Title: Understanding Oregon Checklist of Member Managed Limited Liability Company Operating Agreement Description: The Oregon Checklist of Member Managed Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the guidelines and procedures for managing an LLC in the state of Oregon. This comprehensive operating agreement ensures that members of an LLC are aware of their rights, responsibilities, and expectations within the company. Types of Oregon Checklist of Member Managed Limited Liability Company Operating Agreement: 1. Standard Member Managed LLC Operating Agreement: This type of operating agreement is designed for LCS in Oregon that are managed by all its members. Each member has equal decision-making power and is involved in the day-to-day operations. 2. Customized Member Managed LLC Operating Agreement: Some LCS may choose to draft a customized operating agreement based on their specific needs and requirements. This allows members to modify certain provisions and tailor the agreement to their unique business structure and goals. 3. Professional LLC (LLC) Operating Agreement: A Professional Limited Liability Company (LLC) is a specific type of LLC formed by licensed professionals such as attorneys, architects, doctors, or accountants. The LLC operating agreement follows the same principles as a standard member managed LLC agreement but with additional regulations specific to professional services. Key Elements of Oregon Checklist of Member Managed Limited Liability Company Operating Agreement: 1. Name and Purpose: Clearly state the LLC's official name and the purpose for which it is formed, outlining the primary activities and objectives of the company. 2. Member Rights and Responsibilities: Define the rights, powers, and responsibilities of each member, including voting rights, capital contribution obligations, and duties pertaining to decision-making, profit distribution, and annual meetings. 3. Management Structure: Outline the managerial structure of the LLC, including identifying the managers (members or non-members) responsible for the day-to-day operations and decision-making process. 4. Capital Contributions: Specify the amount of initial capital contributed by each member and their commitment to future capital contributions, if any. This ensures transparency and clarity concerning the financial aspects of the LLC. 5. Profit and Loss Distribution: Establish a formula or method for dividing profits and losses among the members, providing a clear understanding of how earnings will be allocated and distributed. 6. Dissolution and Termination: Include provisions for the dissolution or termination of the LLC, outlining the procedure for winding up the company's affairs and distributing remaining assets. 7. Dispute Resolution: Incorporate clauses that address dispute resolution mechanisms, such as mediation or arbitration, to ensure efficient resolution of conflicts among LLC members. By adhering to the Oregon Checklist of Member Managed Limited Liability Company Operating Agreement, an LLC can operate smoothly and mitigate potential conflicts or misunderstandings among its members.

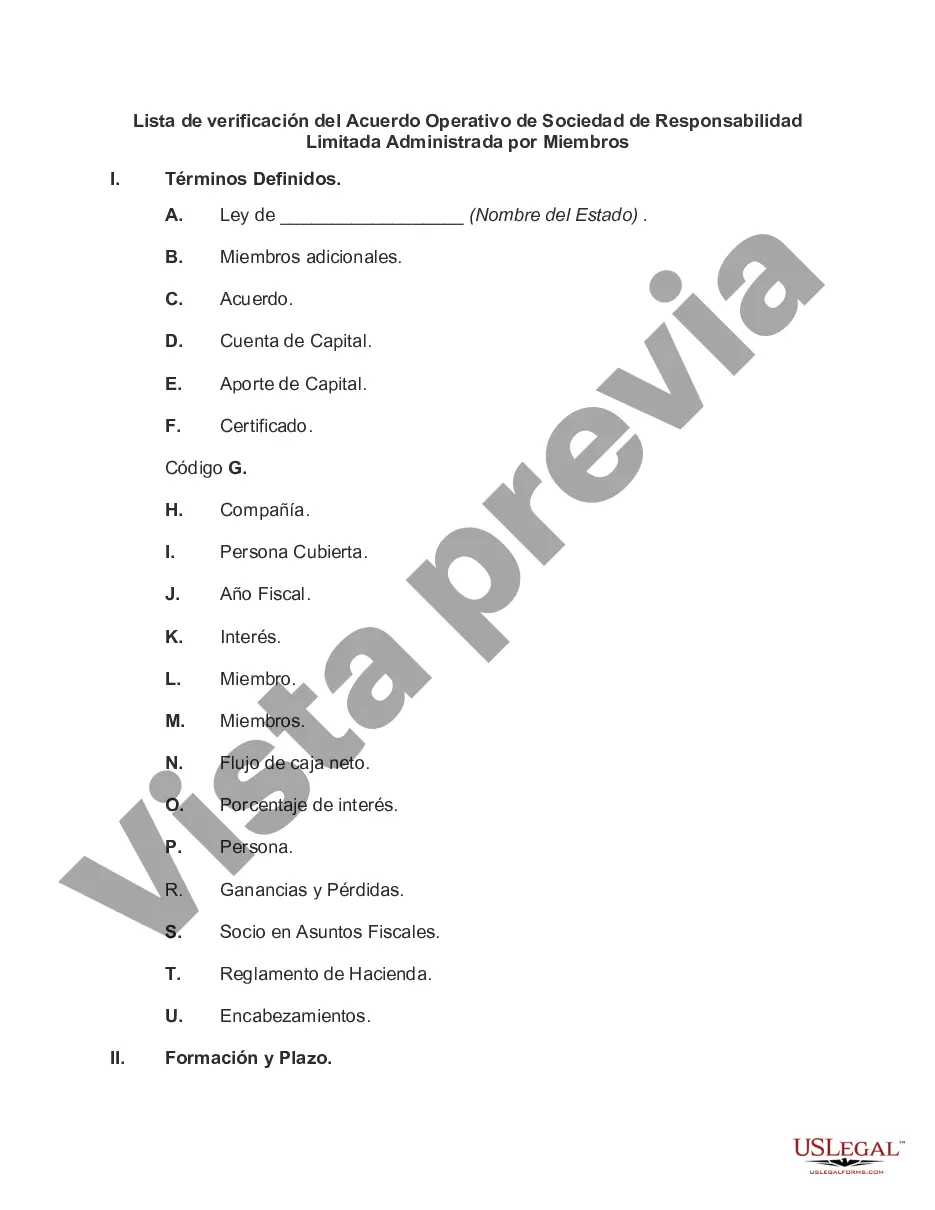

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Lista de verificación del Acuerdo Operativo de Sociedad de Responsabilidad Limitada Administrada por Miembros - Checklist of Member Managed Limited Liability Company Operating Agreement

Description

How to fill out Oregon Lista De Verificación Del Acuerdo Operativo De Sociedad De Responsabilidad Limitada Administrada Por Miembros?

Discovering the right authorized papers template might be a have a problem. Needless to say, there are a variety of templates available online, but how can you discover the authorized form you need? Take advantage of the US Legal Forms site. The support offers thousands of templates, including the Oregon Checklist of Member Managed Limited Liability Company Operating Agreement, which you can use for enterprise and personal requirements. Each of the forms are inspected by professionals and meet up with state and federal specifications.

If you are previously listed, log in to your profile and then click the Acquire option to find the Oregon Checklist of Member Managed Limited Liability Company Operating Agreement. Use your profile to look with the authorized forms you might have ordered in the past. Visit the My Forms tab of the profile and acquire yet another duplicate from the papers you need.

If you are a brand new user of US Legal Forms, allow me to share basic instructions for you to adhere to:

- Initial, make sure you have selected the appropriate form for the city/region. You can look over the form making use of the Preview option and look at the form explanation to guarantee it is the right one for you.

- In the event the form does not meet up with your needs, make use of the Seach field to get the proper form.

- When you are certain that the form is suitable, go through the Buy now option to find the form.

- Pick the costs strategy you would like and enter the necessary information and facts. Build your profile and pay money for your order making use of your PayPal profile or Visa or Mastercard.

- Select the file format and obtain the authorized papers template to your device.

- Complete, change and print out and signal the attained Oregon Checklist of Member Managed Limited Liability Company Operating Agreement.

US Legal Forms is the most significant local library of authorized forms in which you can find various papers templates. Take advantage of the company to obtain expertly-made papers that adhere to status specifications.