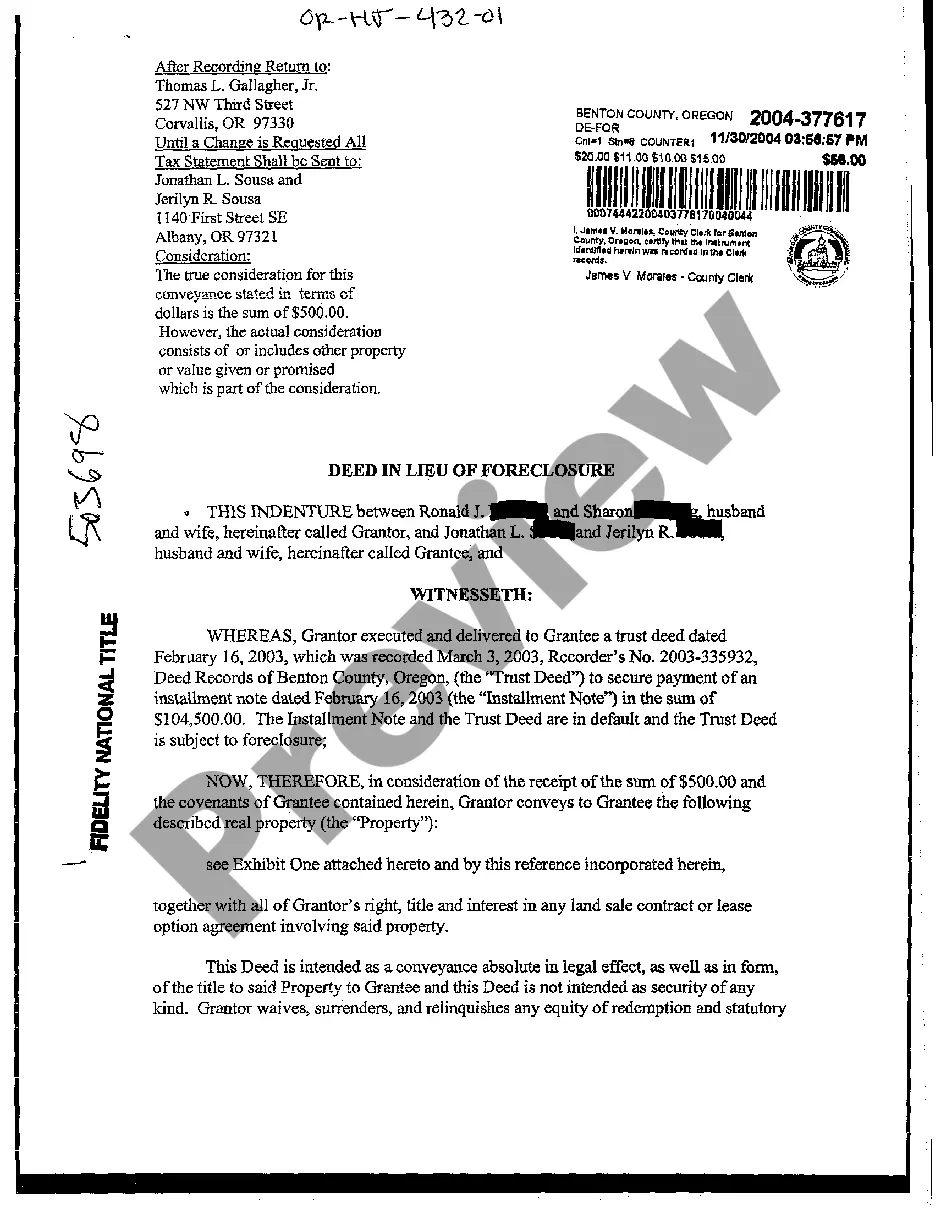

Oregon Deed in Lieu of Foreclosure

Description Deed In Lieu Of Foreclosure Forms

How to fill out Oregon Deed In Lieu Of Foreclosure?

The work with papers isn't the most uncomplicated process, especially for people who rarely deal with legal paperwork. That's why we advise making use of accurate Oregon Deed in Lieu of Foreclosure samples created by professional lawyers. It allows you to prevent troubles when in court or dealing with formal organizations. Find the templates you need on our website for high-quality forms and accurate information.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the template webpage. Soon after getting the sample, it’ll be stored in the My Forms menu.

Customers with no an activated subscription can easily create an account. Follow this simple step-by-step guide to get your Oregon Deed in Lieu of Foreclosure:

- Be sure that the form you found is eligible for use in the state it is needed in.

- Confirm the file. Make use of the Preview option or read its description (if available).

- Click Buy Now if this file is the thing you need or utilize the Search field to get another one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these easy actions, you can fill out the sample in a preferred editor. Check the filled in information and consider asking a legal representative to review your Oregon Deed in Lieu of Foreclosure for correctness. With US Legal Forms, everything becomes easier. Test it now!

Foreclosure Letter Template Form popularity

FAQ

Rather than deal with the foreclosure process, I would like to give you the deed to my home, in exchange for forgiveness on the loan. I do not have a second mortgage, and there are no other liens on the property. I have attached all relevant documents for the house and for my current economic situation.

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

Disadvantages of a Deed in Lieu of Foreclosure. Perhaps the biggest disadvantage of a deed in lieu is that the Lender takes subject to all other encumbrances and interests in the Property. Therefore if there is a second mortgage, for example, a deed in lieu would likely not be a viable strategy.

A deed in lieu of foreclosure is different from a short sale because it transfers the property to the lender instead of selling it to a new buyer.Most lenders find this option less appealing than a short sale because they will need to handle the logistics of the sale instead of the homeowner.

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.