The Oregon Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a legally binding document that outlines the terms and conditions regarding the distribution of dividends among shareholders in a close corporation located in the state of Oregon. This agreement is designed to ensure fairness and clarity in the allocation of dividends, as well as to protect the rights and interests of all shareholders. The purpose of this agreement is to provide a framework for the distribution of dividends in a close corporation, which is a type of business organization with a limited number of shareholders. This agreement is particularly applicable to close corporations in Oregon, as it is tailored to comply with state laws and regulations. Key elements of the Oregon Shareholders' Agreement with Special Allocation of Dividends may include: 1. Dividend Allocation: The agreement specifies how dividends will be allocated among shareholders, whether it be based on the percentage of ownership or in a predetermined fixed ratio. This ensures a fair distribution of profits and avoids potential disputes among shareholders. 2. Dividend Payment Schedule: The agreement may outline the timing and frequency of dividend payments. It may establish regular intervals for dividend distributions, such as quarterly or annually, or allow for ad-hoc distributions based on the corporation's financial performance. 3. Preferential Dividend Rights: The agreement may grant certain shareholders preferential dividend rights, entitling them to receive a higher proportion of dividends compared to other shareholders. This provision may be based on factors such as seniority, financial contributions, or specific roles within the corporation. 4. Dividend Retention: The agreement may address circumstances in which the corporation decides to retain a portion of its profits as retained earnings instead of distributing them as dividends. This provision can ensure the corporation's financial stability and long-term growth. 5. Dissenters' Rights: The agreement may include provisions to protect the interests of dissenting shareholders who oppose the allocation of dividends. This may outline procedures for resolving disputes, such as mediation or arbitration, to ensure a fair resolution. Some types of Oregon Shareholders' Agreements with Special Allocation of Dividends among Shareholders in a Close Corporation may include: 1. Fixed Ratio Allocation Agreement: This type of agreement establishes a predetermined fixed ratio for dividend allocation among shareholders. For example, if there are three shareholders, the agreement may specify a 50%/30%/20% ratio for dividend distribution. 2. Proportional Ownership Agreement: In this type of agreement, dividends are allocated based on the proportional ownership of each shareholder in the corporation. If a shareholder owns 40% of the corporation, they will receive 40% of the total dividends distributed. 3. Preferred Shareholder Agreement: This agreement grants preferential dividend rights to certain shareholders, typically those who hold preferred shares in the corporation. Preferred shareholders may be entitled to receive dividends first, before common shareholders, at a predetermined rate or fixed amount. In conclusion, the Oregon Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation is a crucial document that ensures fair and transparent distribution of dividends in close corporations based in Oregon. With various types of agreements available, it is crucial for shareholders to carefully consider their specific needs and consult legal professionals to tailor an agreement that best suits their corporation's unique circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Pacto de Accionistas con Asignación Especial de Dividendos entre Accionistas en Sociedad Anónima Cerrada - Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation

Description

How to fill out Oregon Pacto De Accionistas Con Asignación Especial De Dividendos Entre Accionistas En Sociedad Anónima Cerrada?

Are you within a situation in which you need to have documents for both company or personal uses just about every working day? There are tons of legitimate record themes available on the Internet, but discovering ones you can rely on is not effortless. US Legal Forms delivers a huge number of form themes, much like the Oregon Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation, which can be composed to fulfill state and federal needs.

When you are already knowledgeable about US Legal Forms internet site and have your account, merely log in. Next, you can download the Oregon Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation web template.

Unless you offer an account and wish to start using US Legal Forms, adopt these measures:

- Get the form you need and ensure it is for your right town/region.

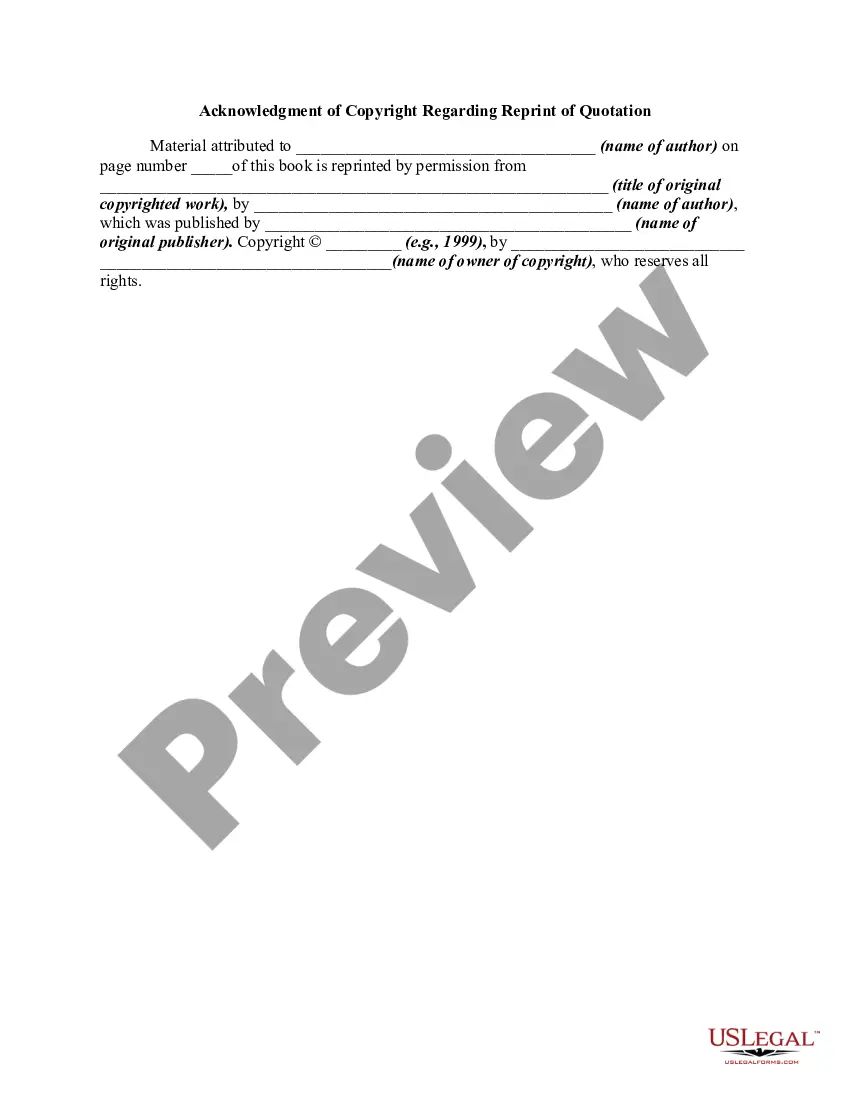

- Utilize the Preview button to check the form.

- See the description to actually have chosen the appropriate form.

- If the form is not what you are looking for, utilize the Lookup area to discover the form that fits your needs and needs.

- Whenever you get the right form, just click Purchase now.

- Choose the costs plan you would like, fill in the desired details to create your account, and purchase the order utilizing your PayPal or bank card.

- Pick a convenient paper format and download your copy.

Locate each of the record themes you have bought in the My Forms food selection. You can get a more copy of Oregon Shareholders' Agreement with Special Allocation of Dividends among Shareholders in a Close Corporation at any time, if possible. Just select the essential form to download or print out the record web template.

Use US Legal Forms, probably the most considerable selection of legitimate varieties, to save time as well as prevent faults. The support delivers appropriately produced legitimate record themes which can be used for a variety of uses. Generate your account on US Legal Forms and initiate creating your daily life easier.