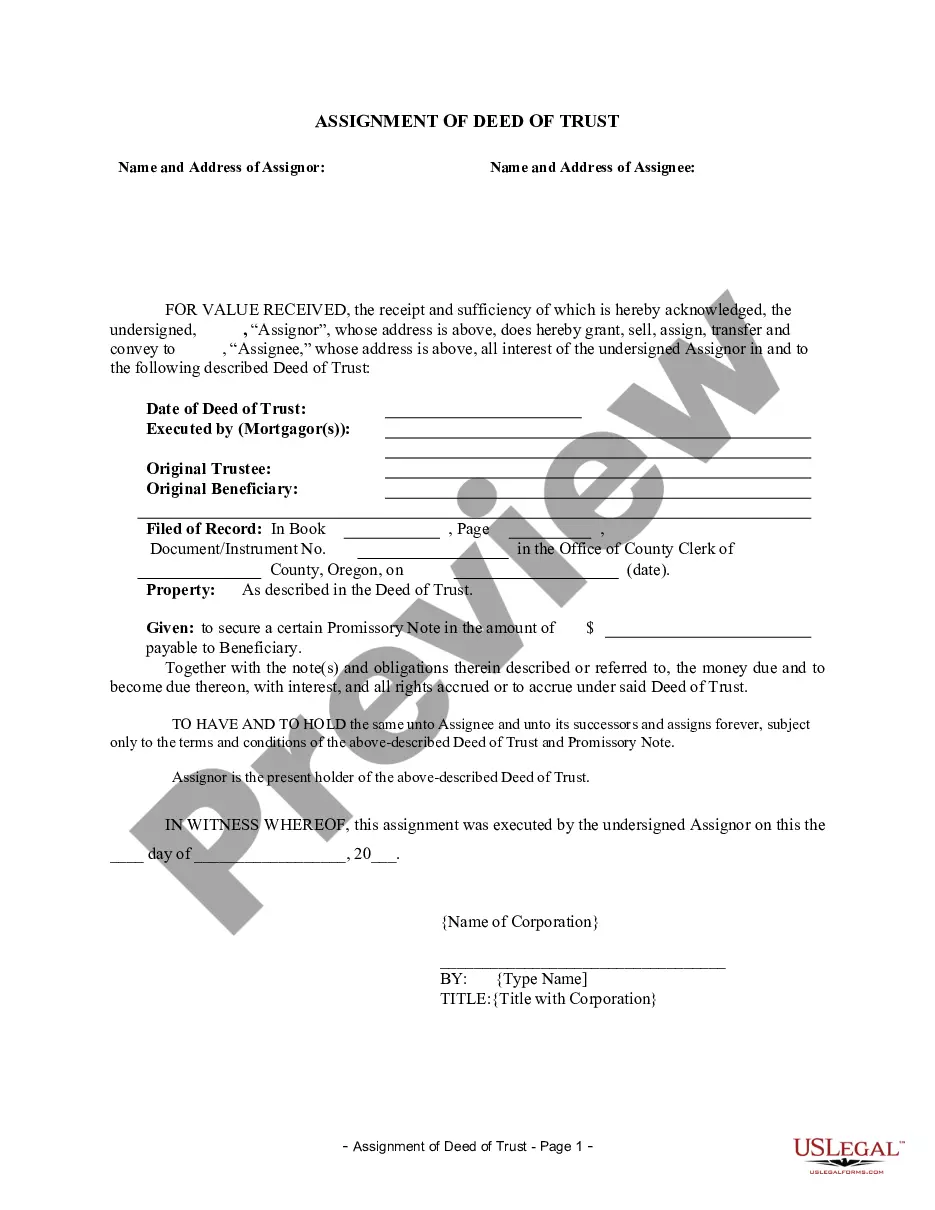

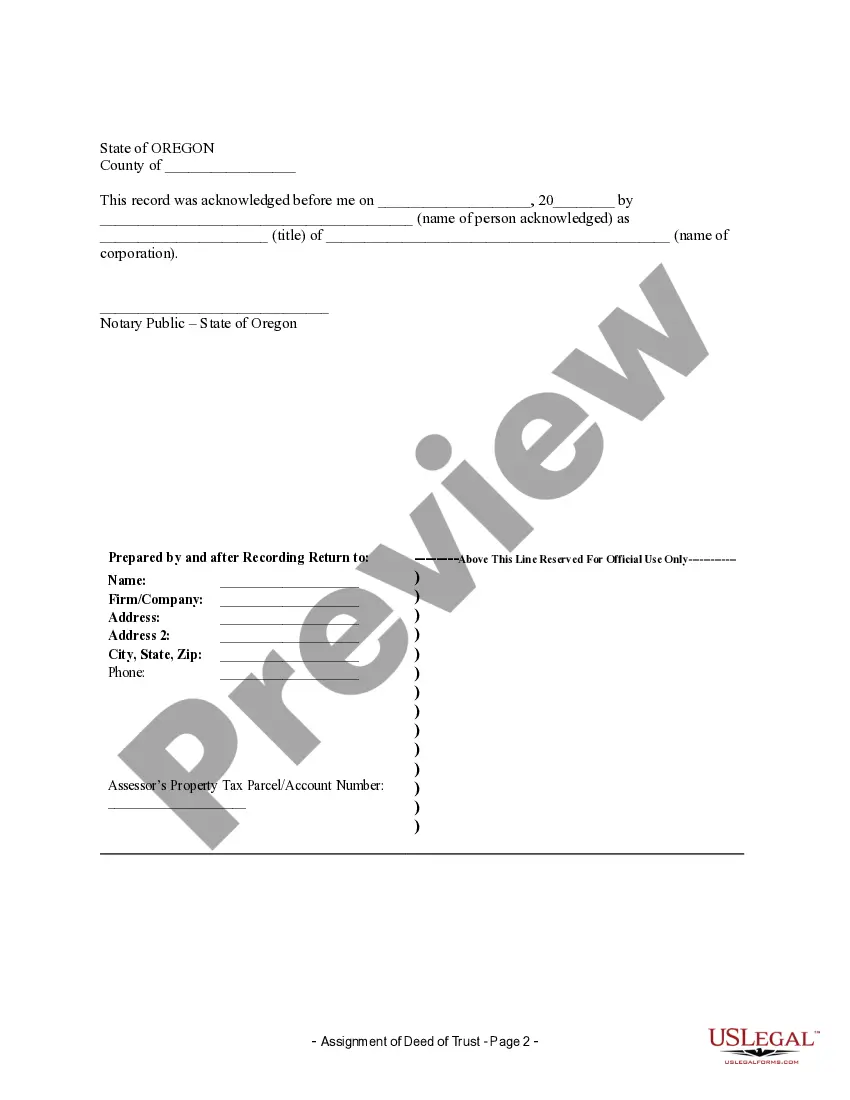

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Or Assignment Deed

Description

How to fill out Oregon Assignment Of Deed Of Trust By Corporate Mortgage Holder?

When it comes to submitting Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, you probably visualize an extensive process that involves getting a suitable sample among a huge selection of similar ones and after that needing to pay out legal counsel to fill it out for you. Generally speaking, that’s a sluggish and expensive option. Use US Legal Forms and choose the state-specific form in just clicks.

For those who have a subscription, just log in and then click Download to have the Oregon Assignment of Deed of Trust by Corporate Mortgage Holder form.

In the event you don’t have an account yet but want one, keep to the point-by-point guide listed below:

- Be sure the document you’re getting is valid in your state (or the state it’s required in).

- Do so by reading the form’s description and also by clicking on the Preview option (if available) to see the form’s information.

- Simply click Buy Now.

- Select the appropriate plan for your financial budget.

- Subscribe to an account and select how you want to pay: by PayPal or by card.

- Download the document in .pdf or .docx format.

- Get the file on the device or in your My Forms folder.

Skilled legal professionals work on drawing up our templates so that after saving, you don't have to worry about modifying content material outside of your individual details or your business’s info. Sign up for US Legal Forms and get your Oregon Assignment of Deed of Trust by Corporate Mortgage Holder example now.