The Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes is a crucial aspect of the state's tax laws. This provision outlines the specific components that are subject to taxation, highlighting what qualifies as taxable income or assets for individuals and businesses in Oklahoma. Key Components: 1. Income Tax: The Oklahoma provision defines the taxable components of income that are subject to taxation. This includes wages, salaries, tips, dividends, interest, business profits, rental income, and any other form of income earned within the state. 2. Sales Tax: Oklahoma also levies sales tax on various taxable components. The provision clearly defines which goods and services are subject to sales tax, ensuring consistency and fairness in the tax system. This includes taxable items ranging from consumer goods to professional services. 3. Property Tax: The provision also contains guidelines for property tax, defining which components of real estate or personal property are subject to taxation. This encompasses land, buildings, vehicles, and other assets owned or held by individuals or businesses within the state. 4. Excise Tax: Oklahoma imposes excise taxes on specific products and activities that fall within taxable components. This could include gasoline, tobacco, alcohol, and various other goods or services that are subject to specific excise taxes. Types of Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes: 1. Individual Taxes: This provision specifically defines the taxable components of income for individual taxpayers, ensuring accurate reporting and collection of their income taxes. 2. Corporate Taxes: The provision also addresses the taxable components applicable to corporations operating in Oklahoma. It outlines the specific income components of corporations subject to taxation and ensures compliance with state tax regulations. 3. Sales and Use Taxes: This part of the provision focuses on taxable components relating to sales and use taxes, clarifying which goods and services are subject to taxation and ensuring consistency in tax collection across different industries. 4. Property Taxes: Within the provision, separate guidelines are included to define taxable components applicable to property taxes, providing a transparent and equitable approach to assessing property value and taxation. By having a comprehensive Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes, the state can effectively determine the tax liabilities of individuals and businesses, promoting fair taxation and supporting essential public services and infrastructure projects.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Disposición que define los componentes imponibles que caen en la definición de escalamiento de los impuestos - Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes

Description

How to fill out Oklahoma Disposición Que Define Los Componentes Imponibles Que Caen En La Definición De Escalamiento De Los Impuestos?

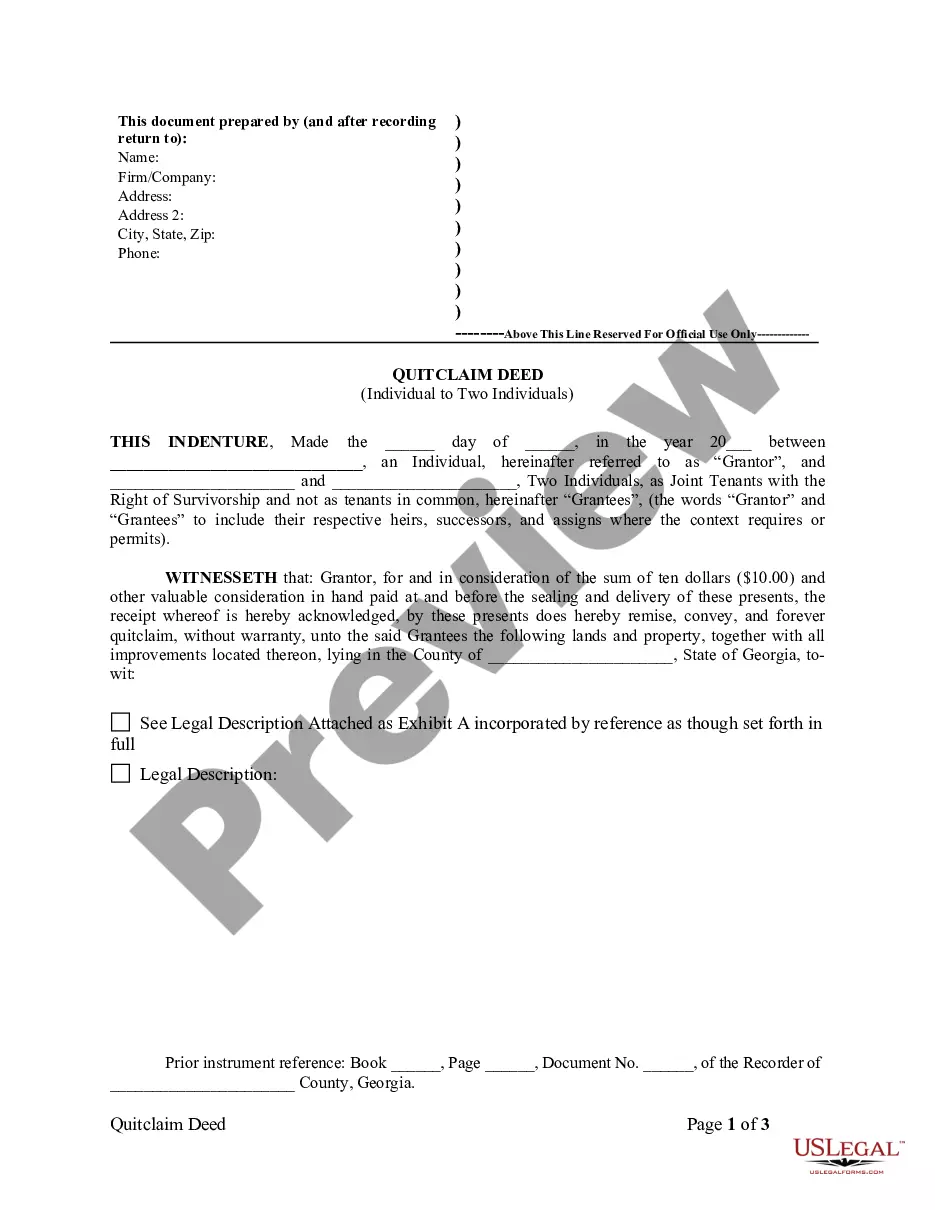

Choosing the right legitimate document design might be a have difficulties. Obviously, there are plenty of layouts accessible on the Internet, but how do you discover the legitimate kind you need? Utilize the US Legal Forms internet site. The service offers 1000s of layouts, such as the Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes, that can be used for enterprise and personal requires. Each of the types are checked out by specialists and meet state and federal specifications.

In case you are previously signed up, log in in your account and click the Acquire option to get the Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes. Make use of account to appear through the legitimate types you possess bought formerly. Proceed to the My Forms tab of your respective account and have one more backup of your document you need.

In case you are a brand new user of US Legal Forms, listed here are easy instructions for you to adhere to:

- Very first, make sure you have chosen the correct kind to your area/area. It is possible to examine the form utilizing the Preview option and browse the form description to make sure this is basically the right one for you.

- In the event the kind will not meet your requirements, take advantage of the Seach industry to find the proper kind.

- Once you are sure that the form is proper, go through the Purchase now option to get the kind.

- Opt for the pricing strategy you want and type in the essential information. Design your account and purchase your order making use of your PayPal account or bank card.

- Opt for the file file format and obtain the legitimate document design in your system.

- Full, edit and print and indication the obtained Oklahoma Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes.

US Legal Forms is definitely the biggest catalogue of legitimate types that you can find a variety of document layouts. Utilize the company to obtain expertly-manufactured papers that adhere to status specifications.