An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

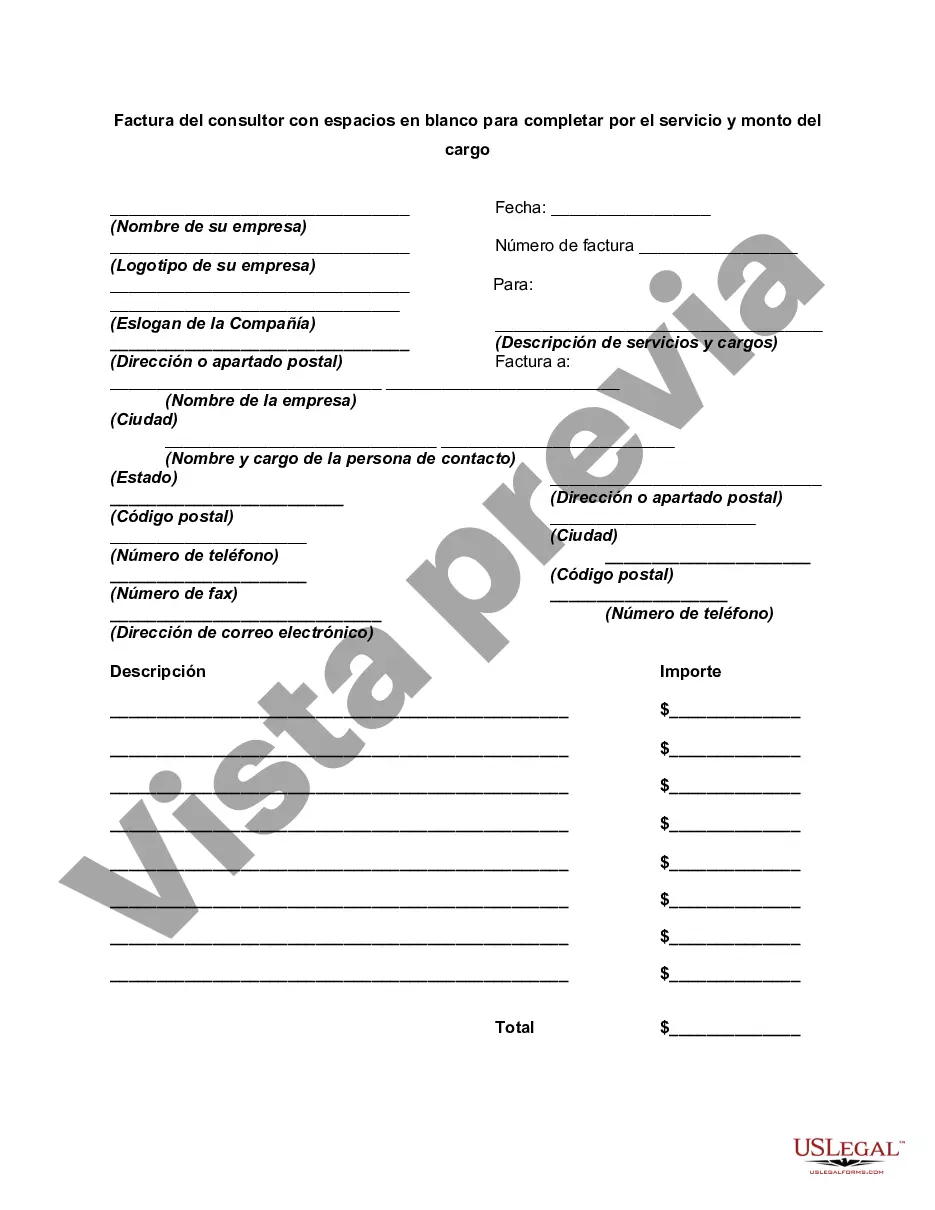

Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is an essential document used by consultants in Oregon to request payment for their services. This invoice template provides a standardized format that simplifies the billing process for both the consultant and the client. The Oregon Invoice of Consultant primarily consists of various blanks that the consultant needs to fill in with relevant information. The key sections of this invoice include: 1. Header: The invoice typically starts with a header that includes the consultant's name, address, contact information, and their logo (if applicable). This allows for easy identification and communication. 2. Invoice Number and Date: Every invoice is assigned a unique number to distinguish it from others. Additionally, the invoice date indicates when it was issued, helping both parties keep track of payments and records. 3. Client Details: This section requires the consultant to enter the client's name, address, contact information, and any specific project or account numbers related to the service rendered. 4. Service Description: Here, the consultant provides a detailed breakdown of the services performed, including dates, activities, and specific tasks completed. This section allows for transparency and clarity regarding what the client is being billed for. 5. Hours or Fees: Consultants can choose to either enter the number of hours worked on a specific task or provide a fixed fee for the service rendered. Depending on the nature of the consulting engagement, either method may be applicable. 6. Additional Charges: If there are any additional expenses incurred during the project, such as travel costs, materials, or third-party fees, they can be added in this section. The consultant should document and itemize these charges for the client's reference. 7. Subtotal, Tax, and Total: The subtotal is calculated by summing up all the charges, including the base fees and any additional costs. If applicable, relevant taxes (such as sales tax) are added, and the total amount due is calculated by combining the subtotal and tax. 8. Payment Instructions: This section outlines the preferred payment method, such as bank transfer, check, or online payment platforms. Details like bank account numbers, payment terms, and due dates are specified here to ensure smooth payment processing. Different types of Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge may include variations based on industry or specific contractual agreements. For instance, consultants in the legal or accounting fields may need to include additional disclosures or disclaimers on their invoices, complying with industry regulations. In conclusion, the Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a versatile tool that enables consultants to invoice clients in Oregon accurately. From header to payment instructions, this template streamlines the invoicing process, ensuring professionalism, consistency, and clarity in financial transactions between consultants and their clients.Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is an essential document used by consultants in Oregon to request payment for their services. This invoice template provides a standardized format that simplifies the billing process for both the consultant and the client. The Oregon Invoice of Consultant primarily consists of various blanks that the consultant needs to fill in with relevant information. The key sections of this invoice include: 1. Header: The invoice typically starts with a header that includes the consultant's name, address, contact information, and their logo (if applicable). This allows for easy identification and communication. 2. Invoice Number and Date: Every invoice is assigned a unique number to distinguish it from others. Additionally, the invoice date indicates when it was issued, helping both parties keep track of payments and records. 3. Client Details: This section requires the consultant to enter the client's name, address, contact information, and any specific project or account numbers related to the service rendered. 4. Service Description: Here, the consultant provides a detailed breakdown of the services performed, including dates, activities, and specific tasks completed. This section allows for transparency and clarity regarding what the client is being billed for. 5. Hours or Fees: Consultants can choose to either enter the number of hours worked on a specific task or provide a fixed fee for the service rendered. Depending on the nature of the consulting engagement, either method may be applicable. 6. Additional Charges: If there are any additional expenses incurred during the project, such as travel costs, materials, or third-party fees, they can be added in this section. The consultant should document and itemize these charges for the client's reference. 7. Subtotal, Tax, and Total: The subtotal is calculated by summing up all the charges, including the base fees and any additional costs. If applicable, relevant taxes (such as sales tax) are added, and the total amount due is calculated by combining the subtotal and tax. 8. Payment Instructions: This section outlines the preferred payment method, such as bank transfer, check, or online payment platforms. Details like bank account numbers, payment terms, and due dates are specified here to ensure smooth payment processing. Different types of Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge may include variations based on industry or specific contractual agreements. For instance, consultants in the legal or accounting fields may need to include additional disclosures or disclaimers on their invoices, complying with industry regulations. In conclusion, the Oregon Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a versatile tool that enables consultants to invoice clients in Oregon accurately. From header to payment instructions, this template streamlines the invoicing process, ensuring professionalism, consistency, and clarity in financial transactions between consultants and their clients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.