Title: Oklahoma Resolution of Meeting of LLC Members to Loan Money — Detailed Description and Types Explained Introduction: The Oklahoma Resolution of Meeting of LLC Members to Loan Money refers to a legal document that outlines the proceedings and decisions of a meeting held by limited liability company (LLC) members, specifically regarding the loaning of money. This resolution is crucial in documenting the terms, conditions, and approval of the loan, ensuring transparency and compliance with the laws of the state of Oklahoma. Here, we will explore the vital details and types of resolutions related to this topic. Key Terms and Keywords: — Oklahoma Resolutiomeetingin— - LLC Members — Loan Money - Legal Documen— - Terms and Conditions — Transparency Compliancenc— - State of Oklahoma Types of Oklahoma Resolution of Meeting of LLC Members to Loan Money: 1. Standard Loan Resolution: This type of resolution typically highlights the specifics of a loan transaction, such as the loan amount, repayment terms, interest rates, and any security or collateral involved. It documents the agreement and approval of LLC members to obtain a loan or extend credit on behalf of the company. 2. Expansion Loan Resolution: When an LLC seeks additional funds to support its expansion plans, this type of resolution is utilized. It outlines the purpose of the loan, the projected use of funds, the anticipated benefits for the company, and any new terms or conditions related to the loan. 3. Emergency Loan Resolution: In case of unforeseen circumstances or urgent financial requirements, an emergency loan resolution is drafted during a meeting of LLC members. This type of resolution allows the company to promptly access funds or credit lines, specifying the reason for the loan and the steps to be taken for repayment within a defined timeframe. 4. Loan Modification Resolution: If an LLC finds it necessary to modify the terms of an existing loan, a loan modification resolution ensues during a meeting of members. This resolution details the proposed changes to the loan agreement, such as adjustment of interest rates, extension of repayment periods, or amendments to collateral requirements. 5. Inter-Company Loan Resolution: In situations where one LLC member provides funds to another member within the same LLC, an inter-company loan resolution is formulated. This document establishes the terms, interest rates, repayment methods, and collateral (if applicable) for the loan, ensuring transparency and preventing potential conflicts of interest. Conclusion: The Oklahoma Resolution of Meeting of LLC Members to Loan Money serves as a vital framework for documenting important financial decisions made by LLC members regarding loans. It provides a clear blueprint for the loan process, whether it involves standard loans, expansion loans, emergency loans, loan modifications, or inter-company lending. By incorporating relevant keywords and understanding the different types of resolutions available, LCS can ensure compliance, transparency, and legal adherence as they navigate the loan mechanisms in the state of Oklahoma.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Resolución de la reunión de los miembros de la LLC para prestar dinero - Resolution of Meeting of LLC Members to Loan Money

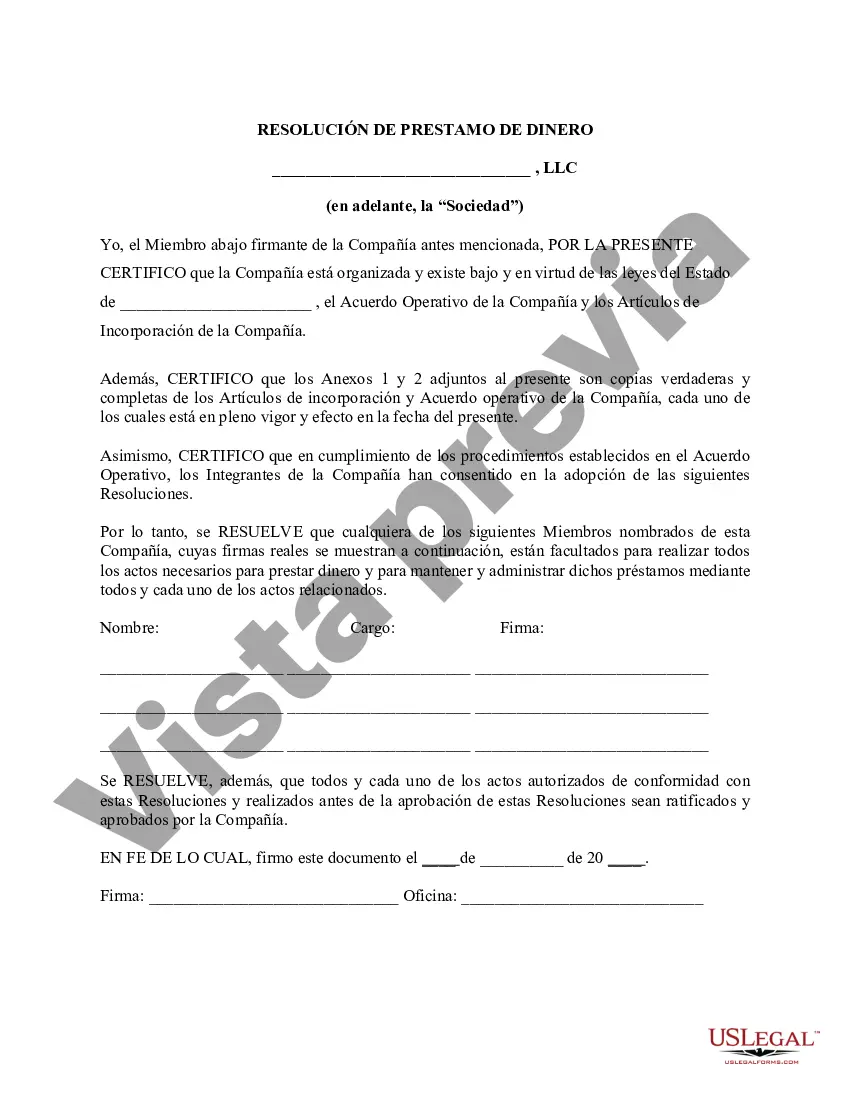

Description

How to fill out Oklahoma Resolución De La Reunión De Los Miembros De La LLC Para Prestar Dinero?

If you want to total, acquire, or produce legitimate papers themes, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on-line. Utilize the site`s simple and practical lookup to find the files you need. Different themes for organization and individual functions are sorted by categories and says, or key phrases. Use US Legal Forms to find the Oklahoma Resolution of Meeting of LLC Members to Loan Money with a few clicks.

In case you are previously a US Legal Forms buyer, log in to the profile and click on the Obtain key to obtain the Oklahoma Resolution of Meeting of LLC Members to Loan Money. Also you can entry kinds you earlier acquired from the My Forms tab of your profile.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate area/nation.

- Step 2. Take advantage of the Review option to check out the form`s content. Never overlook to read through the explanation.

- Step 3. In case you are unhappy with the form, make use of the Research field at the top of the screen to find other models of the legitimate form format.

- Step 4. When you have identified the form you need, go through the Purchase now key. Pick the prices strategy you like and add your accreditations to register for the profile.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Select the formatting of the legitimate form and acquire it in your device.

- Step 7. Complete, revise and produce or sign the Oklahoma Resolution of Meeting of LLC Members to Loan Money.

Each legitimate papers format you purchase is your own eternally. You have acces to every form you acquired with your acccount. Select the My Forms portion and choose a form to produce or acquire yet again.

Contend and acquire, and produce the Oklahoma Resolution of Meeting of LLC Members to Loan Money with US Legal Forms. There are many expert and condition-particular kinds you may use for your personal organization or individual requirements.