The Oklahoma Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. is an executive compensation program specific to nonemployee directors of the company who are based in Oklahoma. This plan allows eligible nonemployee directors to receive stock options as a form of incentive and reward for their contributions to the company's growth and success. Under this plan, nonemployee directors are granted the right to purchase a specific number of shares of Cocos, Inc. at a predetermined exercise price within a specified time period. These stock options provide directors with the opportunity to benefit from any increase in the company's stock price over time. The Oklahoma Nonemployee Directors Nonqualified Stock Option Plan is designed to align the interests of nonemployee directors with those of the company's shareholders. By offering stock options, the plan encourages directors to make decisions that benefit the long-term success and profitability of Cocos, Inc., as this directly impacts the value of their stock options. Some different variations or types of this plan may include: 1. Standard Stock Option: This is the most common type of nonqualified stock option plan, where directors have the right to purchase company stock at a specific exercise price within a designated period. 2. Performance-Based Stock Option: Some variations of the Oklahoma Nonemployee Directors Nonqualified Stock Option Plan may include performance-based criteria that directors must meet in order to exercise their stock options. This can include financial targets, revenue goals, or other key performance indicators that need to be achieved by the company. 3. Vesting Schedule: Another type of variation could involve a vesting schedule, where the stock options gradually become exercisable over time. This encourages directors to remain with the company and contribute to its success for a specified period of time before fully gaining the benefit of their stock options. Overall, the Oklahoma Nonemployee Directors Nonqualified Stock Option Plan serves as a valuable tool for attracting and retaining highly qualified individuals to serve as nonemployee directors. It aligns their interests with the company's shareholders and provides them with a form of equity-based compensation that can significantly enhance their overall compensation package.

Oklahoma Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

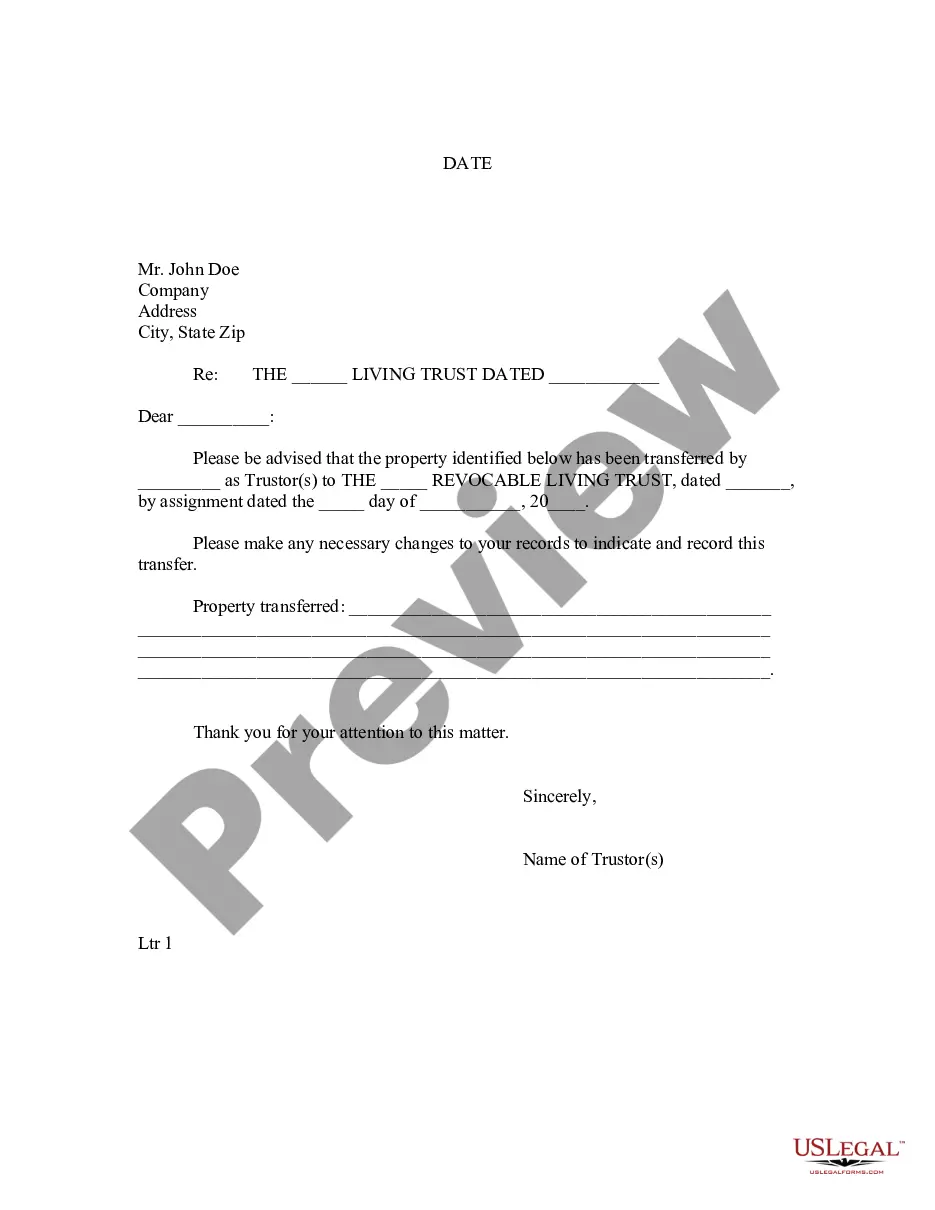

How to fill out Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

Are you in the placement where you need paperwork for both enterprise or individual purposes almost every time? There are a variety of legal papers themes available on the net, but discovering versions you can rely isn`t easy. US Legal Forms offers a huge number of develop themes, much like the Oklahoma Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc., that happen to be created to satisfy state and federal specifications.

In case you are already knowledgeable about US Legal Forms internet site and get your account, simply log in. Following that, it is possible to acquire the Oklahoma Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. design.

Unless you come with an accounts and want to begin using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is to the correct area/state.

- Utilize the Review button to review the form.

- See the explanation to ensure that you have chosen the proper develop.

- If the develop isn`t what you`re seeking, make use of the Research industry to find the develop that suits you and specifications.

- Once you discover the correct develop, click Buy now.

- Choose the costs strategy you need, complete the required details to make your money, and buy your order with your PayPal or charge card.

- Pick a practical document file format and acquire your copy.

Get each of the papers themes you may have bought in the My Forms menus. You can obtain a more copy of Oklahoma Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. any time, if necessary. Just click on the needed develop to acquire or print the papers design.

Use US Legal Forms, the most extensive collection of legal types, to save lots of time and avoid faults. The assistance offers skillfully produced legal papers themes that you can use for a selection of purposes. Generate your account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income will be included when you file your tax return.

How are NSOs taxed when exercised? In short: You pay ordinary income tax rates on the difference between the strike price and the 409A valuation. Your employer already withholds a part, but it's the bare minimum (usually 25%)

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company.

If not, you must add it to Form 1040, Line 7 when you fill out your 2023 tax return. Because you sold the stock, you must report the sale on your 2023 Schedule D. The stock sale is considered a short-term transaction because you owned the stock less than a year.