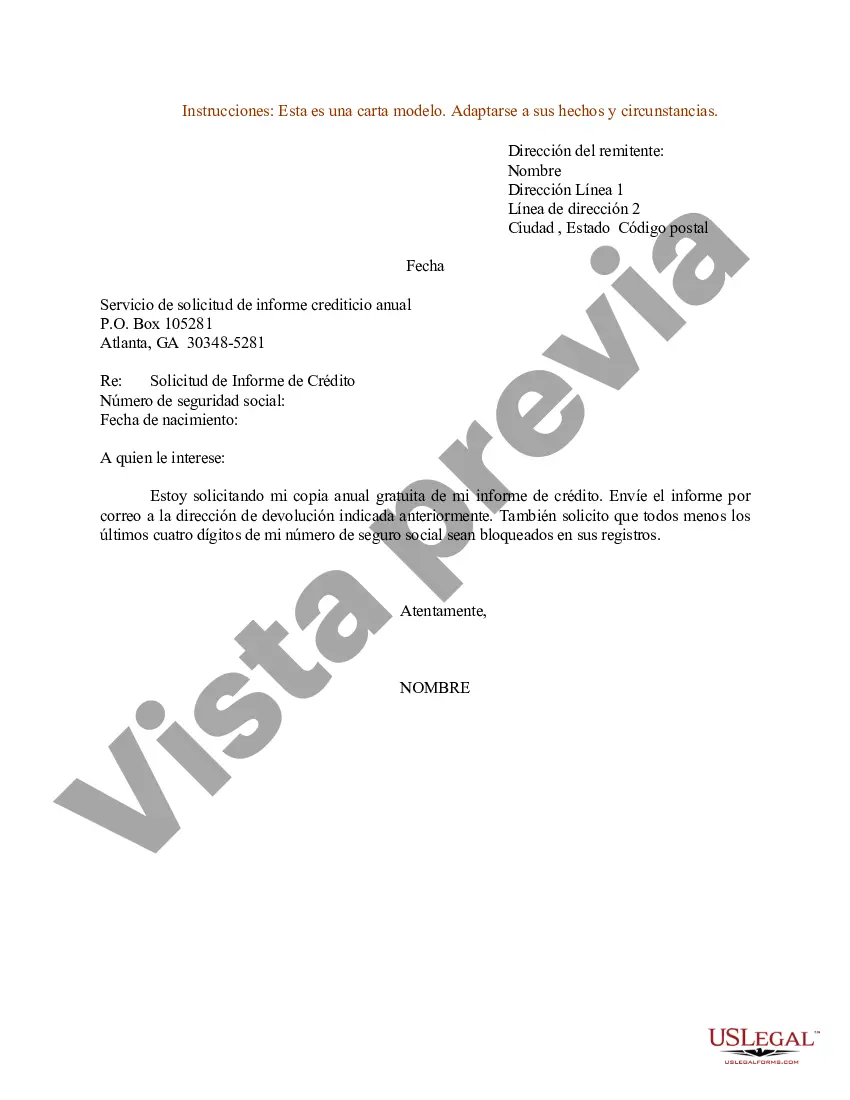

Title: Comprehensive Guide: Oregon Sample Letter for Requesting Free Credit Report Allowed by Federal Law Introduction: In accordance with the federal law, individuals have the right to request a free credit report from each of the three major credit bureaus once per year. This informative article aims to provide a detailed description of the process in Oregon. We will discuss the importance of regularly checking your credit report and guide you through the steps of writing an effective sample letter to obtain your free credit report. Additionally, we will cover any specific types of Oregon sample letters that might exist. Keywords: Oregon, sample letter, request, free credit report, federal law, major credit bureaus, importance, checking, process, writing, effective, specific types. Main Body: 1. Understanding the Importance of Regularly Checking Your Credit Report in Oregon: Maintaining a healthy credit score is crucial for many aspects of your financial well-being. Regularly reviewing your credit report ensures the accuracy of the information contained within and helps detect any potential fraud or errors. By requesting your free credit report, you can stay on top of your credit status and address any discrepancies promptly. 2. What is a Free Credit Report and Who Provides It: Under federal law, the three major credit bureaus — Equifax, Experian, anTransUnionio— - are required to provide individuals with one free credit report per year upon request. A combination of all three reports allows for a more comprehensive analysis of your credit history. 3. Composing an Oregon Sample Letter for Requesting a Free Credit Report: To request your free credit report, it is recommended to write a formal letter to the credit bureaus. The key elements to include in your sample letter are: a. Personal Information: Full name, address, date of birth, and Social Security Number. b. Request: Clearly state that you would like to obtain a free credit report and name the credit bureau(s) you want the report from. c. Reason: Mention your rights under federal law to receive a free credit report and emphasize the importance of reviewing your credit information. d. Documentation: Enclose copies of identity verification documents such as a driver's license, utility bill, or Social Security card. e. Contact information: Provide your phone number and email address if you would like the credit bureau to contact you via these channels. 4. Types of Oregon Sample Letters for Requesting a Free Credit Report: While there may not be specific variants of sample letters for Oregon, the general sample letter provided above can be tailored based on the desired credit bureau(s) you wish to request the report from. Ensure you adjust the name and contact information accordingly. Conclusion: Requesting a free credit report is an essential practice to safeguard your financial interests and monitor your creditworthiness. By following the guidelines provided and composing a well-crafted Oregon sample letter, you can exercise your rights and receive the information you need to make informed financial decisions. Keywords: safeguard, financial interests, monitor, creditworthiness, guidelines, exercise rights, well-crafted, informed financial decisions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out Oregon Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

If you need to full, down load, or print authorized document templates, use US Legal Forms, the greatest variety of authorized varieties, that can be found on the web. Take advantage of the site`s basic and convenient research to find the papers you will need. Various templates for organization and person purposes are categorized by types and suggests, or keywords. Use US Legal Forms to find the Oregon Sample Letter for Request for Free Credit Report Allowed by Federal Law with a few clicks.

In case you are currently a US Legal Forms customer, log in for your profile and then click the Obtain switch to have the Oregon Sample Letter for Request for Free Credit Report Allowed by Federal Law. You can also access varieties you earlier downloaded in the My Forms tab of your respective profile.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape for that appropriate city/region.

- Step 2. Take advantage of the Review solution to check out the form`s articles. Do not overlook to read through the outline.

- Step 3. In case you are not happy with all the kind, use the Look for discipline at the top of the display to find other variations of your authorized kind web template.

- Step 4. When you have discovered the shape you will need, select the Acquire now switch. Opt for the costs strategy you prefer and put your references to sign up for the profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the structure of your authorized kind and down load it on the device.

- Step 7. Complete, revise and print or indication the Oregon Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Every single authorized document web template you acquire is the one you have for a long time. You have acces to each kind you downloaded inside your acccount. Click on the My Forms segment and choose a kind to print or down load yet again.

Be competitive and down load, and print the Oregon Sample Letter for Request for Free Credit Report Allowed by Federal Law with US Legal Forms. There are many professional and state-certain varieties you can use for your personal organization or person requires.