Oregon Demand for Collateral by Creditor

Description

How to fill out Demand For Collateral By Creditor?

Are you presently in a condition where you frequently require documents for business or specific objectives? There are numerous legitimate document formats available online, yet finding reliable versions can be challenging.

US Legal Forms provides an extensive collection of form templates, such as the Oregon Demand for Collateral by Creditor, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, just Log In. Subsequently, you can download the Oregon Demand for Collateral by Creditor form.

Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Oregon Demand for Collateral by Creditor whenever needed. Just follow the required form to download or print the document template.

Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid errors. The service offers properly crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life easier.

- Select the form you require and ensure it corresponds to the correct city/region.

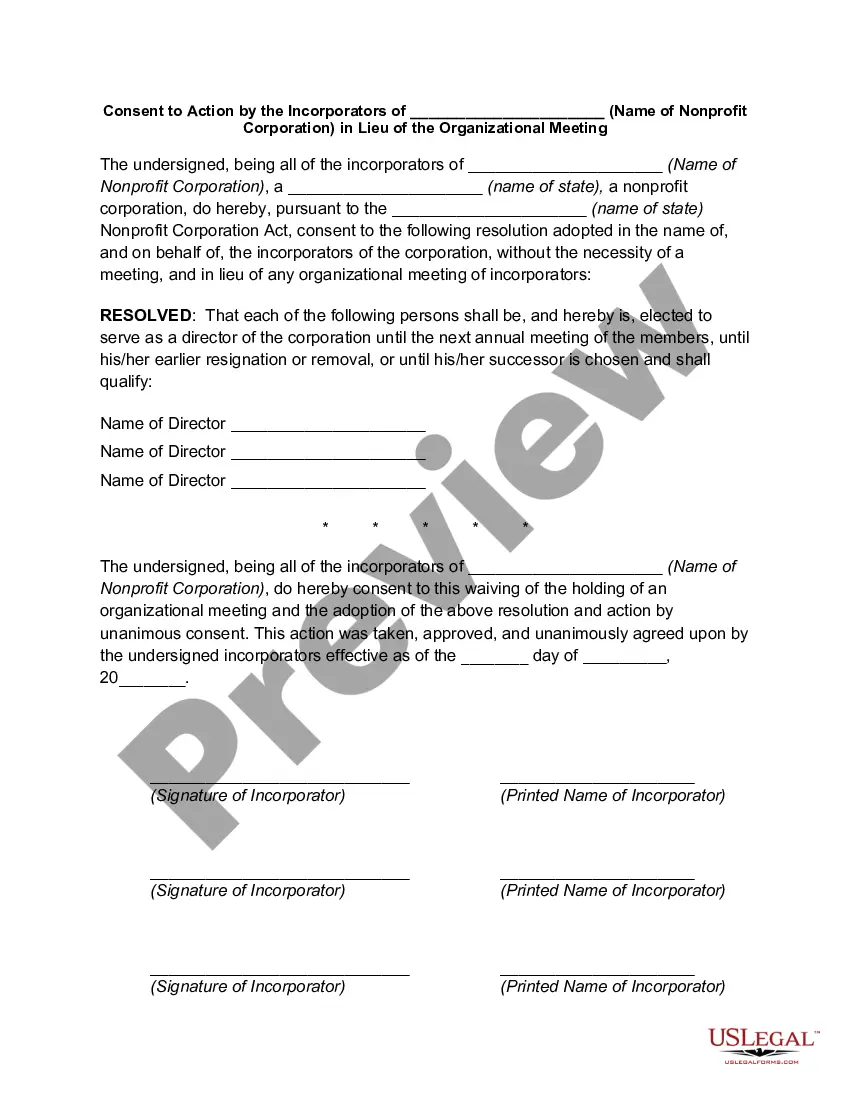

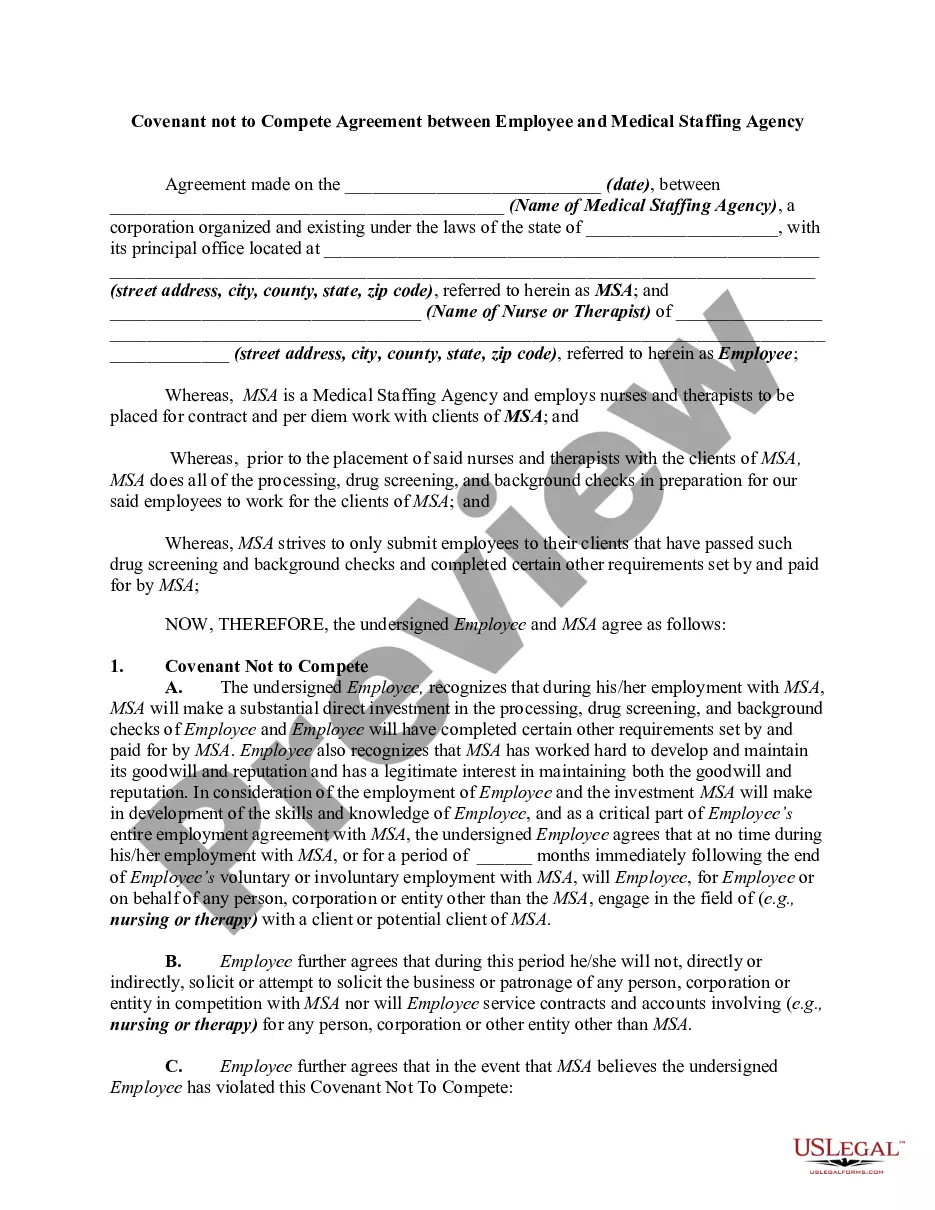

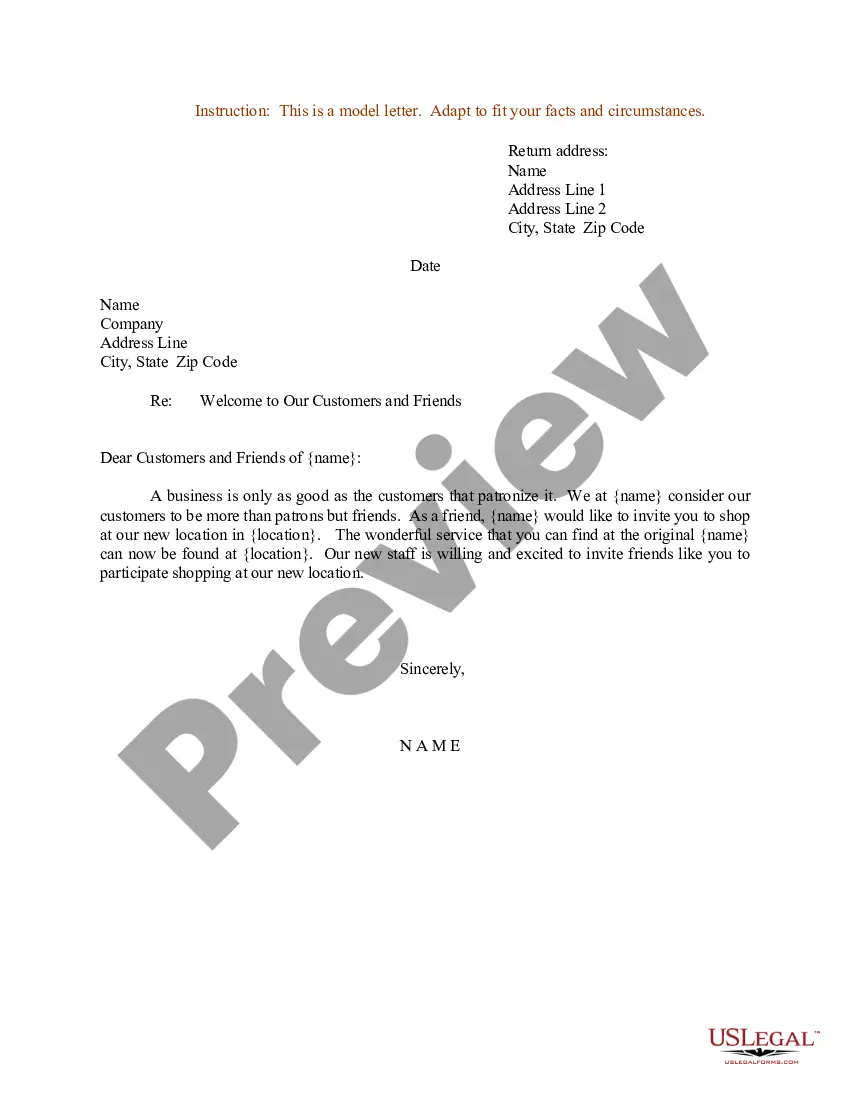

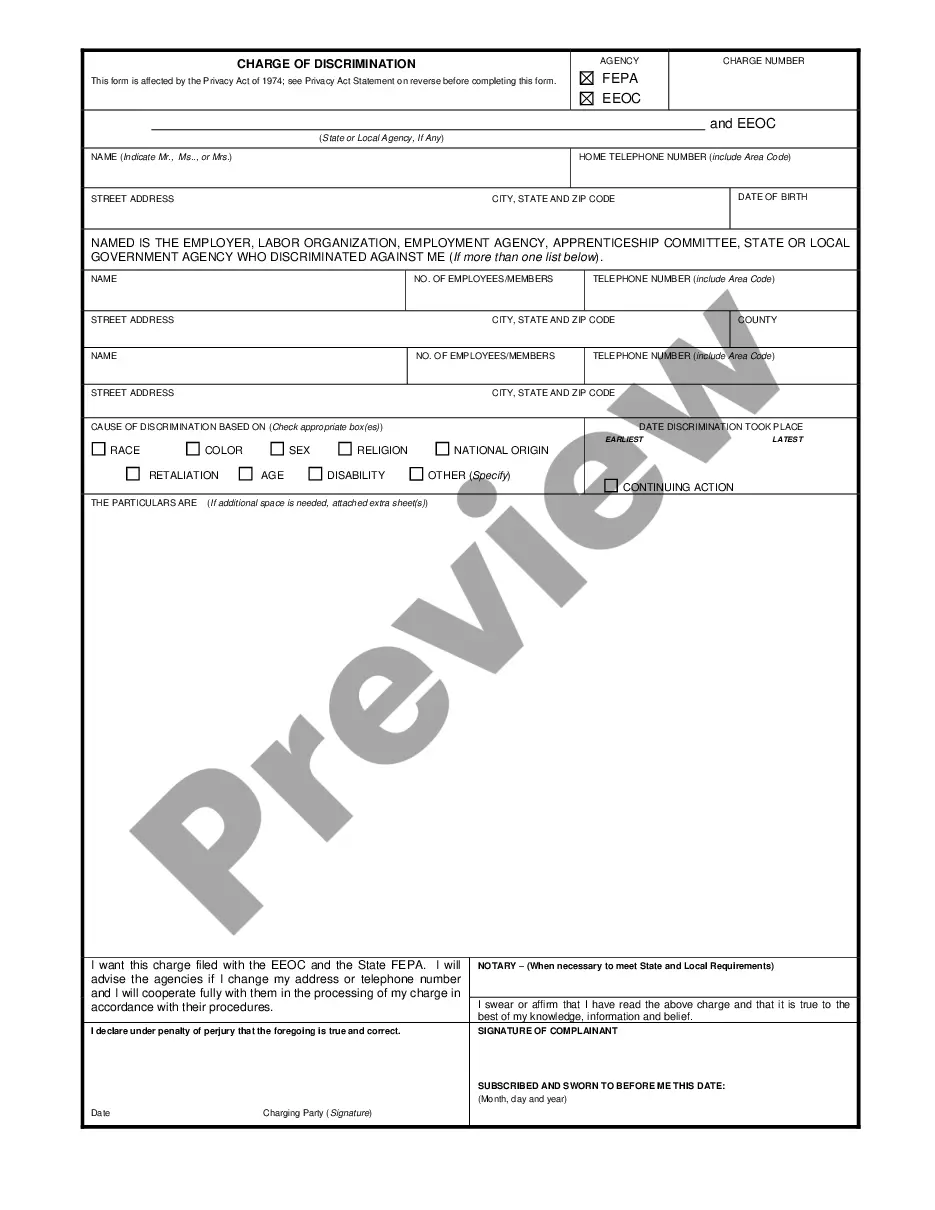

- Use the Review button to examine the form.

- Check the description to verify that you have selected the correct form.

- If the form is not what you're looking for, utilize the Lookup field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the billing plan you prefer, complete the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- Select a convenient file format and download your version.

Form popularity

FAQ

Indeed, Oregon has adopted the Uniform Commercial Code, establishing legal standards for commercial transactions throughout the state. This adoption is notable for creditors and businesses engaged in commerce, as it provides predictability and order in transactions involving collateral. Being familiar with the UCC is essential for managing an Oregon Demand for Collateral by Creditor effectively. It ensures compliance with state laws.

Yes, Oregon has adopted the Uniform Trust Code, which provides a comprehensive set of rules governing trusts and trustees' responsibilities. This adoption enhances the framework for managing trusts within the state. Having a clear understanding of the Uniform Trust Code is helpful when dealing with complex financial situations, including those related to an Oregon Demand for Collateral by Creditor. It fosters trust in the management of assets.

The UCC in Oregon refers to the Uniform Commercial Code applied within the state, governing the sale of goods and secured transactions. It outlines the rights and obligations of parties involved in these transactions. The UCC provides a clear framework for creditors to follow when making an Oregon Demand for Collateral by Creditor. This framework helps ensure smooth business operations and legal compliance.

The process by which a creditor takes possession of collateral is known as repossession. This is a crucial aspect when a debt remains unpaid, and a creditor pursues an Oregon Demand for Collateral by Creditor. Creditors must follow the legal guidelines established under the UCC to ensure that repossession is conducted legitimately. Proper procedures help maintain compliance and protect both parties' rights.

Yes, in the context of an Oregon Demand for Collateral by Creditor, the debtor retains specific rights regarding the collateral. These rights include the ability to redeem the collateral before it is sold and to receive notice of any actions taken by the creditor. Understanding these rights is vital for both creditors and debtors in maintaining a fair transaction process. This knowledge can aid in avoiding disputes.

The borrowing statute in Oregon relates to the time period allowed for a creditor to file a claim after a debt remains unpaid. This statute can influence various financial transactions, including those related to property and collateral. Being aware of this statute is essential when dealing with an Oregon Demand for Collateral by Creditor. It ensures creditors can protect their rights and interests effectively.

Yes, Oregon has adopted the Uniform Commercial Code, integrating it into the state's commercial laws. This means creditors and debtors alike operate under a standardized set of rules. The UCC's adoption helps streamline transactions involving collateral and other commercial interests. It plays a significant role in handling an Oregon Demand for Collateral by Creditor.

The Uniform Commercial Code (UCC) has been adopted by all 50 states in the United States. This includes Oregon, which follows the UCC's guidelines for transactions concerning personal property. By adopting the UCC, states provide a consistent legal framework that simplifies commerce. Understanding the UCC is critical for creditors managing an Oregon Demand for Collateral by Creditor.

The primary action a debt collector can take is to seek payment through legal channels if necessary. They can file a lawsuit or obtain a judgment, but they must conduct these actions within the law. If you find yourself receiving an Oregon Demand for Collateral by Creditor, using resources like USLegalForms can help you understand your options and navigate the situation.

Debt collectors cannot harass you or misrepresent themselves while collecting debts. This means they must not engage in deceitful practices or pressure you in a way that feels threatening. If you face an Oregon Demand for Collateral by Creditor, knowing these rights can empower you in your discussions with collectors.