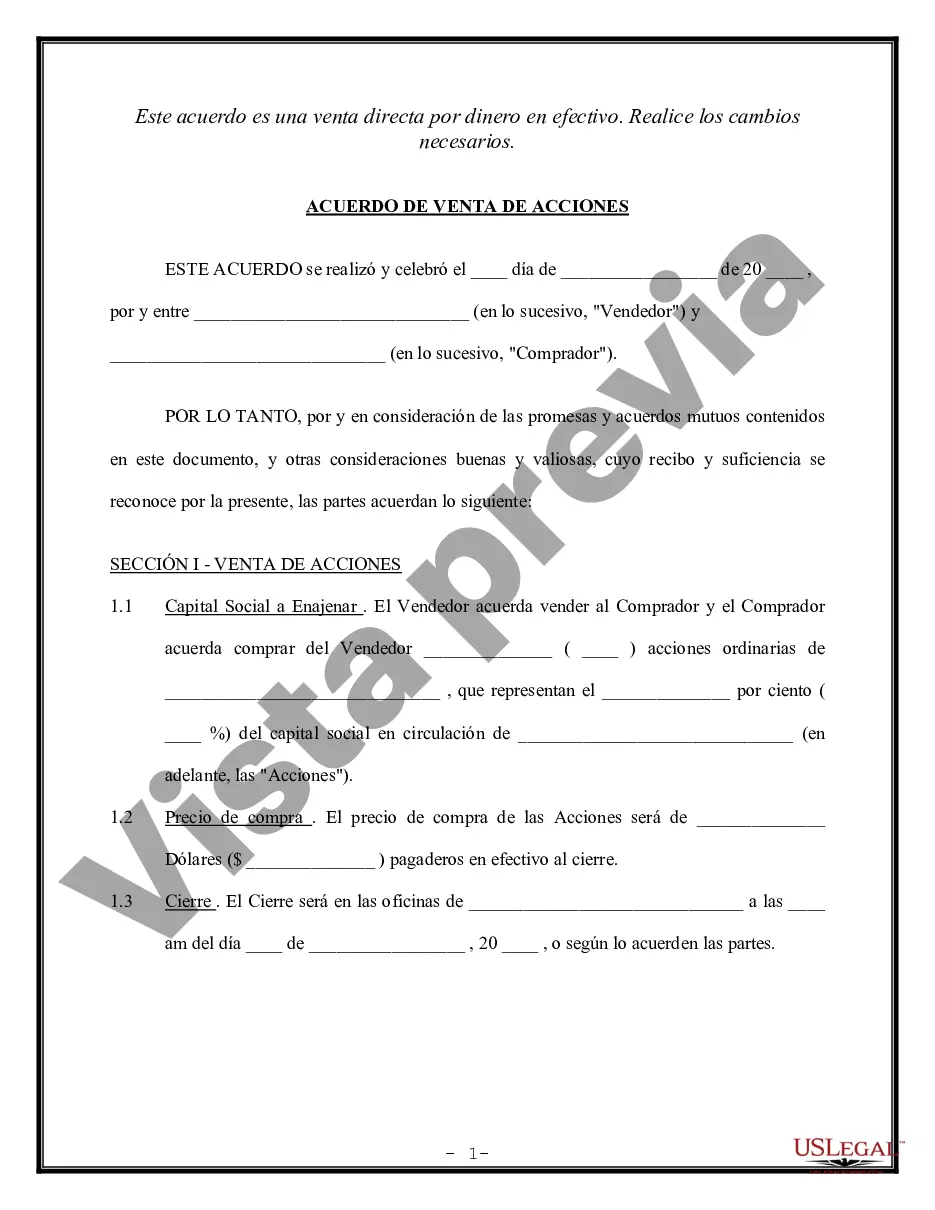

Oregon Shareholder Agreement to Sell Stock to Other Shareholder is a legal document that outlines the terms and conditions under which a shareholder can sell their stock to another shareholder within the state of Oregon. This agreement serves as a safeguard to ensure a smooth and fair transaction between shareholders, providing clarity on rights, responsibilities, and procedures involved in the sale of stock. The Oregon Shareholder Agreement to Sell Stock to Other Shareholder typically includes several key components. Firstly, it outlines the parties involved, identifying the selling shareholder, the purchasing shareholder, and the corporation in which the stock is held. The agreement specifies the number of shares being sold, along with any restrictions or special considerations, such as vesting periods or incentive-based requirements. Furthermore, the agreement discusses the valuation of the stock being sold. It may specify a predetermined price or establish a mechanism for determining the fair market value at the time of the sale. This is essential to avoid conflicts and disputes over the price between the parties involved. The agreement also addresses the payment terms and methods for the sale. It outlines the payment schedule, whether it will be a lump sum payment or installments, and the mode of payment such as cash, check, or wire transfer. Additionally, the agreement may include provisions for any financing arrangements or loans associated with the purchase of the stock. To safeguard the interests of both parties, the agreement may contain representations and warranties. These may include assurances from the selling shareholder that they have full ownership rights to the stock being sold and that there are no outstanding claims or encumbrances on the shares. Similarly, the purchasing shareholder may provide assurances regarding their ability to complete the purchase and any necessary approvals or consents they have obtained. The Oregon Shareholder Agreement to Sell Stock to Other Shareholder also addresses the potential for disputes and a mechanism for resolving them. It may include provisions for mediation, arbitration, or other alternative dispute resolution methods to avoid costly and time-consuming litigation. In terms of different types of Oregon Shareholder Agreements to Sell Stock to Other Shareholder, there can be variations based on specific circumstances or conditions. For example, there could be agreements designed for closely held corporations, publicly traded companies, or agreements tailored for different industries or sectors. Additionally, agreements can be modified to cater to unique situations involving minority shareholders, majority shareholders, or even specific types of stocks, such as preferred shares or restricted stock units. In conclusion, an Oregon Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding contract that governs the sale of stock between shareholders within the state of Oregon. It ensures a transparent, fair, and efficient process for buying and selling shares, protecting the interests of both parties involved in the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Oregon Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

Are you currently within a position that you need to have papers for possibly organization or specific uses just about every day time? There are a variety of lawful file web templates accessible on the Internet, but finding ones you can rely on is not straightforward. US Legal Forms gives thousands of type web templates, just like the Oregon Shareholder Agreement to Sell Stock to Other Shareholder, which are composed to fulfill state and federal needs.

When you are already knowledgeable about US Legal Forms web site and also have a free account, merely log in. Following that, you can down load the Oregon Shareholder Agreement to Sell Stock to Other Shareholder template.

Should you not have an account and wish to begin using US Legal Forms, abide by these steps:

- Get the type you will need and make sure it is to the correct area/county.

- Make use of the Preview key to review the shape.

- Browse the description to ensure that you have selected the appropriate type.

- In case the type is not what you`re seeking, take advantage of the Lookup discipline to find the type that meets your needs and needs.

- When you obtain the correct type, click on Get now.

- Pick the pricing plan you would like, complete the necessary info to make your money, and pay for your order using your PayPal or charge card.

- Pick a hassle-free paper file format and down load your duplicate.

Locate each of the file web templates you have bought in the My Forms menus. You can aquire a more duplicate of Oregon Shareholder Agreement to Sell Stock to Other Shareholder whenever, if necessary. Just select the required type to down load or produce the file template.

Use US Legal Forms, the most comprehensive selection of lawful varieties, to conserve efforts and steer clear of errors. The support gives expertly created lawful file web templates which you can use for an array of uses. Produce a free account on US Legal Forms and begin making your life easier.