Title: Oklahoma Lost Receipt Form: A Comprehensive Overview and Types Introduction: The Oklahoma Lost Receipt Form serves as a vital document for individuals and businesses in the state. This detailed description will provide valuable insights into the purpose, requirements, and types of Lost Receipt Forms in Oklahoma, while incorporating relevant keywords for clarity and search optimization. Keywords: Oklahoma, Lost Receipt Form, purpose, requirements, types 1. Purpose of the Oklahoma Lost Receipt Form: The Oklahoma Lost Receipt Form is primarily used for reimbursement purposes, allowing individuals or businesses to claim expenses by providing an alternative to a physically misplaced receipt. It enables accurate record-keeping while ensuring transparency and accountability. 2. Requirements for Filing a Lost Receipt Form in Oklahoma: In order to comply with the appropriate guidelines, individuals or businesses must adhere to several mandatory requirements when filing a Lost Receipt Form. The essential elements typically include: — Full name and contact details of the individual or business submitting the form. — Date and amount of the expense incurred. — Descriptive information specifying the nature and purpose of the expense. — Justification explaining the reason for the missing receipt. — Any additional supporting documentation, such as credit card statements or email correspondence related to the expense. 3. Types of Oklahoma Lost Receipt Forms: a. Personal Lost Receipt Form: This form is applicable to individual taxpayers in Oklahoma who wish to claim expenses for personal purposes. Whether it's for medical, charity, or educational expenses, this form aids in obtaining proper reimbursement without a physical receipt. b. Business Lost Receipt Form: Designed for businesses operating within Oklahoma, this form is typically used for a wide range of expenses, including office supplies, travel, meals, and entertainment. It allows businesses to maintain accurate financial records and claim reimbursements without relying solely on lost physical receipts. c. Government Lost Receipt Form: Government agencies and entities in Oklahoma utilize this specific form to track and process expenses incurred during official duties. The form ensures proper documentation and authorizes reimbursement for lost receipts, enabling efficient financial management within government organizations. d. Rental Lost Receipt Form: This form is especially relevant in Oklahoma's real estate and rental industry. Tenants who have misplaced their rental receipts can use this form to formalize their claim for reimbursement or to prove payment if a dispute arises between the tenant and landlord. Conclusion: The Oklahoma Lost Receipt Form is an essential document that facilitates reimbursement and expense management within the state. Understanding its purpose, requirements, and various types allows individuals, businesses, and government entities to navigate the reimbursement process efficiently while maintaining accurate financial records. By utilizing the appropriate Lost Receipt Form, individuals and organizations in Oklahoma can ensure transparency, compliance, and seamless financial operations.

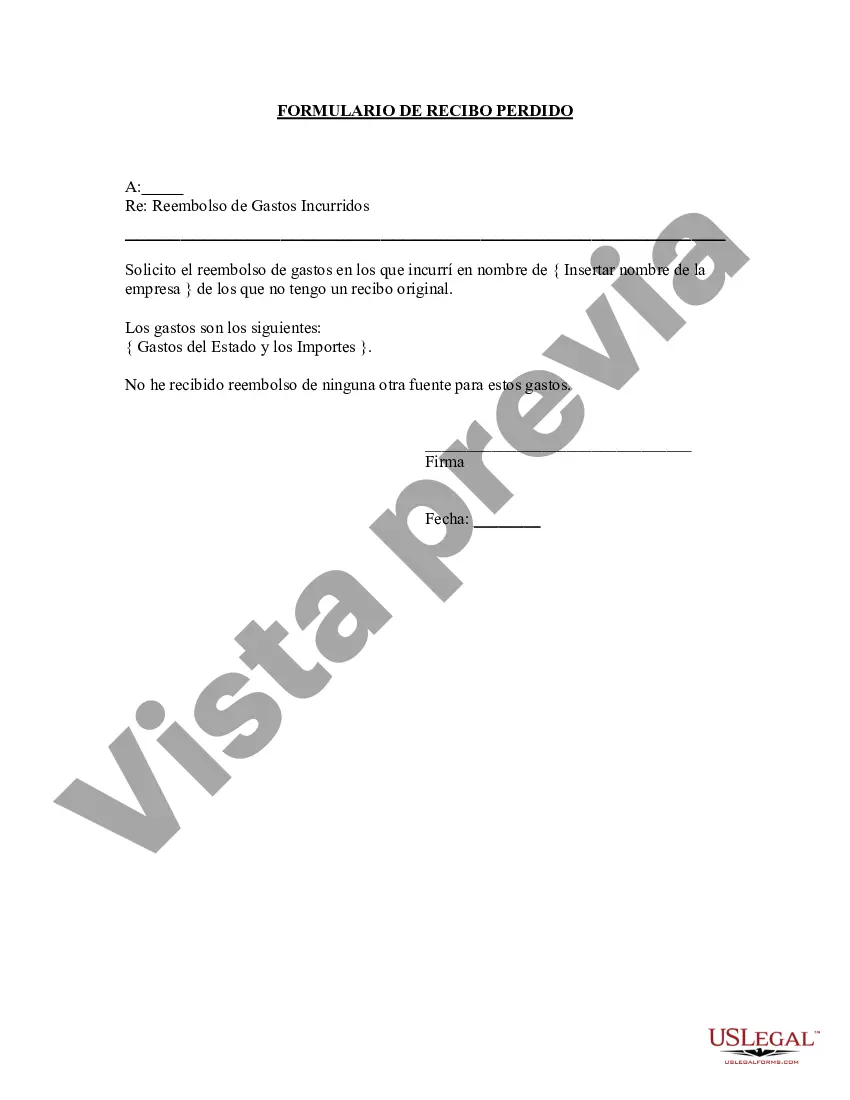

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Formulario de recibo perdido - Lost Receipt Form

Description

How to fill out Oklahoma Formulario De Recibo Perdido?

Are you currently in the place that you need to have papers for sometimes company or person functions just about every day? There are plenty of lawful record layouts available on the net, but locating kinds you can depend on isn`t easy. US Legal Forms gives thousands of develop layouts, much like the Oklahoma Lost Receipt Form, that happen to be published in order to meet federal and state requirements.

Should you be already informed about US Legal Forms internet site and also have a free account, basically log in. Following that, you are able to download the Oklahoma Lost Receipt Form format.

Should you not have an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is to the proper metropolis/area.

- Use the Preview option to examine the form.

- Look at the outline to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you`re looking for, utilize the Search field to find the develop that meets your needs and requirements.

- When you discover the proper develop, click Purchase now.

- Select the prices plan you desire, fill in the required information and facts to generate your bank account, and buy an order with your PayPal or charge card.

- Decide on a hassle-free document file format and download your version.

Get all of the record layouts you might have bought in the My Forms menu. You can obtain a further version of Oklahoma Lost Receipt Form any time, if required. Just click on the required develop to download or print the record format.

Use US Legal Forms, by far the most substantial assortment of lawful kinds, to save lots of time and avoid faults. The service gives expertly created lawful record layouts which can be used for a variety of functions. Produce a free account on US Legal Forms and start creating your life a little easier.