Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

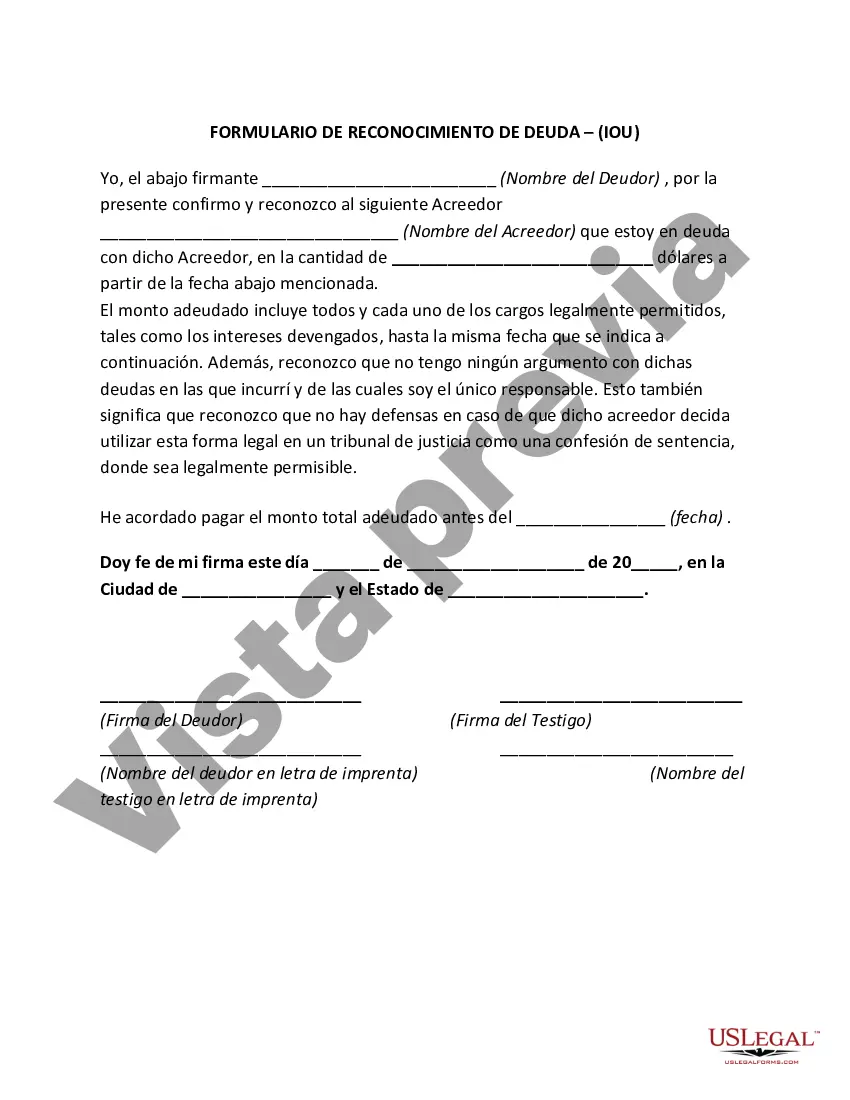

Oregon Debt Acknowledgment, also commonly referred to as IOU (I Owe You), is a legal document used to acknowledge an outstanding debt or financial obligation between two parties in the state of Oregon, USA. It is a written agreement that provides evidence of the debt, serving as a valuable tool for both the debtor and the creditor. The Oregon Debt Acknowledgment contains various key elements, including: 1. Parties Involved: The document identifies the debtor (person or entity owing the debt) and the creditor (person or entity to whom the debt is owed). 2. Effective Date: This indicates the date on which the debt acknowledgment becomes effective, marking the starting point of the debtor's obligation to repay the debt. 3. Debt Amount: The IOU specifies the exact amount of the debt owed by the debtor to the creditor. It may include interest, late fees, or any other charges agreed upon between the parties. 4. Terms of Repayment: The document outlines the agreed-upon terms under which the debt will be repaid, including the repayment schedule or periodic installments, if applicable. It may also include details concerning the payment method, such as cash, check, or electronic transfer. 5. Signature and Witness: The debtor must sign the Oregon Debt Acknowledgment, confirming their acknowledgment of the debt and agreement to the stated repayment terms. Additionally, the document may require a witness to sign, ensuring its authenticity and enforceability. Oregon Debt Acknowledgment may vary based on the specific circumstances. Different types of IOUs or Debt Acknowledgments in Oregon may include: 1. Promissory Note: This type of Debt Acknowledgment establishes a contractual agreement between the debtor and creditor regarding repayment terms, including interest rates and penalties for non-payment. 2. Lump Sum Debt Acknowledgment: In this case, the debtor acknowledges a debt owed and agrees to repay it in one lump sum payment, rather than through installments. 3. Structured Repayment Agreement: This type of IOU outlines a repayment plan that consists of periodic installments, typically with predetermined amounts and due dates. 4. Secured Debt Acknowledgment: Here, the debtor provides collateral, such as property or assets, to secure the repayment of the debt. If the debtor fails to fulfill their obligation, the creditor may seize and sell the collateral to recover the outstanding amount. It is crucial for both parties to carefully review and understand the terms outlined in the Oregon Debt Acknowledgment before signing. Consulting with a legal professional may be advisable to ensure that the document accurately reflects the intentions of both parties and complies with applicable laws and regulations.Oregon Debt Acknowledgment, also commonly referred to as IOU (I Owe You), is a legal document used to acknowledge an outstanding debt or financial obligation between two parties in the state of Oregon, USA. It is a written agreement that provides evidence of the debt, serving as a valuable tool for both the debtor and the creditor. The Oregon Debt Acknowledgment contains various key elements, including: 1. Parties Involved: The document identifies the debtor (person or entity owing the debt) and the creditor (person or entity to whom the debt is owed). 2. Effective Date: This indicates the date on which the debt acknowledgment becomes effective, marking the starting point of the debtor's obligation to repay the debt. 3. Debt Amount: The IOU specifies the exact amount of the debt owed by the debtor to the creditor. It may include interest, late fees, or any other charges agreed upon between the parties. 4. Terms of Repayment: The document outlines the agreed-upon terms under which the debt will be repaid, including the repayment schedule or periodic installments, if applicable. It may also include details concerning the payment method, such as cash, check, or electronic transfer. 5. Signature and Witness: The debtor must sign the Oregon Debt Acknowledgment, confirming their acknowledgment of the debt and agreement to the stated repayment terms. Additionally, the document may require a witness to sign, ensuring its authenticity and enforceability. Oregon Debt Acknowledgment may vary based on the specific circumstances. Different types of IOUs or Debt Acknowledgments in Oregon may include: 1. Promissory Note: This type of Debt Acknowledgment establishes a contractual agreement between the debtor and creditor regarding repayment terms, including interest rates and penalties for non-payment. 2. Lump Sum Debt Acknowledgment: In this case, the debtor acknowledges a debt owed and agrees to repay it in one lump sum payment, rather than through installments. 3. Structured Repayment Agreement: This type of IOU outlines a repayment plan that consists of periodic installments, typically with predetermined amounts and due dates. 4. Secured Debt Acknowledgment: Here, the debtor provides collateral, such as property or assets, to secure the repayment of the debt. If the debtor fails to fulfill their obligation, the creditor may seize and sell the collateral to recover the outstanding amount. It is crucial for both parties to carefully review and understand the terms outlined in the Oregon Debt Acknowledgment before signing. Consulting with a legal professional may be advisable to ensure that the document accurately reflects the intentions of both parties and complies with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.