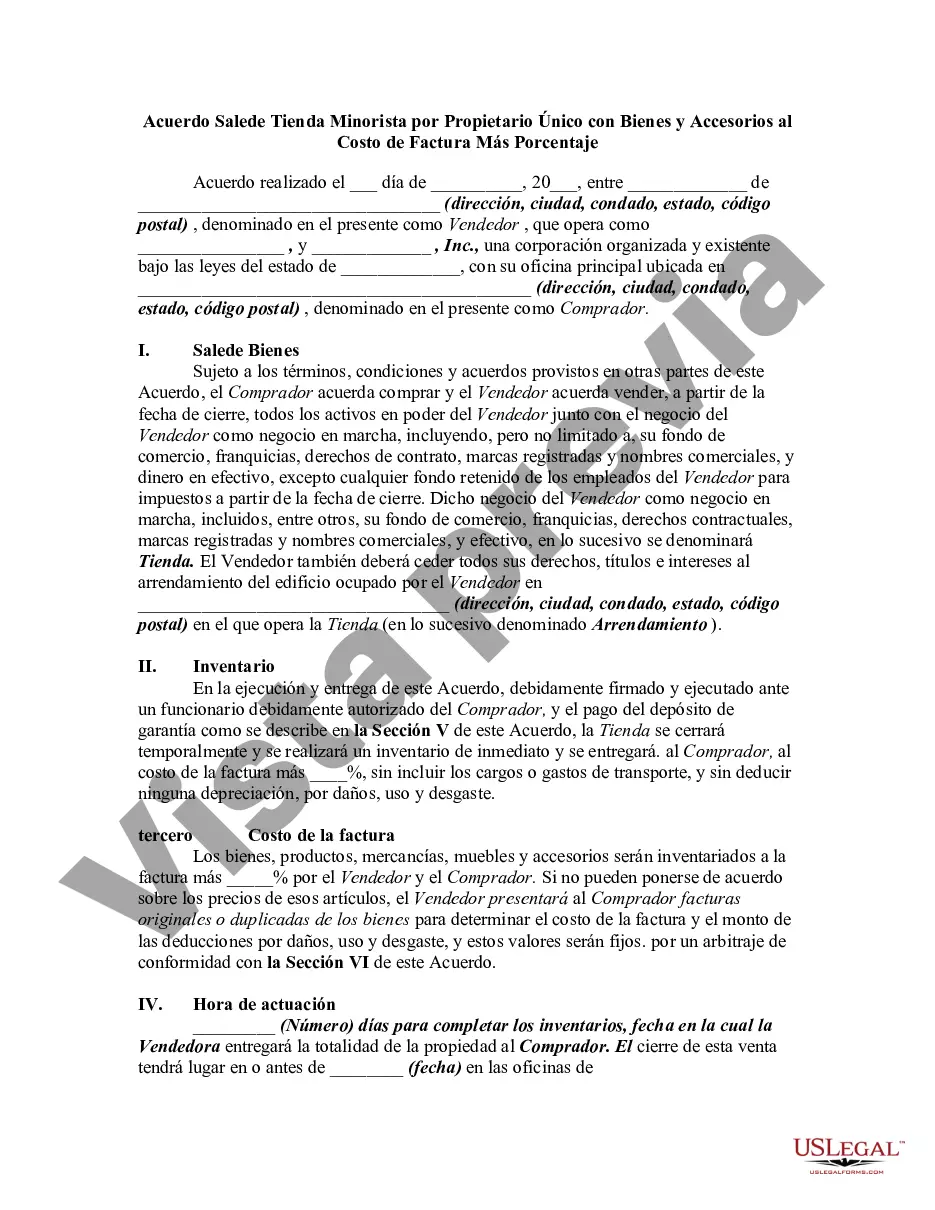

The Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding document used for purchasing a retail store in the state of Oregon. This agreement outlines the terms and conditions of the sale, including the purchase price, payment method, and other important details. By using relevant keywords, let's dive into a detailed description of this agreement: 1. Introduction: The Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a standardized legal contract used when selling a retail business owned by a sole proprietor in the state of Oregon. This agreement ensures that both the buyer and seller are protected and have a clear understanding of the terms and conditions of the sale. 2. Key Elements: a. Purchase Price: The agreement specifies the total purchase price of the retail store, which includes the inventory, fixtures, and other assets. This price is typically calculated by combining the invoice cost of the goods with an additional percentage or markup negotiated by both parties. b. Payment Method: The agreement details the payment method agreed upon by the buyer and seller. This can include lump sum payments, installments, or any other mutually agreed-upon arrangement. c. Assets Included: The agreement lists all the goods and fixtures included in the sale. This can encompass everything from inventory and equipment to display cases and signage. d. Conditions: Any additional conditions relevant to the sale, such as the transfer of licenses, lease agreements, or warranties, are outlined in the agreement. e. Liabilities and Obligations: The agreement explains the extent of the seller's liabilities and any warranties or guarantees offered. It also clarifies the responsibilities of the buyer in assuming the operation of the retail store. f. Closing Date and Location: The agreement stipulates the date and location at which the sale is to be concluded. 3. Types of Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: While there may not be distinctly different types of this agreement, variations can occur depending on customization and specific terms negotiated between the parties. Each agreement will reflect the unique circumstances and requirements of the buyer and seller. In essence, the Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage establishes a legally binding relationship between the buyer and seller, ensuring the smooth transfer of ownership and protecting both parties' rights throughout the transaction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Oregon Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

You may invest hours on the Internet looking for the legal record web template that meets the federal and state requirements you need. US Legal Forms offers thousands of legal varieties which are evaluated by specialists. It is possible to acquire or printing the Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from your services.

If you already have a US Legal Forms account, it is possible to log in and click the Obtain button. After that, it is possible to total, revise, printing, or sign the Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Each legal record web template you get is yours for a long time. To acquire yet another duplicate of the obtained kind, proceed to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms website for the first time, stick to the easy instructions below:

- Very first, be sure that you have chosen the correct record web template for your county/town of your choosing. Read the kind explanation to make sure you have picked the correct kind. If offered, utilize the Preview button to search through the record web template at the same time.

- If you wish to find yet another variation of your kind, utilize the Research field to obtain the web template that fits your needs and requirements.

- Upon having found the web template you want, just click Purchase now to carry on.

- Select the rates plan you want, type your accreditations, and register for your account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal account to pay for the legal kind.

- Select the file format of your record and acquire it for your gadget.

- Make alterations for your record if possible. You may total, revise and sign and printing Oregon Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Obtain and printing thousands of record web templates while using US Legal Forms web site, that provides the biggest collection of legal varieties. Use expert and state-particular web templates to handle your organization or personal demands.