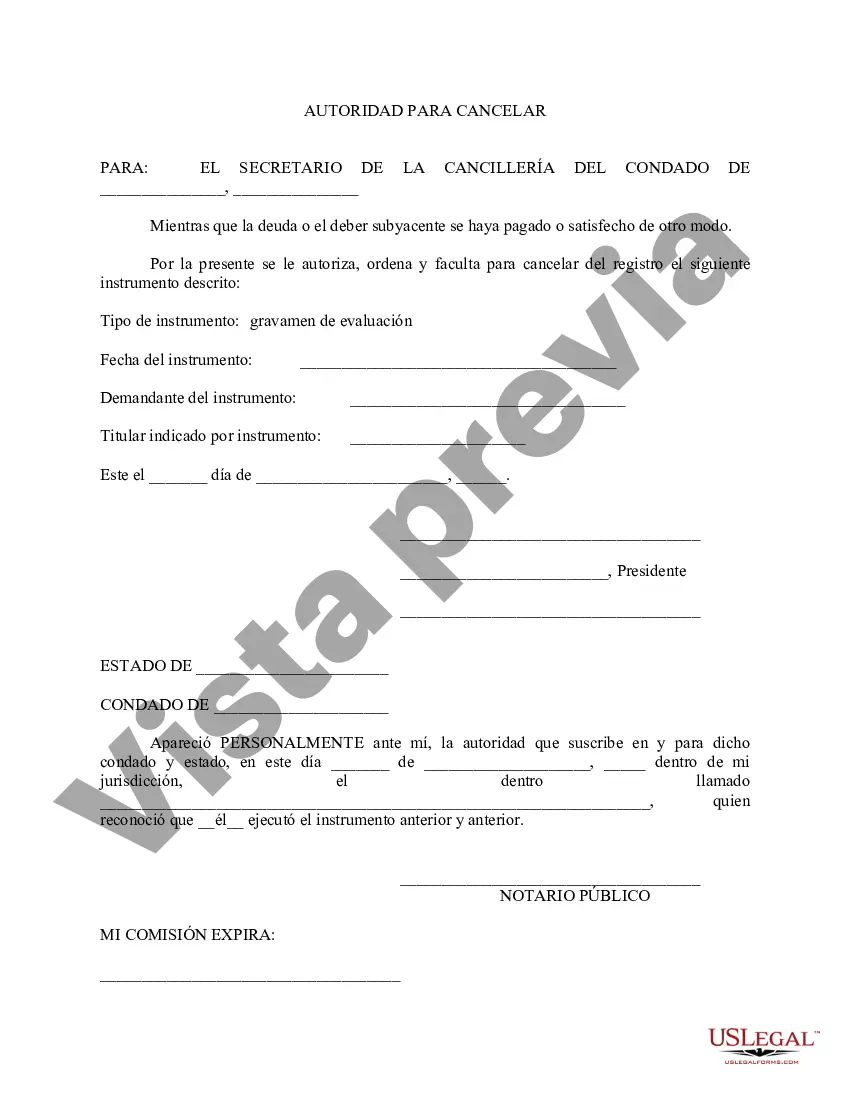

This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

The Oregon Authority to Cancel refers to a legal procedure that allows the cancellation or dissolution of a specific entity or organization registered in the state of Oregon. This authority is typically granted by the Oregon Secretary of State, who oversees business registrations and filings within the state. The authority to cancel an entity can be exercised for various reasons, such as the entity ceasing its operations, the owners or shareholders deciding to dissolve the entity, or failure to comply with state regulations and maintain active status. It is important to note that the process and requirements for cancellation may vary depending on the type of entity being dissolved. 1. Oregon Authority to Cancel — Business Corporation: When a business corporation decides to dissolve or cease operations, it is required to follow the Oregon Authority to Cancel for Business Corporations. This involves filing the appropriate paperwork with the Oregon Secretary of State, such as Articles of Dissolution, which officially terminates the corporation's existence. Additionally, any tax obligations and other legal requirements must be fulfilled prior to cancellation. 2. Oregon Authority to Cancel — Limited Liability Company (LLC): For an LLC seeking cancellation, the owners or members must comply with the Oregon Authority to Cancel for Limited Liability Companies. This usually involves filing Articles of Dissolution, which indicates the intent to dissolve the LLC. Similar to business corporations, tax obligations, outstanding debts, and other legal obligations must be resolved before cancellation is granted. 3. Oregon Authority to Cancel — Nonprofit Corporation: Nonprofit organizations in Oregon have a specific process known as the Oregon Authority to Cancel for Nonprofit Corporations. To dissolve a nonprofit corporation, a board of directors or members must adopt a resolution recommending dissolution and approve a plan of dissolution. The corporation then files Articles of Dissolution, indicating the intent to terminate the nonprofit organization. Compliance with tax requirements and distribution of remaining assets to qualified entities may also be necessary. It is important to consult with legal counsel or seek guidance from the Oregon Secretary of State's office to ensure that the specific requirements and procedures for cancellation are properly followed. The Oregon Authority to Cancel provides a structured framework to ensure that entity cancellations are carried out in accordance with state laws and regulations.The Oregon Authority to Cancel refers to a legal procedure that allows the cancellation or dissolution of a specific entity or organization registered in the state of Oregon. This authority is typically granted by the Oregon Secretary of State, who oversees business registrations and filings within the state. The authority to cancel an entity can be exercised for various reasons, such as the entity ceasing its operations, the owners or shareholders deciding to dissolve the entity, or failure to comply with state regulations and maintain active status. It is important to note that the process and requirements for cancellation may vary depending on the type of entity being dissolved. 1. Oregon Authority to Cancel — Business Corporation: When a business corporation decides to dissolve or cease operations, it is required to follow the Oregon Authority to Cancel for Business Corporations. This involves filing the appropriate paperwork with the Oregon Secretary of State, such as Articles of Dissolution, which officially terminates the corporation's existence. Additionally, any tax obligations and other legal requirements must be fulfilled prior to cancellation. 2. Oregon Authority to Cancel — Limited Liability Company (LLC): For an LLC seeking cancellation, the owners or members must comply with the Oregon Authority to Cancel for Limited Liability Companies. This usually involves filing Articles of Dissolution, which indicates the intent to dissolve the LLC. Similar to business corporations, tax obligations, outstanding debts, and other legal obligations must be resolved before cancellation is granted. 3. Oregon Authority to Cancel — Nonprofit Corporation: Nonprofit organizations in Oregon have a specific process known as the Oregon Authority to Cancel for Nonprofit Corporations. To dissolve a nonprofit corporation, a board of directors or members must adopt a resolution recommending dissolution and approve a plan of dissolution. The corporation then files Articles of Dissolution, indicating the intent to terminate the nonprofit organization. Compliance with tax requirements and distribution of remaining assets to qualified entities may also be necessary. It is important to consult with legal counsel or seek guidance from the Oregon Secretary of State's office to ensure that the specific requirements and procedures for cancellation are properly followed. The Oregon Authority to Cancel provides a structured framework to ensure that entity cancellations are carried out in accordance with state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.