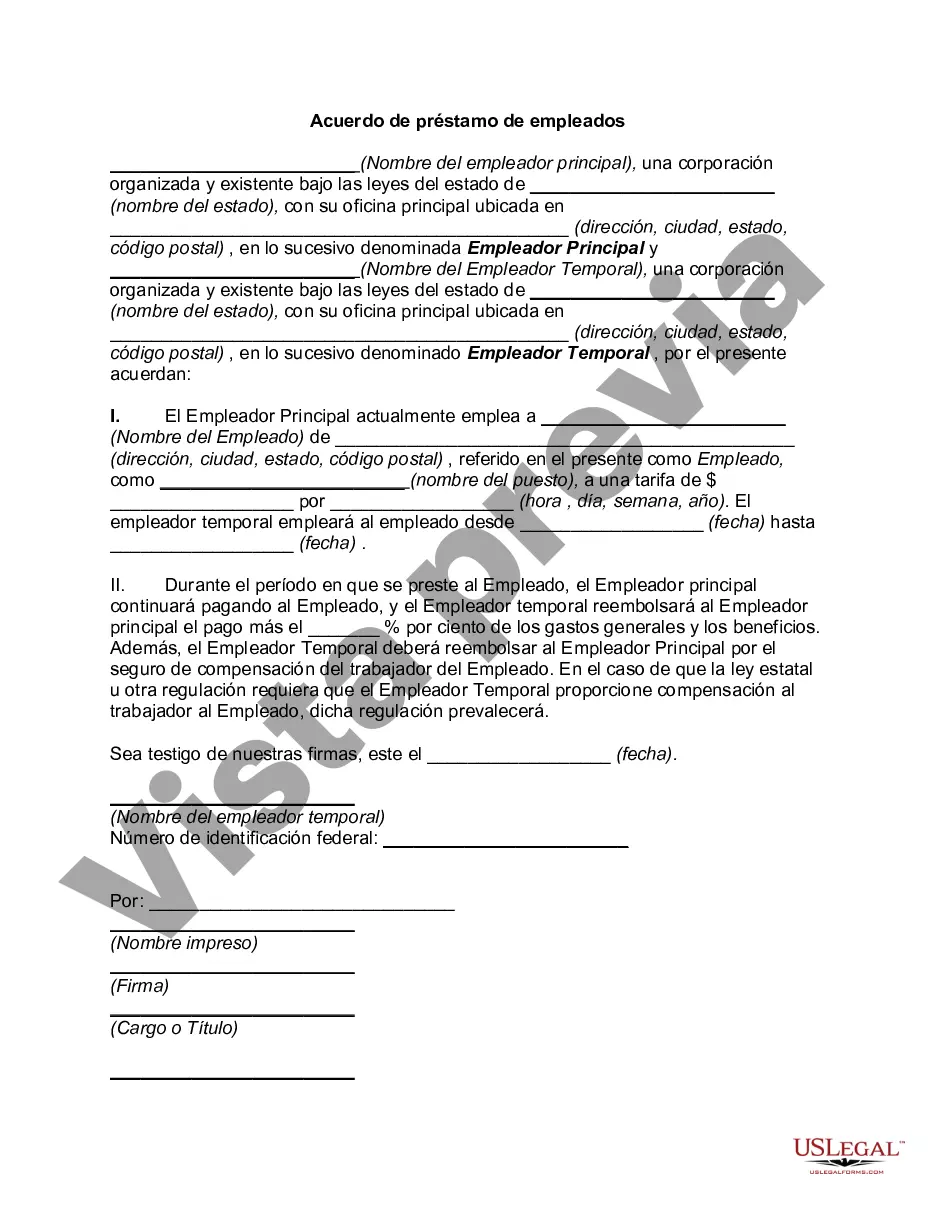

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Acuerdo de préstamo de empleados - Employee Lending Agreement

Description

How to fill out Oklahoma Acuerdo De Préstamo De Empleados?

You may spend hours on the Internet trying to find the legitimate file web template that meets the federal and state needs you want. US Legal Forms offers a large number of legitimate forms that happen to be reviewed by pros. You can actually down load or produce the Oklahoma Employee Lending Agreement from your services.

If you already have a US Legal Forms bank account, you can log in and click the Obtain option. Following that, you can total, modify, produce, or sign the Oklahoma Employee Lending Agreement. Every legitimate file web template you acquire is your own for a long time. To get an additional copy for any bought form, visit the My Forms tab and click the related option.

If you use the US Legal Forms website for the first time, keep to the basic directions below:

- Initial, make sure that you have selected the right file web template for the county/area of your choice. Read the form outline to ensure you have selected the proper form. If readily available, take advantage of the Preview option to check throughout the file web template also.

- If you would like discover an additional variation from the form, take advantage of the Lookup discipline to get the web template that meets your requirements and needs.

- Upon having located the web template you would like, click on Purchase now to carry on.

- Pick the pricing plan you would like, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal bank account to cover the legitimate form.

- Pick the structure from the file and down load it for your device.

- Make changes for your file if needed. You may total, modify and sign and produce Oklahoma Employee Lending Agreement.

Obtain and produce a large number of file layouts utilizing the US Legal Forms web site, that offers the most important selection of legitimate forms. Use skilled and express-particular layouts to take on your organization or specific demands.