The Oklahoma Personnel Payroll Associate Checklist is an essential tool used by organizations operating in Oklahoma to streamline their personnel and payroll processes. This comprehensive checklist ensures that all relevant tasks and procedures are properly followed, minimizing errors and ensuring compliance with state regulations. The Oklahoma Personnel Payroll Associate Checklist can be customized based on the specific needs of an organization, but it generally includes the following key elements: 1. Employee Data Collection: This involves collecting vital information such as employee names, addresses, Social Security numbers, and employment eligibility verification documents. 2. Time and Attendance Management: Tracking employee working hours, breaks, and time off requests accurately is crucial. The checklist ensures that time cards or other systems are utilized to record and monitor employee attendance effectively. 3. Pay Rate Calculations: Payroll associates use this checklist to ensure accurate calculations of regular wages, overtime, shift differentials, and any other applicable pay rate adjustments. 4. Deductions and Benefits: The checklist assists in accurately deducting various employee benefits, such as health insurance premiums, retirement contributions, and voluntary deductions specified by employees. 5. Tax Withholding: Payroll associates must withhold the correct amount for federal and state income tax purposes. The checklist guides them through the calculation and withholding process effectively. 6. Payroll Reporting: This includes generating and reviewing payroll reports, ensuring that all employee compensation, taxes, and deductions are accurately recorded, and complying with required reporting deadlines. 7. Compliance with Labor Laws: The checklist incorporates compliance with Oklahoma labor laws and regulations, such as minimum wage laws, leave entitlements (e.g., sick leave or family leave), and any other applicable employment legislation. Different types of Oklahoma Personnel Payroll Associate Checklists may include specific sections tailored to different industries or sectors, such as manufacturing, healthcare, or retail. Additionally, some organizations may have multiple checklists for different personnel categories, like full-time employees, part-time employees, or contractors. Overall, the Oklahoma Personnel Payroll Associate Checklist is an indispensable tool for any organization aiming to ensure accurate payroll processing, timely reporting, and compliance with state regulations. By following this comprehensive checklist, payroll associates can confidently carry out their responsibilities, minimizing errors and contributing to smooth personnel and payroll management practices.

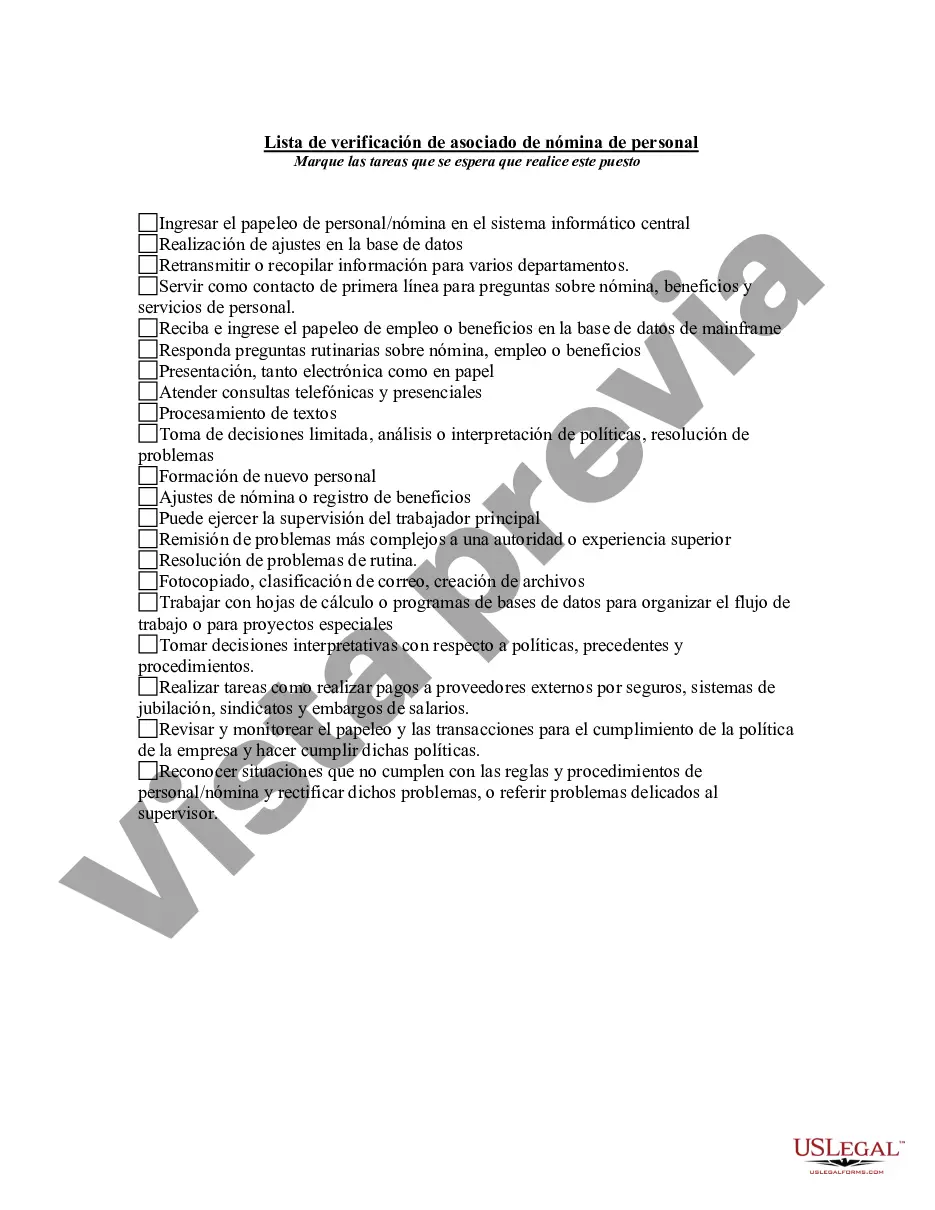

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Lista de verificación de asociado de nómina de personal - Personnel Payroll Associate Checklist

Description

How to fill out Oklahoma Lista De Verificación De Asociado De Nómina De Personal?

Are you presently inside a place where you will need paperwork for either business or individual purposes virtually every time? There are a lot of lawful record layouts available online, but discovering versions you can trust is not straightforward. US Legal Forms delivers 1000s of form layouts, such as the Oklahoma Personnel Payroll Associate Checklist, that happen to be written in order to meet federal and state requirements.

In case you are already informed about US Legal Forms site and also have a free account, merely log in. After that, you are able to acquire the Oklahoma Personnel Payroll Associate Checklist design.

Should you not come with an account and want to begin to use US Legal Forms, adopt these measures:

- Get the form you want and ensure it is for your right city/area.

- Utilize the Preview key to analyze the shape.

- Look at the outline to actually have selected the correct form.

- In the event the form is not what you are trying to find, make use of the Search area to discover the form that fits your needs and requirements.

- When you get the right form, click on Get now.

- Pick the prices plan you desire, submit the desired details to generate your bank account, and pay money for the order with your PayPal or Visa or Mastercard.

- Choose a convenient file format and acquire your backup.

Locate all of the record layouts you may have bought in the My Forms food list. You may get a further backup of Oklahoma Personnel Payroll Associate Checklist any time, if necessary. Just click the needed form to acquire or printing the record design.

Use US Legal Forms, one of the most extensive collection of lawful forms, to save lots of time and steer clear of blunders. The service delivers appropriately produced lawful record layouts which can be used for a selection of purposes. Create a free account on US Legal Forms and initiate creating your life easier.