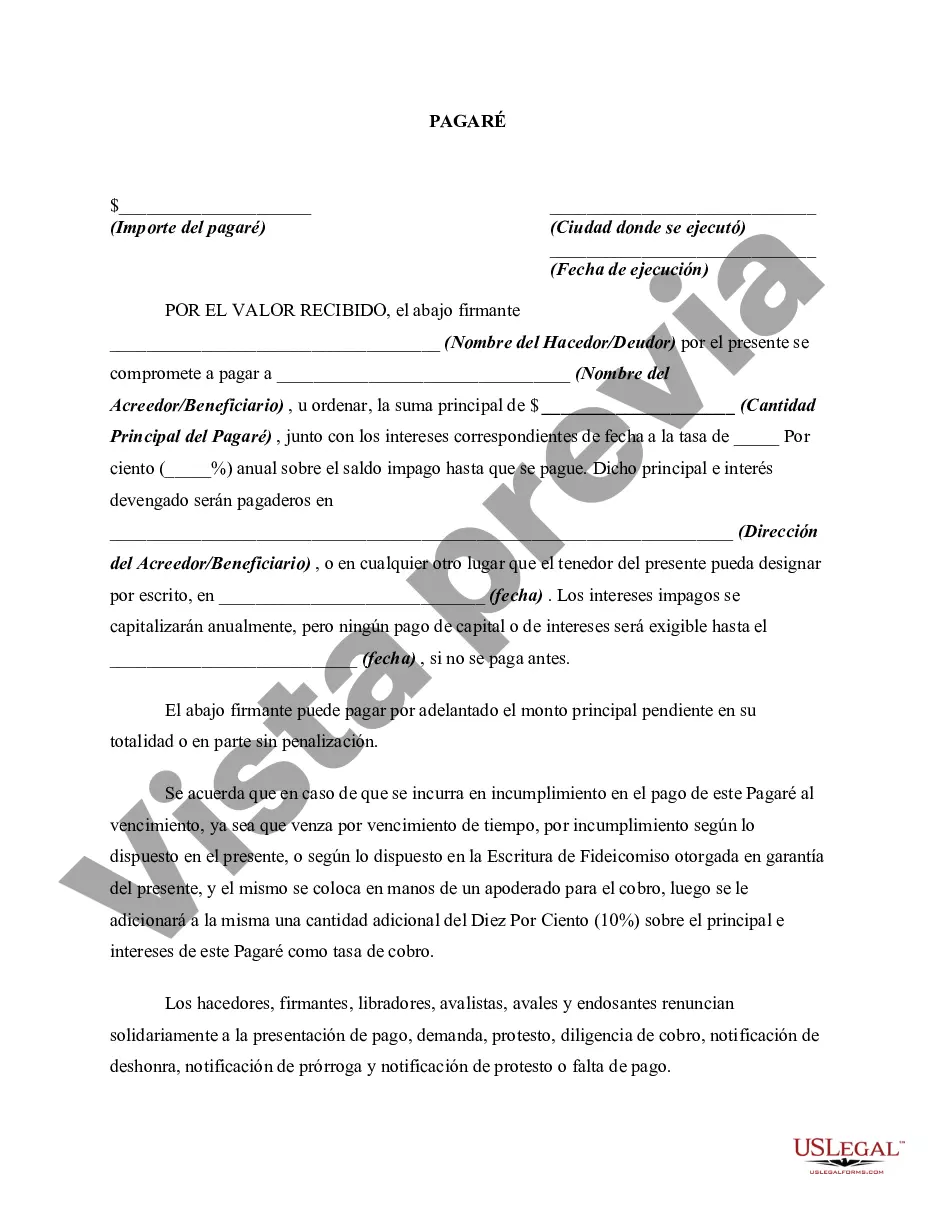

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines a borrower's promise to repay a loan amount to the lender within a specified timeframe. This specific type of promissory note is unique because it does not require any payments until the maturity date, and the interest on the loan accrued annually is compounded. The Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides a clear understanding of the terms and conditions associated with the loan. It specifies the principal amount borrowed, the interest rate applied annually, the maturity date, and any additional fees or charges imposed on the borrower. This type of promissory note enables borrowers to defer making regular payments until the maturity date, which can be advantageous for individuals or businesses with irregular cash flows or specific financial circumstances. By not having to make payments throughout the term, borrowers have the flexibility to allocate their funds to other financial obligations or investments. The interest on the loan compounds annually, meaning that it accrues on both the principal amount and the accumulated interest from previous years. As a result, the total amount due at maturity is higher than the initial principal borrowed. This compounding interest structure can potentially benefit lenders, providing an opportunity to earn higher returns on their investment. While the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually generally follows a standard format, there may be variations or additional types based on specific loan agreements or individual circumstances. Some possible variations include: 1. Secured Promissory Note: This type of promissory note may require the borrower to provide collateral, such as real estate or personal assets, to secure the loan. If the borrower defaults on repayment, the lender has the right to seize the collateral to recover the outstanding amount. 2. Convertible Promissory Note: This type of promissory note includes an option for the lender to convert the loan into equity in the borrower's business if certain conditions are met. This allows the lender to potentially become a shareholder in the borrower's company. 3. Balloon Payment Promissory Note: While the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually does not require regular payments, a balloon payment promissory note structure may be used. This structure involves making smaller periodic payments throughout the loan term and a large "balloon" payment due at maturity. Overall, the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides a flexible repayment option for borrowers and a potential opportunity for lenders to earn higher returns through compounding interest. It is crucial for both parties to thoroughly understand the terms and seek legal advice when drafting or signing such agreements to ensure compliance with state laws and protect their respective interests.Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding document that outlines a borrower's promise to repay a loan amount to the lender within a specified timeframe. This specific type of promissory note is unique because it does not require any payments until the maturity date, and the interest on the loan accrued annually is compounded. The Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides a clear understanding of the terms and conditions associated with the loan. It specifies the principal amount borrowed, the interest rate applied annually, the maturity date, and any additional fees or charges imposed on the borrower. This type of promissory note enables borrowers to defer making regular payments until the maturity date, which can be advantageous for individuals or businesses with irregular cash flows or specific financial circumstances. By not having to make payments throughout the term, borrowers have the flexibility to allocate their funds to other financial obligations or investments. The interest on the loan compounds annually, meaning that it accrues on both the principal amount and the accumulated interest from previous years. As a result, the total amount due at maturity is higher than the initial principal borrowed. This compounding interest structure can potentially benefit lenders, providing an opportunity to earn higher returns on their investment. While the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually generally follows a standard format, there may be variations or additional types based on specific loan agreements or individual circumstances. Some possible variations include: 1. Secured Promissory Note: This type of promissory note may require the borrower to provide collateral, such as real estate or personal assets, to secure the loan. If the borrower defaults on repayment, the lender has the right to seize the collateral to recover the outstanding amount. 2. Convertible Promissory Note: This type of promissory note includes an option for the lender to convert the loan into equity in the borrower's business if certain conditions are met. This allows the lender to potentially become a shareholder in the borrower's company. 3. Balloon Payment Promissory Note: While the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually does not require regular payments, a balloon payment promissory note structure may be used. This structure involves making smaller periodic payments throughout the loan term and a large "balloon" payment due at maturity. Overall, the Oregon Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually provides a flexible repayment option for borrowers and a potential opportunity for lenders to earn higher returns through compounding interest. It is crucial for both parties to thoroughly understand the terms and seek legal advice when drafting or signing such agreements to ensure compliance with state laws and protect their respective interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.