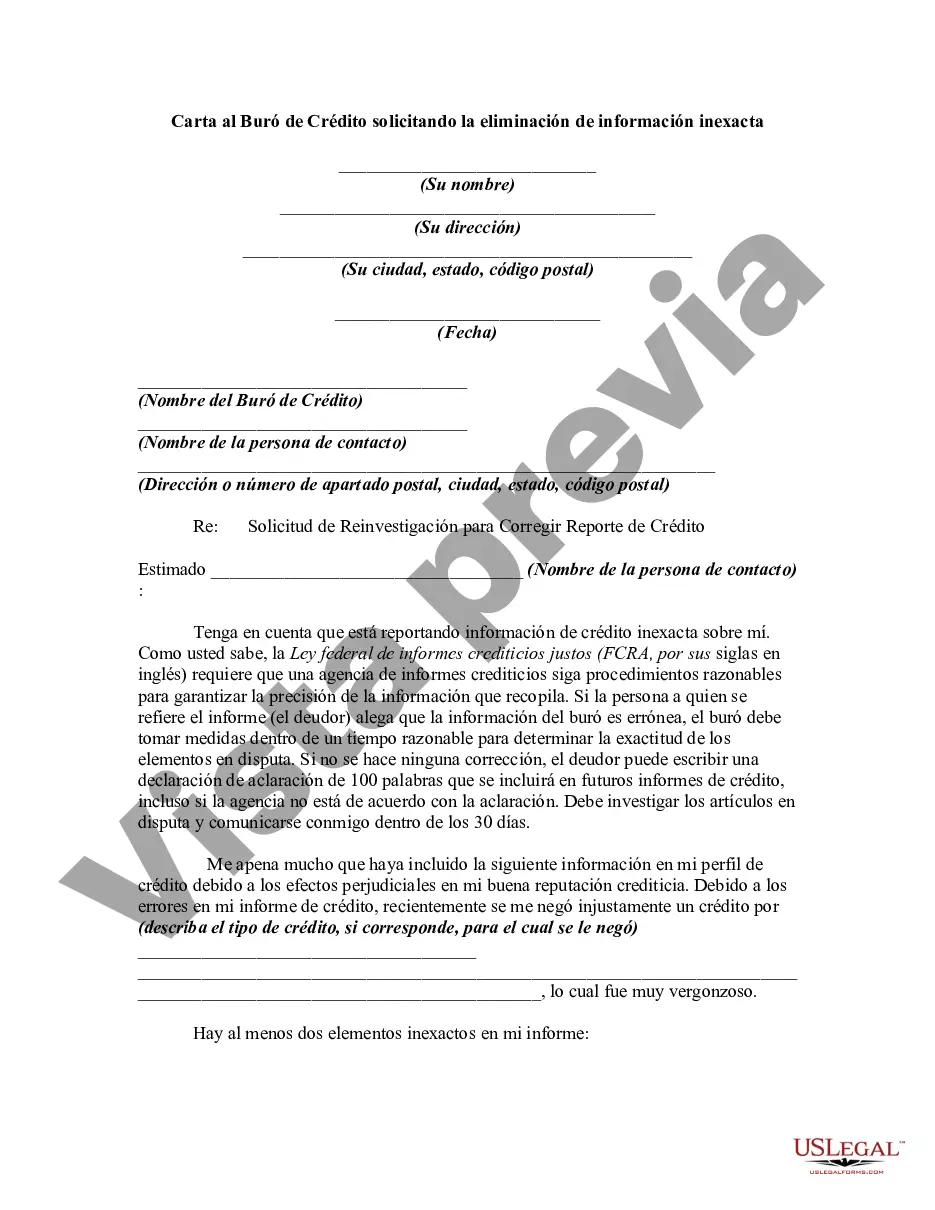

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Title: Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information Description: An Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal written document submitted to credit bureaus located in the state of Oregon. This letter serves as a means to dispute incorrect or inaccurate information that might negatively affect an individual's credit score and overall financial reputation. It is important to address any erroneous data on credit reports promptly, as it can impact loan eligibility, interest rates, and other financial aspects. Credit bureaus play a pivotal role in managing consumer credit information, and by submitting this letter, individuals seek to rectify erroneous entries. Types of Oregon Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Identity Theft Dispute Letter: This type of letter is utilized when an individual suspects fraudulent activity on their credit report due to identity theft. It includes detailed explanations of the discrepancies with supporting evidence to request removal of the inaccurate information. 2. Incorrect Account Information Letter: If there are any discrepancies regarding open or closed accounts, incorrect payments, or balances that are inaccurately reported on the credit report, this type of letter is used to request the credit bureau to investigate and rectify the errors. 3. Outdated Negative Entries Dispute Letter: Negative information, such as late payments or collections, that exceeds the legally allowed reporting period (typically seven years) may be considered outdated. This letter is used to request the removal of such obsolete negative entries from the credit report. 4. Inaccurate Personal Information Letter: Personal identification information, including names, addresses, or social security numbers, that are incorrectly reported in a credit file can greatly impact an individual's creditworthiness. This type of letter is used to inform credit bureaus about errors in personal information and request correction. 5. Mixed File Dispute Letter: In situations where someone else's information is mistakenly linked or mixed with the individual's credit report, this letter is utilized to rectify the inaccuracies and ensure accurate reporting. By using an Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information tailored to the specific issue at hand, individuals can actively engage in the process of disputing and correcting inaccurate information on their credit reports. This proactive approach helps maintain a fair and accurate representation of one's credit history, leading to better financial opportunities in the future.Title: Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information Description: An Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information is a formal written document submitted to credit bureaus located in the state of Oregon. This letter serves as a means to dispute incorrect or inaccurate information that might negatively affect an individual's credit score and overall financial reputation. It is important to address any erroneous data on credit reports promptly, as it can impact loan eligibility, interest rates, and other financial aspects. Credit bureaus play a pivotal role in managing consumer credit information, and by submitting this letter, individuals seek to rectify erroneous entries. Types of Oregon Letters to Credit Bureau Requesting Removal of Inaccurate Information: 1. Identity Theft Dispute Letter: This type of letter is utilized when an individual suspects fraudulent activity on their credit report due to identity theft. It includes detailed explanations of the discrepancies with supporting evidence to request removal of the inaccurate information. 2. Incorrect Account Information Letter: If there are any discrepancies regarding open or closed accounts, incorrect payments, or balances that are inaccurately reported on the credit report, this type of letter is used to request the credit bureau to investigate and rectify the errors. 3. Outdated Negative Entries Dispute Letter: Negative information, such as late payments or collections, that exceeds the legally allowed reporting period (typically seven years) may be considered outdated. This letter is used to request the removal of such obsolete negative entries from the credit report. 4. Inaccurate Personal Information Letter: Personal identification information, including names, addresses, or social security numbers, that are incorrectly reported in a credit file can greatly impact an individual's creditworthiness. This type of letter is used to inform credit bureaus about errors in personal information and request correction. 5. Mixed File Dispute Letter: In situations where someone else's information is mistakenly linked or mixed with the individual's credit report, this letter is utilized to rectify the inaccuracies and ensure accurate reporting. By using an Oregon Letter to Credit Bureau Requesting the Removal of Inaccurate Information tailored to the specific issue at hand, individuals can actively engage in the process of disputing and correcting inaccurate information on their credit reports. This proactive approach helps maintain a fair and accurate representation of one's credit history, leading to better financial opportunities in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.