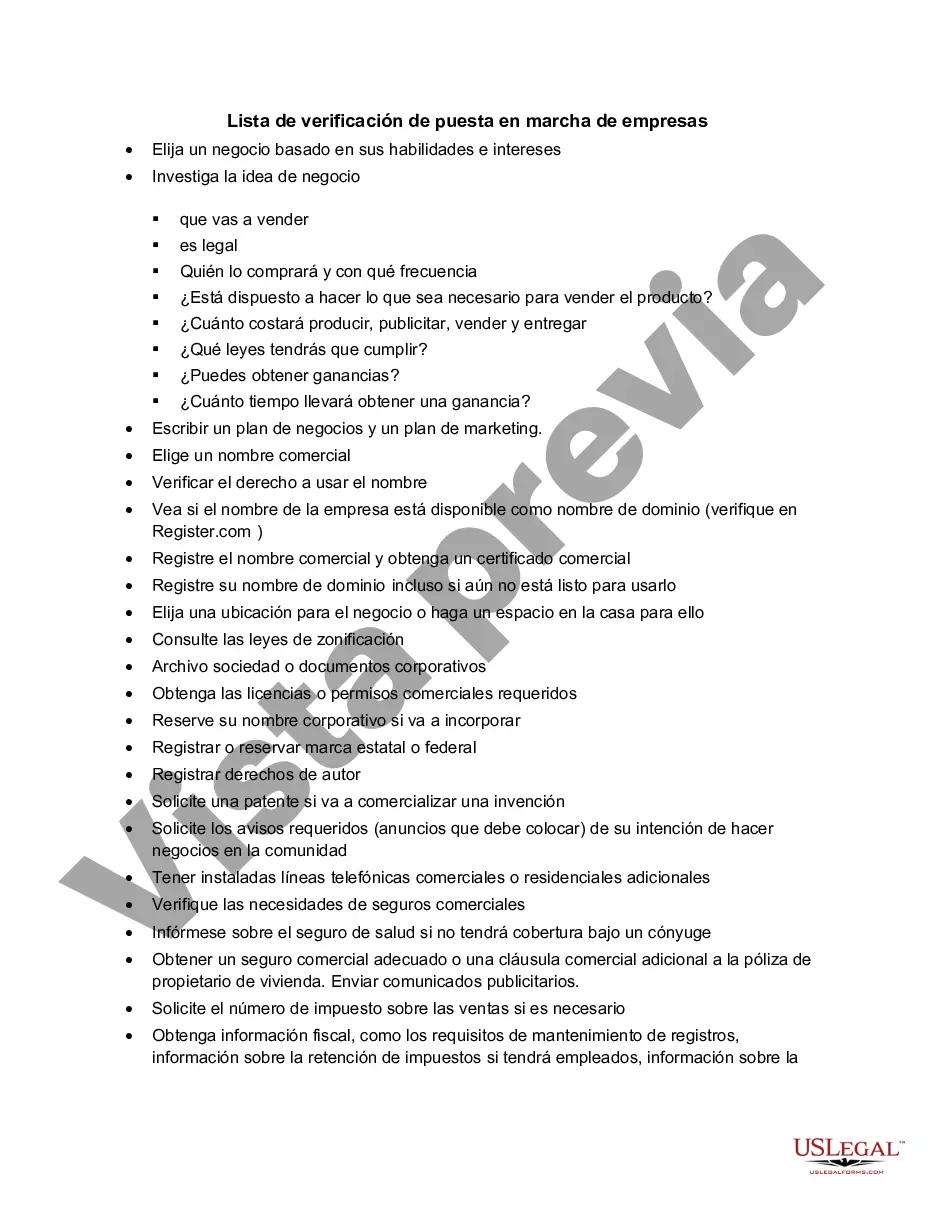

Oregon Business Start-up Checklist is a comprehensive list of tasks and requirements that individuals or entrepreneurs need to complete when starting a business in the state of Oregon. This checklist aims to ensure that all necessary steps are followed and necessary permits, licenses, and registrations are obtained. The Oregon Business Start-Up Checklist includes various key steps that need to be taken into consideration. It covers important legal, financial, and administrative tasks that entrepreneurs must go through in order to establish a successful business in Oregon. This checklist generally includes the following items: 1. Business Name Registration: Entrepreneurs need to choose a unique name for their business and register it with the Oregon Secretary of State. This step ensures that applicants' chosen name is not already in use. 2. Legal Structure Selection: Entrepreneurs must decide on the legal structure of their business, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. This decision affects taxation, liability, and ownership arrangements. 3. Federal Employer Identification Number (VEIN): Obtaining a VEIN is mandatory for most businesses, as it allows them to conduct various tax-related transactions. It is usually acquired from the Internal Revenue Service (IRS). 4. Licenses and Permits: Various licenses and permits may be required depending on the nature of the business. These can include professional licenses, health permits, zoning permits, and others. The checklist entails identifying the necessary permits and obtaining them from the appropriate agencies. 5. Business Taxes: Entrepreneurs must understand their tax obligations and register for state and local taxes. This includes taxes related to sales, income, employment, and other applicable taxes. 6. Business Insurance: It is essential to determine the insurance requirements for the business, such as general liability, worker's compensation, or professional liability insurance. Proper insurance coverage helps protect the business and its assets. 7. Location and Zoning Compliance: Entrepreneurs need to ensure that their business location complies with local zoning regulations and restrictions. Zoning laws vary depending on the area, and adhering to them is crucial to avoid legal complications. 8. Hiring Employees: If the business aims to hire employees, certain obligations come into play, such as verifying employment eligibility, ensuring workplace safety, and complying with applicable labor laws, including minimum wage and overtime regulations. Different types of Oregon Business Start-up Checklists may exist based on the specific industry or business sector. These specialized checklists focus on industry-specific licenses, permits, and requirements. For instance, food establishments may have a separate checklist that includes permits related to food handling, health inspections, and compliance with food safety regulations. In conclusion, the Oregon Business Start-up Checklist acts as a vital guide for individuals starting their own business in Oregon. It ensures entrepreneurs cover all necessary legal, financial, and administrative aspects of establishing and operating a business in compliance with Oregon state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Lista de verificación de puesta en marcha de empresas - Business Start-up Checklist

Description

How to fill out Oregon Lista De Verificación De Puesta En Marcha De Empresas?

US Legal Forms - one of many biggest libraries of authorized types in the States - offers a variety of authorized papers layouts you can down load or print out. While using internet site, you can find thousands of types for company and individual purposes, sorted by categories, states, or key phrases.You will discover the most recent models of types such as the Oregon Business Start-up Checklist in seconds.

If you have a registration, log in and down load Oregon Business Start-up Checklist through the US Legal Forms collection. The Down load button can look on every single form you view. You have access to all formerly saved types from the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, allow me to share simple guidelines to help you started:

- Be sure you have picked the proper form for the town/county. Click the Review button to check the form`s information. See the form description to ensure that you have selected the correct form.

- In the event the form doesn`t match your demands, utilize the Research industry on top of the display to obtain the one who does.

- Should you be pleased with the form, affirm your option by clicking on the Buy now button. Then, opt for the prices program you prefer and give your credentials to sign up for an accounts.

- Method the deal. Make use of bank card or PayPal accounts to perform the deal.

- Find the formatting and down load the form in your device.

- Make alterations. Complete, revise and print out and signal the saved Oregon Business Start-up Checklist.

Each template you included in your money lacks an expiry particular date and it is your own permanently. So, in order to down load or print out another backup, just go to the My Forms portion and click on around the form you need.

Obtain access to the Oregon Business Start-up Checklist with US Legal Forms, one of the most comprehensive collection of authorized papers layouts. Use thousands of professional and state-specific layouts that satisfy your small business or individual demands and demands.