The Oklahoma Waiver of Qualified Joint and Survivor Annuity (JSA) is an important provision that impacts retirement planning and the distribution of pension benefits. JSA is a safeguard designed to protect the interests of spouses who may outlive the primary annuitant or pension plan holder. In this article, we will explore the intricacies of the Oklahoma Waiver of Qualified Joint and Survivor Annuity, its purpose, and the different types that exist. The JSA is a legal requirement under the Employee Retirement Income Security Act (ERICA) that mandates pension plans to provide certain specific benefits to a married participant and their spouse. Specifically, it ensures that if a participant chooses to receive their pension benefits in any form other than a joint and survivor annuity, the spouse's consent, in writing, is obtained. This waiver gives the participant the option to forgo the JSA, allowing them to choose an alternative form of distribution, typically a single-life annuity or a lump sum payment. However, it's crucial to note that by waiving the JSA, the participant and their spouse effectively give up the lifelong financial protection that a joint and survivor annuity can offer. In Oklahoma, there are two primary types of viewable SAS: 1. Traditional JSA: In this type of annuity, the participant receives monthly payments during their lifetime, and upon their death, the surviving spouse continues to receive a predetermined percentage (usually 50% or 100%) of the original benefit for the rest of their life. 2. Pop-up JSA: With a pop-up JSA, the participant receives the same monthly payments during their lifetime as in a traditional JSA. However, if the participant's spouse predeceases them, the monthly payments "pop up" to the higher single-life annuity amount for the remaining lifetime of the participant. It's important to understand the implications and consequences of waiving the JSA. The decision to waive should be made after careful consideration of the financial needs and objectives of both the participant and their spouse. Consulting with a qualified financial advisor or an attorney specializing in retirement planning is highly recommended navigating this complex aspect of pension benefits. In summary, the Oklahoma Waiver of Qualified Joint and Survivor Annuity serves as a protective measure for married participants and their spouses in pension plans. By providing different options for annuity distributions, it enables participants to tailor their retirement income strategy. However, it is crucial to approach this decision carefully, considering the potential long-term financial impact on both parties involved.

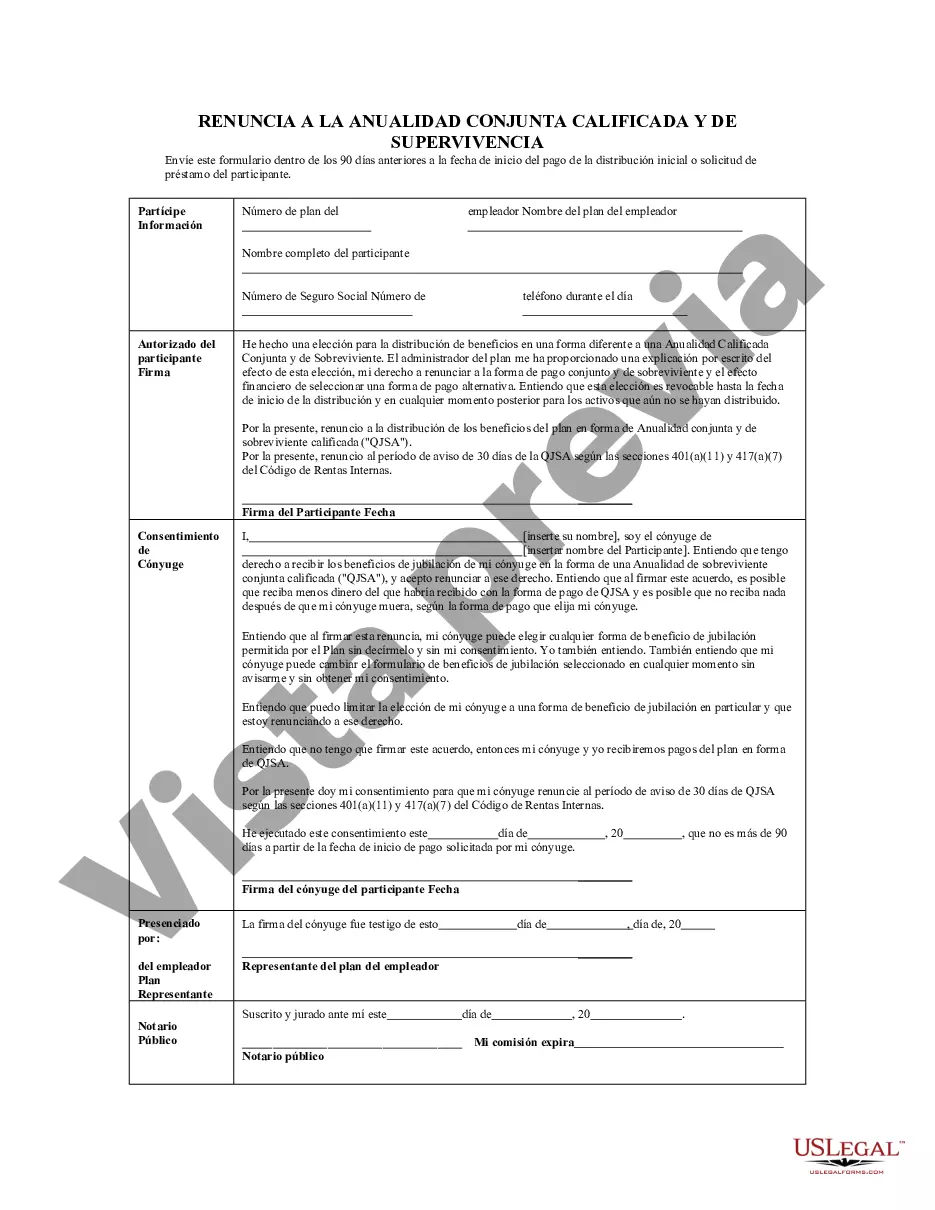

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Oklahoma Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Choosing the right lawful file web template can be a battle. Naturally, there are a lot of layouts available on the Internet, but how do you discover the lawful form you require? Utilize the US Legal Forms internet site. The support delivers a huge number of layouts, for example the Oklahoma Waiver of Qualified Joint and Survivor Annuity - QJSA, that can be used for company and personal demands. Each of the varieties are checked by pros and satisfy federal and state specifications.

When you are already registered, log in for your bank account and click the Acquire key to get the Oklahoma Waiver of Qualified Joint and Survivor Annuity - QJSA. Utilize your bank account to appear throughout the lawful varieties you may have purchased formerly. Visit the My Forms tab of the bank account and have one more backup from the file you require.

When you are a fresh end user of US Legal Forms, here are easy directions that you should comply with:

- Initially, be sure you have selected the appropriate form for the city/state. It is possible to look through the shape using the Review key and study the shape description to make sure it is the right one for you.

- If the form is not going to satisfy your needs, utilize the Seach area to get the correct form.

- When you are positive that the shape would work, select the Get now key to get the form.

- Choose the pricing strategy you would like and type in the necessary information and facts. Design your bank account and pay money for the order making use of your PayPal bank account or Visa or Mastercard.

- Pick the file format and acquire the lawful file web template for your device.

- Comprehensive, modify and print and indication the acquired Oklahoma Waiver of Qualified Joint and Survivor Annuity - QJSA.

US Legal Forms is the greatest collection of lawful varieties that you can find different file layouts. Utilize the company to acquire skillfully-made files that comply with condition specifications.