The Oregon Bill of Transfer to a Trust is a legal document used in estate planning to transfer assets from an individual to a trust. It enables individuals to designate beneficiaries, outline specific instructions for the distribution of assets, and protect their assets from probate. This bill is an essential component of creating a comprehensive estate plan, ensuring that one's wishes are carried out and their loved ones are taken care of after their passing. The Oregon Bill of Transfer to a Trust is governed by specific state laws, which individuals must comply with in order to ensure its validity. The bill typically includes detailed information about the individual creating the trust (known as the settler), the trustee (person responsible for managing the trust assets), and the beneficiaries. There are various types of Oregon Bills of Transfer to a Trust, each serving unique purposes and addressing specific needs: 1. Revocable Living Trust: This is the most common type of trust used in estate planning. It allows individuals to retain full control and ownership of their assets during their lifetime. They can make changes, revoke, or amend the trust as they wish, ensuring flexibility and adaptability. 2. Irrevocable Trust: Unlike the revocable living trust, this type of trust cannot be altered or revoked once established. It offers increased asset protection, helps mitigate estate taxes, and ensures the assets are safeguarded for specific purposes, such as providing for minor children or individuals with special needs. 3. Testamentary Trust: This trust is created within an individual's last will and testament, and it only becomes effective upon their passing. Testamentary trusts can be customized and provide instructions on how the assets should be managed and distributed after the individual's death. 4. Charitable Trust: Oregon allows the creation of charitable trusts, which are designed to benefit nonprofit organizations or charitable causes. These trusts offer specific tax benefits to individuals while supporting charitable endeavors that align with their values and beliefs. The Oregon Bill of Transfer to a Trust provides individuals with a powerful tool to protect their assets, minimize tax liabilities, and efficiently transfer wealth to their chosen beneficiaries. It is important to consult with an experienced estate planning attorney to ensure compliance with state laws and guarantee the successful execution of this crucial document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Factura de transferencia a un fideicomiso - Bill of Transfer to a Trust

Description

How to fill out Oregon Factura De Transferencia A Un Fideicomiso?

You may devote time on the Internet searching for the authorized record format that meets the state and federal specifications you require. US Legal Forms supplies a huge number of authorized kinds which can be examined by professionals. It is simple to acquire or printing the Oregon Bill of Transfer to a Trust from our assistance.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load key. Afterward, it is possible to total, edit, printing, or indication the Oregon Bill of Transfer to a Trust. Every authorized record format you buy is yours eternally. To acquire another duplicate associated with a obtained develop, go to the My Forms tab and click the corresponding key.

If you are using the US Legal Forms web site the first time, follow the straightforward recommendations under:

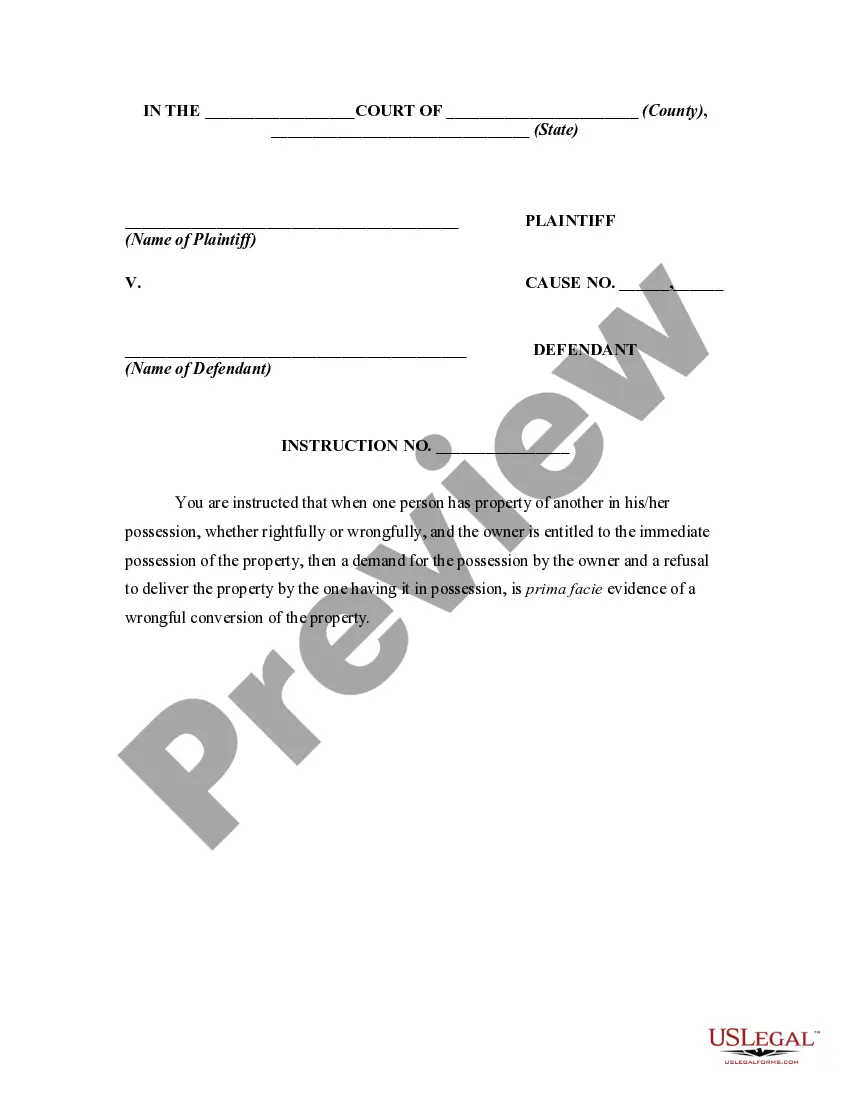

- Initially, make sure that you have selected the best record format to the area/metropolis of your choice. Browse the develop outline to make sure you have picked the right develop. If available, make use of the Preview key to check through the record format too.

- If you would like find another model from the develop, make use of the Lookup area to obtain the format that suits you and specifications.

- Upon having identified the format you desire, click on Get now to move forward.

- Choose the prices strategy you desire, type your qualifications, and sign up for your account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal bank account to pay for the authorized develop.

- Choose the file format from the record and acquire it to the device.

- Make adjustments to the record if needed. You may total, edit and indication and printing Oregon Bill of Transfer to a Trust.

Down load and printing a huge number of record layouts while using US Legal Forms website, which provides the biggest selection of authorized kinds. Use skilled and status-particular layouts to take on your company or personal demands.