This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Privacy and Confidentiality Policy for Credit Counseling Services is a set of guidelines and regulations put in place to protect the privacy and confidentiality of individuals seeking credit counseling in the state of Oregon. These policies are designed to ensure that credit counseling agencies handle their clients' information in a secure and responsible manner while providing the necessary assistance. Confidentiality plays a crucial role in credit counseling services, as clients often disclose personal and financial information during counseling sessions. The Oregon Privacy and Confidentiality Policy aims to address the following key aspects: 1. Data Collection and Consent: Credit counseling agencies in Oregon must inform clients about the information they collect, why it is collected, and how it will be used. They should obtain explicit consent from clients before gathering any personal or financial data. 2. Information Security: Credit counseling agencies are required to implement robust security measures to protect clients' personal and financial information from unauthorized access, use, or disclosure. This includes using firewalls, encryption, secure data storage, and regularly updating security software. 3. Use and Disclosure: Any use or disclosure of client information should be limited to the purpose for which it was collected. Credit counseling agencies should obtain client consent before sharing their information with third parties, except in cases where disclosure is required by law or necessary for providing services. 4. Employee Training and Access: Credit counseling agencies must ensure that their employees are trained in privacy and confidentiality policies and understand the importance of protecting client information. Access to client data should be restricted to authorized personnel only. 5. Retention and Disposal: Personal and financial information should only be retained for as long as necessary and securely disposed of once it is no longer needed. This may involve securely deleting electronic records or using cross-cut shredding for physical documents. It's important to note that while the Oregon Privacy and Confidentiality Policy provides a general framework for credit counseling services, specific policies may vary between different agencies. Some agencies may have additional safeguards or industry-specific policies in place to further protect client privacy. Therefore, it is crucial for individuals seeking credit counseling services to review and understand the specific privacy and confidentiality policies of the agency they choose to work with. By adhering to the Oregon Privacy and Confidentiality Policy for Credit Counseling Services, agencies help foster a trustworthy and secure environment for individuals seeking assistance with their finances. These policies ensure that clients' personal and financial information remains private and confidential throughout the credit counseling process, promoting transparency, trust, and peace of mind for those in need.Oregon Privacy and Confidentiality Policy for Credit Counseling Services is a set of guidelines and regulations put in place to protect the privacy and confidentiality of individuals seeking credit counseling in the state of Oregon. These policies are designed to ensure that credit counseling agencies handle their clients' information in a secure and responsible manner while providing the necessary assistance. Confidentiality plays a crucial role in credit counseling services, as clients often disclose personal and financial information during counseling sessions. The Oregon Privacy and Confidentiality Policy aims to address the following key aspects: 1. Data Collection and Consent: Credit counseling agencies in Oregon must inform clients about the information they collect, why it is collected, and how it will be used. They should obtain explicit consent from clients before gathering any personal or financial data. 2. Information Security: Credit counseling agencies are required to implement robust security measures to protect clients' personal and financial information from unauthorized access, use, or disclosure. This includes using firewalls, encryption, secure data storage, and regularly updating security software. 3. Use and Disclosure: Any use or disclosure of client information should be limited to the purpose for which it was collected. Credit counseling agencies should obtain client consent before sharing their information with third parties, except in cases where disclosure is required by law or necessary for providing services. 4. Employee Training and Access: Credit counseling agencies must ensure that their employees are trained in privacy and confidentiality policies and understand the importance of protecting client information. Access to client data should be restricted to authorized personnel only. 5. Retention and Disposal: Personal and financial information should only be retained for as long as necessary and securely disposed of once it is no longer needed. This may involve securely deleting electronic records or using cross-cut shredding for physical documents. It's important to note that while the Oregon Privacy and Confidentiality Policy provides a general framework for credit counseling services, specific policies may vary between different agencies. Some agencies may have additional safeguards or industry-specific policies in place to further protect client privacy. Therefore, it is crucial for individuals seeking credit counseling services to review and understand the specific privacy and confidentiality policies of the agency they choose to work with. By adhering to the Oregon Privacy and Confidentiality Policy for Credit Counseling Services, agencies help foster a trustworthy and secure environment for individuals seeking assistance with their finances. These policies ensure that clients' personal and financial information remains private and confidential throughout the credit counseling process, promoting transparency, trust, and peace of mind for those in need.

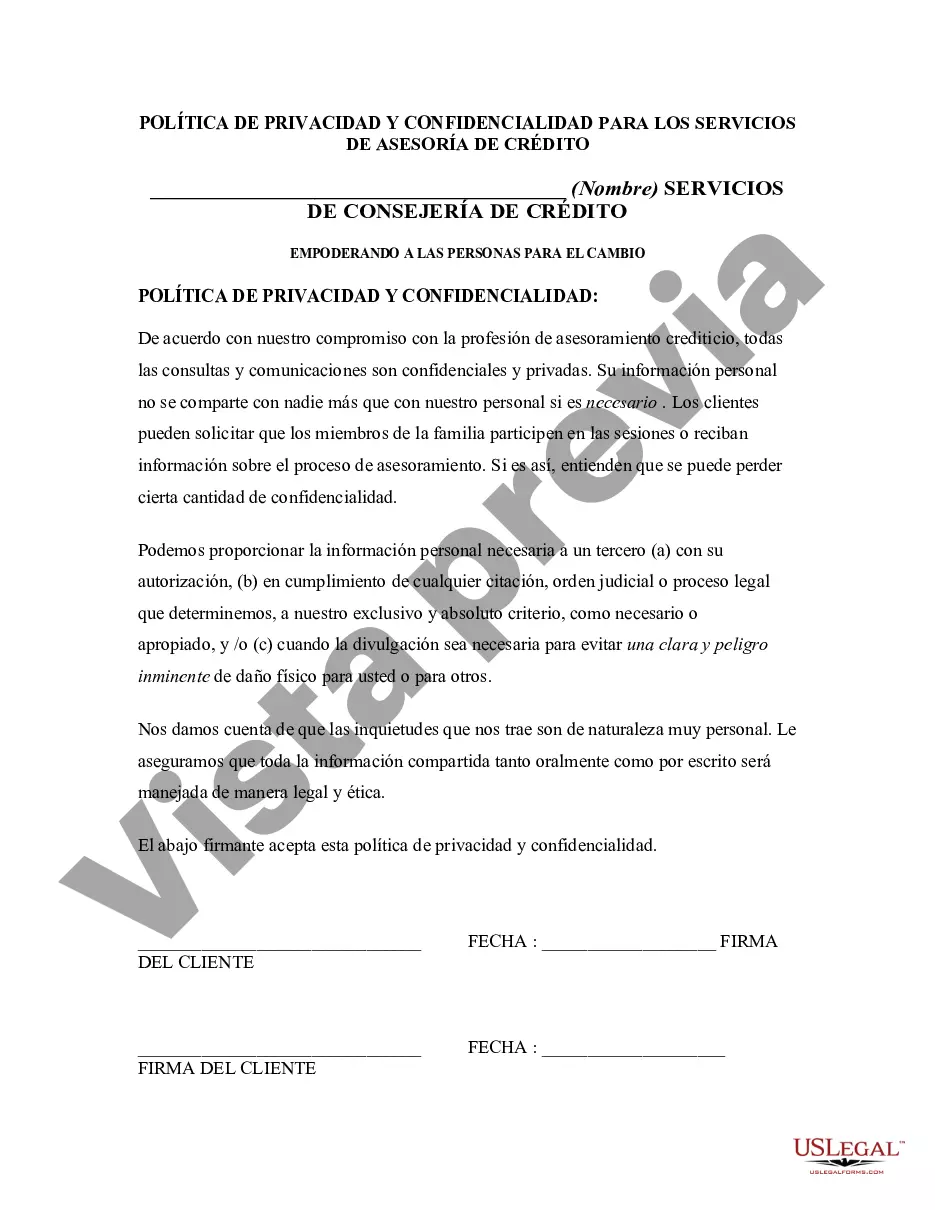

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.