In Oregon, the Assignment and Transfer of Stock refers to the process of transferring ownership of shares or stocks in a corporation from one individual or entity to another. This legal transaction involves the transferor (the original stockholder) assigning their ownership rights to the transferee (the new stockholder). The Oregon Assignment and Transfer of Stock encompasses various important aspects and requires compliance with state laws and the corporation's governing documents. One common type of Oregon Assignment and Transfer of Stock is an Inter Vivos Transfer. This type of transfer occurs during the lifetime of the stockholder and involves the voluntary transfer of shares. It typically requires the completion of specific forms, including the assignment form provided by the corporation. The assignment form includes essential information such as the number of shares being transferred, the name of the transferee, and the date of the transfer. Another type of Assignment and Transfer of Stock in Oregon relates to the Transfer Upon Death. This type of transfer occurs upon the death of a stockholder and typically follows the instructions outlined in their will or trust. The process varies based on whether the stockholder had a valid will, a living trust, or neither. In cases where the stockholder had a valid will, the transfer of stock may go through the probate process. If a living trust exists, the transfer occurs according to the trust's provisions, bypassing probate. It's important to note that the Oregon Assignment and Transfer of Stock must adhere to the requirements set forth by the Oregon Business Corporation Act. This act outlines the procedures, limitations, and rights associated with the transfer of stock. Any transfer must be consistent with the corporation's articles of incorporation, bylaws, and any applicable shareholders' agreement. To initiate the Assignment and Transfer of Stock, the stockholder must complete and sign the assignment document, often in the presence of a notary public. The transferee then submits the completed assignment form to the corporation along with any additional required documentation, such as stock power or affidavit of domicile. The corporation, upon receipt of the completed transfer documents, reviews them for accuracy and compliance. Once approved, the corporation updates its stock registry to reflect the change in ownership. The transferee becomes the new legal owner of the stock, with all the associated rights, responsibilities, and entitlements. In summary, the Oregon Assignment and Transfer of Stock is a legal process involving the transfer of ownership of shares or stocks in a corporation from one party to another. Types of transfer include Inter Vivos Transfer and Transfer Upon Death. The process requires adherence to state laws and the corporation's governing documents, completion of necessary forms, and submission of required documentation. Proper compliance ensures a valid and documented transfer of ownership.

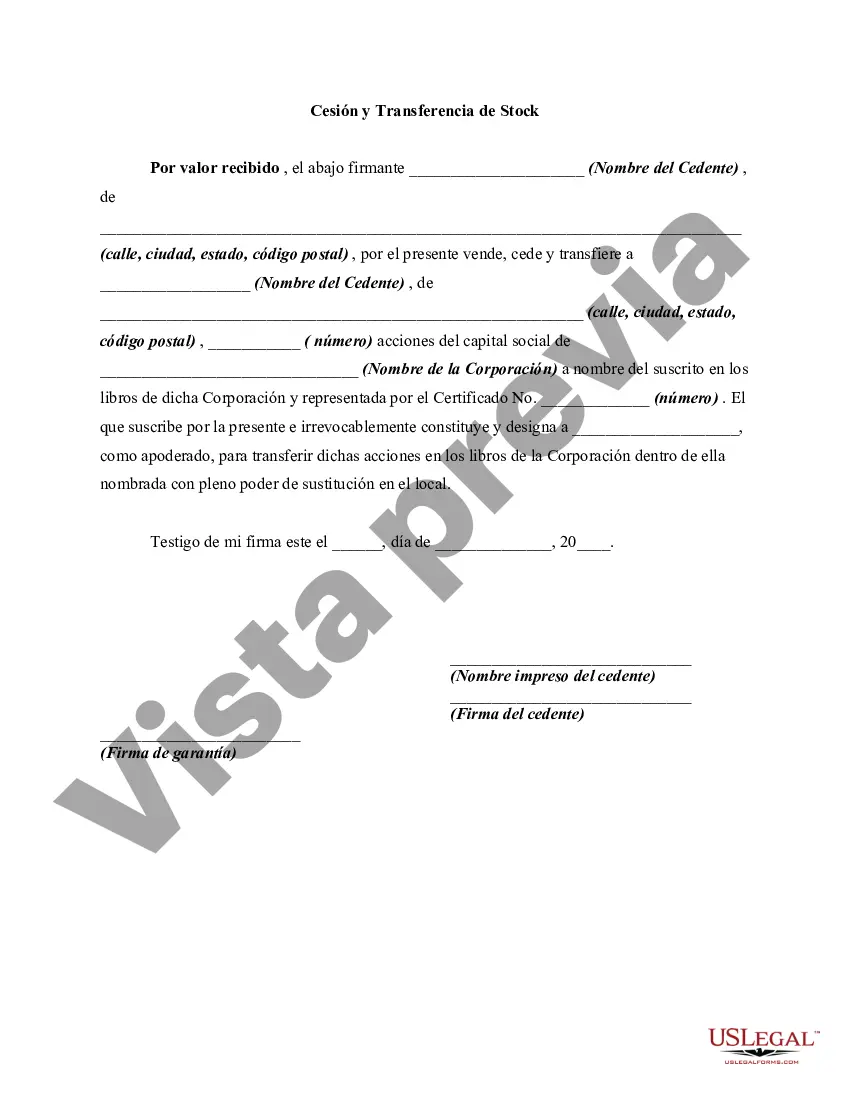

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Oregon Cesión Y Transferencia De Stock?

US Legal Forms - among the biggest libraries of legitimate varieties in the United States - gives a wide array of legitimate record web templates you may download or print out. While using site, you will get a huge number of varieties for company and person reasons, sorted by groups, suggests, or search phrases.You can find the latest variations of varieties such as the Oregon Assignment and Transfer of Stock within minutes.

If you already possess a subscription, log in and download Oregon Assignment and Transfer of Stock from the US Legal Forms library. The Down load key will show up on each develop you look at. You get access to all in the past delivered electronically varieties inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the first time, here are simple guidelines to get you started out:

- Be sure to have picked the right develop for your metropolis/state. Click on the Review key to check the form`s articles. Read the develop outline to ensure that you have selected the proper develop.

- When the develop does not match your specifications, use the Lookup discipline towards the top of the screen to discover the one which does.

- If you are content with the form, verify your decision by clicking on the Purchase now key. Then, pick the pricing strategy you want and offer your references to sign up to have an bank account.

- Method the purchase. Utilize your charge card or PayPal bank account to complete the purchase.

- Pick the file format and download the form in your system.

- Make alterations. Fill out, revise and print out and sign the delivered electronically Oregon Assignment and Transfer of Stock.

Every web template you put into your money lacks an expiry day which is yours permanently. So, if you want to download or print out an additional copy, just proceed to the My Forms area and then click about the develop you will need.

Get access to the Oregon Assignment and Transfer of Stock with US Legal Forms, one of the most comprehensive library of legitimate record web templates. Use a huge number of expert and express-specific web templates that satisfy your company or person demands and specifications.