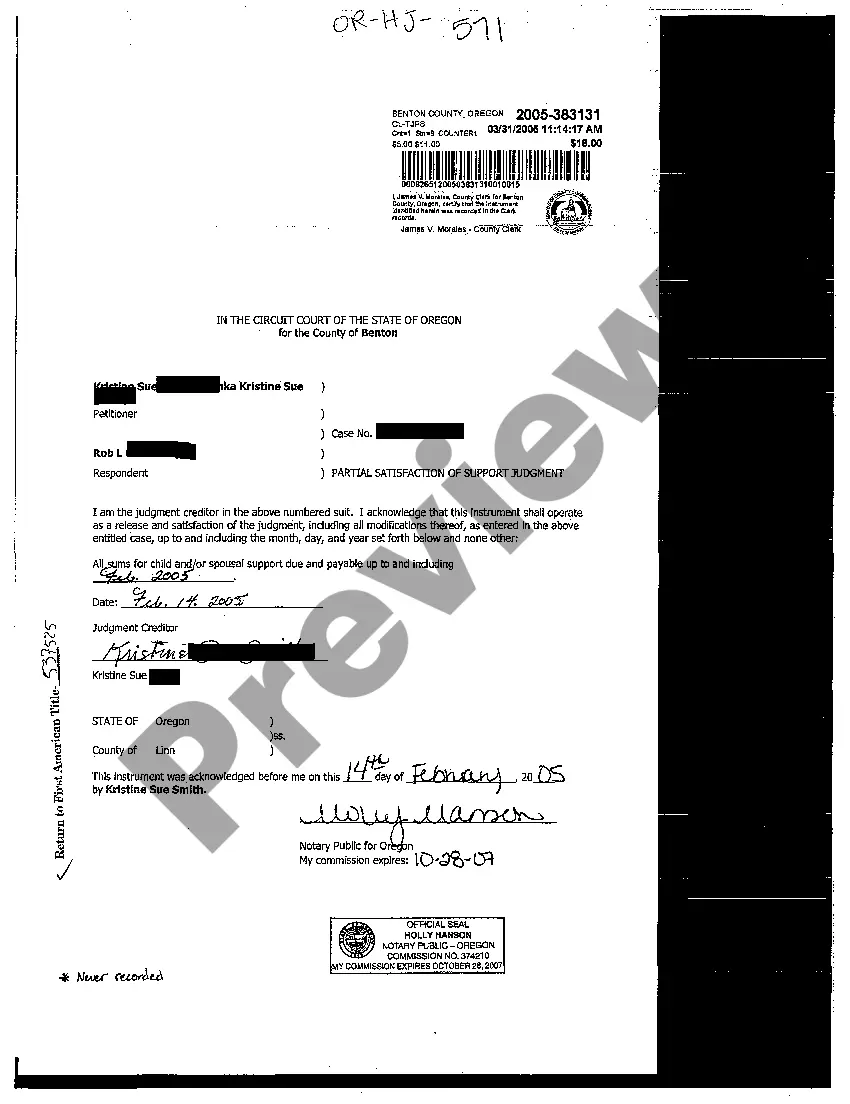

Oregon Partial Satisfaction of Support Judgment

Description

How to fill out Oregon Partial Satisfaction Of Support Judgment?

Creating documents isn't the most uncomplicated job, especially for those who almost never work with legal papers. That's why we advise making use of accurate Oregon Partial Satisfaction of Support Judgment samples made by skilled lawyers. It gives you the ability to eliminate difficulties when in court or handling formal organizations. Find the samples you want on our site for high-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. Once you’re in, the Download button will immediately appear on the file webpage. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can quickly get an account. Utilize this short step-by-step guide to get the Oregon Partial Satisfaction of Support Judgment:

- Ensure that the document you found is eligible for use in the state it’s necessary in.

- Verify the document. Make use of the Preview option or read its description (if available).

- Buy Now if this template is what you need or return to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

Right after doing these straightforward actions, it is possible to fill out the sample in a preferred editor. Recheck filled in information and consider requesting a legal representative to examine your Oregon Partial Satisfaction of Support Judgment for correctness. With US Legal Forms, everything gets much easier. Give it a try now!

Form popularity

FAQ

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

You may ask your judgment creditor to file a satisfaction of judgment form. The length of time gives to the creditor to file the form varies from state to state, but it is usually between 14 and 30 days after your request.

The defendant should ask for a letter confirming that the entire amount of the judgment has been paid. He or she may do so by sending a demand letter to the plaintiff. The release and satisfaction form is filed with the court clerk and entered into the case record.

A Satisfaction of Judgment is basically an official receipt which says that you owed a certain amount, but that it has been paid, either partially or in full.

A document signed by the party who is owed money under a court judgment (called the judgment creditor) stating that the full amount due on the judgment has been paid.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

You will need one original, notarized copy for the judgment debtor. If you recorded an abstract of judgment to place a lien against the debtor's real property, you will need an original, notarized copy of your Acknowledgment of Satisfaction of Judgment (EJ-100) for each county where you placed a lien.

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.You should pay legitimate judgments and dispute inaccurate judgments to ensure these do not affect your finances unduly.