The Oklahoma State of Delaware Limited Partnership Tax Notice is an important document that provides detailed information about the tax obligations for limited partnerships registered in Delaware but conducting business operations in the state of Oklahoma. This notice outlines the specific tax requirements, due dates, and necessary forms that need to be completed by the limited partnership entity. Keywords: Oklahoma State of Delaware, Limited Partnership Tax Notice, tax obligations, limited partnerships, Delaware, business operations, tax requirements, due dates, forms, entity. Different Types of Oklahoma State of Delaware Limited Partnership Tax Notices: 1. Annual Partnership Returns: This type of tax notice is issued every year and provides instructions on how to file the annual partnership return, detailing the income, deductions, and credits of the limited partnership. 2. Estimated Tax Payments: This notice informs the limited partnership about the requirement to submit estimated tax payments in advance throughout the tax year, based on their projected total income. Guidelines and schedules for making these payments are provided. 3. Tax Clearance Certificate: In case the limited partnership plans to dissolve or withdraw from doing business in Oklahoma, this notice explains the procedure to obtain a tax clearance certificate. This certificate ensures that all tax liabilities have been settled before terminating the partnership. 4. Withholding Requirements: If the limited partnership has employees or contractors in the state of Oklahoma, this notice outlines the obligations regarding withholding income taxes from employee wages and submitting them to the state revenue agency. 5. Sales and Use Tax: Limited partnerships engaged in retail or other taxable transactions may receive a tax notice regarding sales and use tax obligations. This notice guides the partnership on how to calculate and remit sales tax on qualifying sales and usage of taxable goods and services. 6. Penalty and Audit Notices: In certain cases, the Oklahoma State of Delaware Limited Partnership Tax Notice may also pertain to penalties, interests, or audit inquiries. These notices address any non-compliance issues and provide guidance on resolving them. It is crucial for limited partnerships registered in Delaware and operating in Oklahoma to carefully review and understand the specific requirements mentioned in the Oklahoma State of Delaware Limited Partnership Tax Notice. Failure to comply with these obligations may result in penalties, interest charges, or potential legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Aviso de impuestos de sociedad limitada del estado de Delaware - State of Delaware Limited Partnership Tax Notice

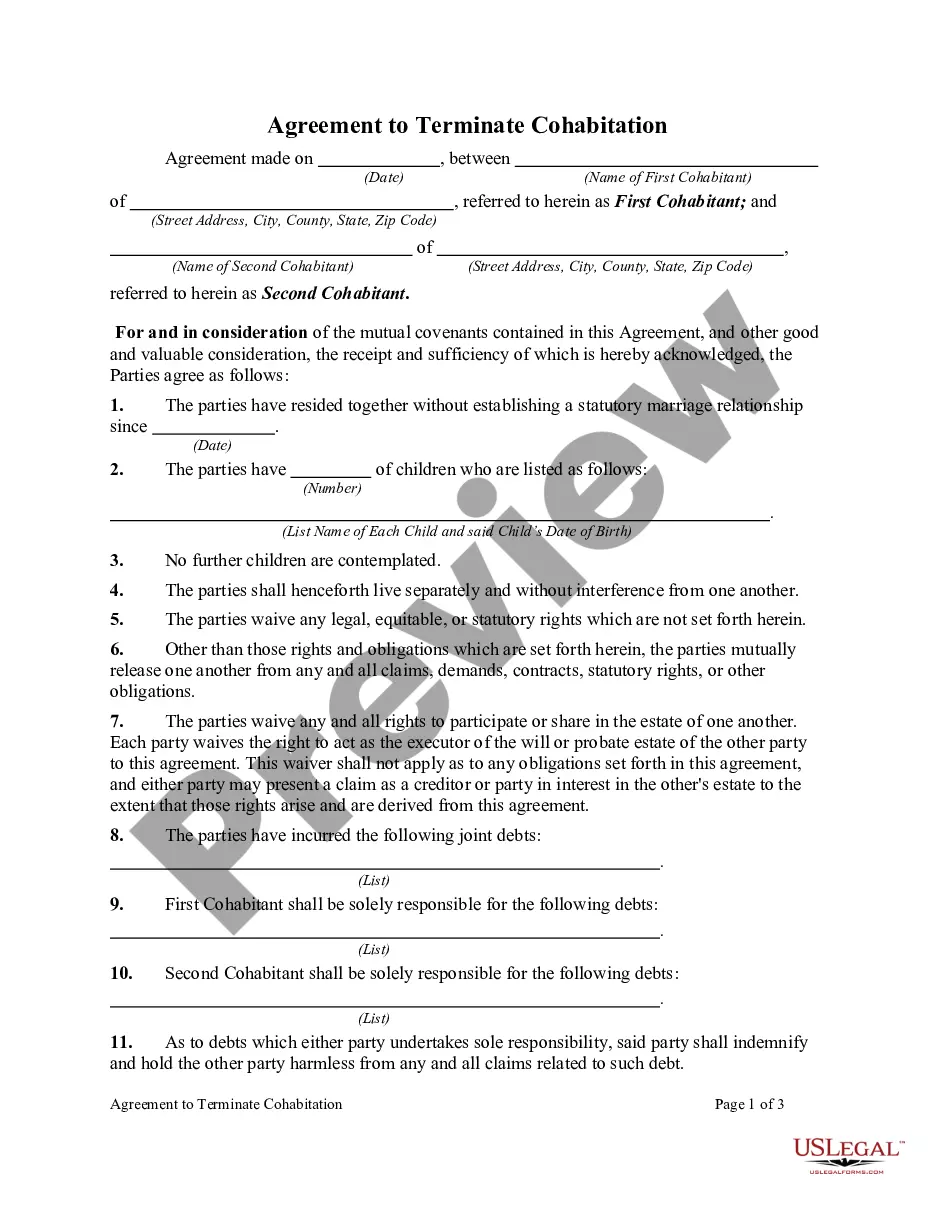

Description

How to fill out Oklahoma Aviso De Impuestos De Sociedad Limitada Del Estado De Delaware?

US Legal Forms - one of many most significant libraries of legitimate types in the United States - gives a wide range of legitimate file templates you are able to down load or print. Utilizing the internet site, you can get a large number of types for company and person functions, sorted by classes, claims, or search phrases.You can find the latest versions of types such as the Oklahoma State of Delaware Limited Partnership Tax Notice in seconds.

If you currently have a membership, log in and down load Oklahoma State of Delaware Limited Partnership Tax Notice through the US Legal Forms collection. The Obtain switch can look on every form you view. You get access to all formerly delivered electronically types inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, allow me to share simple recommendations to help you get started out:

- Be sure to have picked out the proper form for your personal metropolis/state. Go through the Preview switch to check the form`s information. Browse the form description to actually have selected the proper form.

- When the form does not match your specifications, take advantage of the Search industry on top of the display to discover the one that does.

- Should you be content with the shape, verify your decision by clicking on the Acquire now switch. Then, pick the pricing strategy you favor and offer your references to register for an accounts.

- Method the purchase. Make use of credit card or PayPal accounts to accomplish the purchase.

- Choose the formatting and down load the shape on your system.

- Make alterations. Fill out, modify and print and sign the delivered electronically Oklahoma State of Delaware Limited Partnership Tax Notice.

Each and every web template you added to your money does not have an expiration day and it is yours permanently. So, if you would like down load or print an additional copy, just visit the My Forms portion and click on about the form you need.

Obtain access to the Oklahoma State of Delaware Limited Partnership Tax Notice with US Legal Forms, probably the most considerable collection of legitimate file templates. Use a large number of specialist and state-particular templates that satisfy your business or person needs and specifications.