Title: Understanding the Oregon Final Notice of Past Due Account: Types and Detailed Description Introduction: The Oregon Final Notice of Past Due Account serves as an important document for addressing outstanding debts within the state. In this article, we will explore the different types of Oregon Final Notice of Past Due Account and provide a detailed description of their purpose, content, and potential implications. Understanding these notices can help individuals and businesses navigate the recovery process efficiently. Keywords: Oregon, Final Notice, Past Due Account, types, description I. Oregon Final Notice of Past Due Account — Overview: The Oregon Final Notice of Past Due Account is a formal communication sent to individuals or businesses who have failed to resolve outstanding debts. Such accounts may involve various entities, including utility companies, landlords, healthcare providers, credit card companies, etc. The notice represents an escalation from previous reminders and indicates the urgent need for immediate action. Keywords: Oregon, Final Notice, Past Due Account, communication, outstanding debts, escalation, immediate action II. Types of Oregon Final Notice of Past Due Account: 1. Consumer Debt: This type of notice is issued to individuals who have unpaid debts related to personal finance, such as credit card bills, medical expenses, overdue loans, or outstanding utility bills. Consumer debt notices typically contain specific information regarding the overdue amounts, due dates, and consequences of non-payment. Keywords: Oregon, Final Notice, Past Due Account, consumer debt, credit card bills, medical expenses, overdue loans, utility bills, non-payment 2. Commercial Debt: The Oregon Final Notice of Past Due Account is also employed in cases where businesses owe money to other businesses, suppliers, or service providers. These notices highlight the importance of fulfilling financial obligations promptly, emphasizing the potential impact on professional relationships and creditworthiness. Keywords: Oregon, Final Notice, Past Due Account, commercial debt, business debts, suppliers, service providers, financial obligations, creditworthiness III. Detailed Description of Oregon Final Notice of Past Due Account: 1. Content: The Oregon Final Notice of Past Due Account typically includes the following information: — Sender's details: Name, address, contact information of the issuing party. — Recipient's details: Name, address, account number of the debtor. — Debt information: Detailed breakdown of the outstanding amount, including principal, interest, and any applicable fees. — Due dates: Specific dates by which the payment should be made to avoid further consequences. — Consequences of non-payment: Explicitly mentioned adverse actions, such as legal actions, credit reporting, or collection agency involvement. — Contact information: Instructions on how to resolve the debt and who to contact for more information or payment arrangements. Keywords: Oregon, Final Notice, Past Due Account, content, sender's details, recipient's details, debt information, due dates, consequences, contact information 2. Implications: It is crucial to understand the potential implications of receiving an Oregon Final Notice of Past Due Account. Ignoring or failing to address the notice can lead to various consequences, including: — Negative impact on credit score: Non-payment can result in the debtor's credit score being negatively affected, potentially leading to difficulties in obtaining credit in the future. — Legal actions: Continued non-payment may prompt the creditor to initiate legal proceedings or hire a collection agency to pursue the debt. — Collection efforts: Debt collectors may contact the debtor through phone calls, letters, or personal visits until the debt is resolved. Keywords: Oregon, Final Notice, Past Due Account, implications, credit score, legal actions, collection efforts, debtors, creditors. Conclusion: Understanding the Oregon Final Notice of Past Due Account and its various types is crucial for anyone facing outstanding debts in the state. These notices demand urgent attention and prompt action to avoid negative consequences of credit damage or legal actions. By addressing the content and implications of the notice adequately, individuals and businesses can navigate the debt recovery process effectively. Keywords: Oregon, Final Notice, Past Due Account, understanding, outstanding debts, urgent attention, prompt action, credit damage, legal actions, debt recovery process.

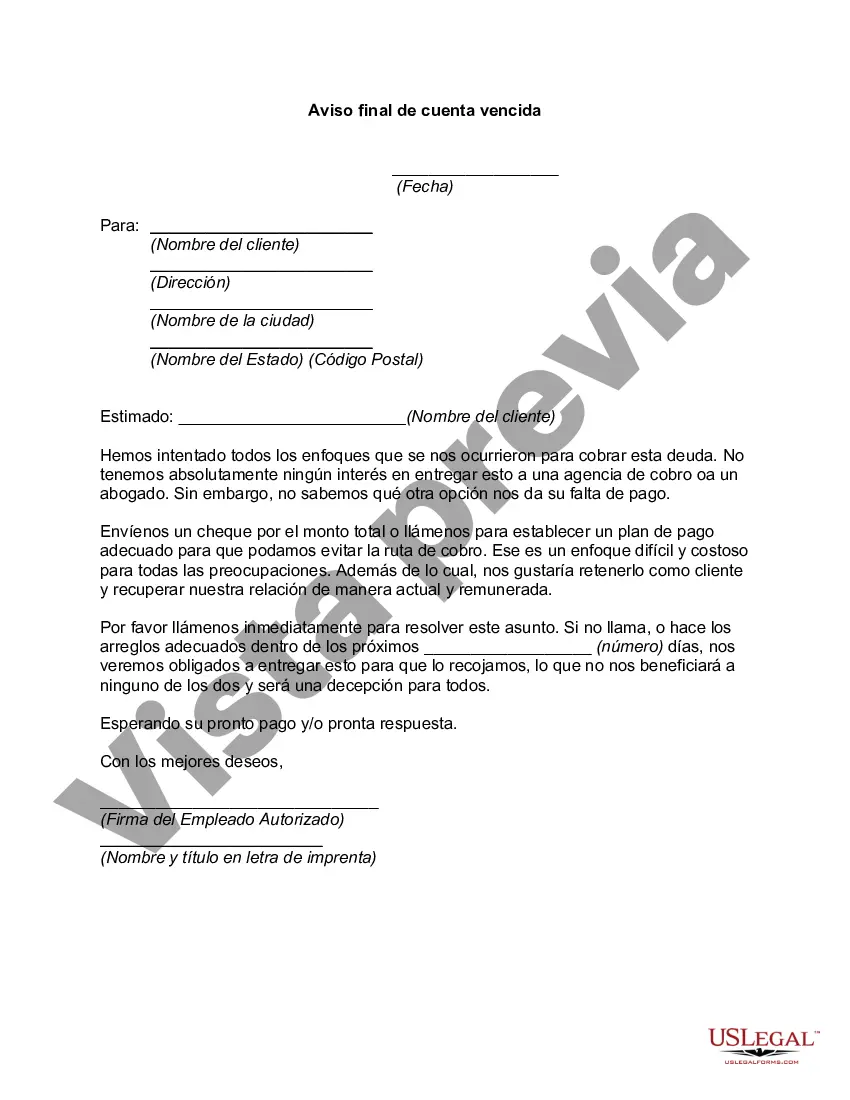

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Aviso final de cuenta vencida - Final Notice of Past Due Account

Description

How to fill out Oregon Aviso Final De Cuenta Vencida?

Discovering the right lawful record web template could be a have difficulties. Needless to say, there are a lot of themes available on the net, but how can you obtain the lawful type you require? Use the US Legal Forms site. The services delivers a huge number of themes, such as the Oregon Final Notice of Past Due Account, which can be used for business and private requirements. All the varieties are examined by professionals and satisfy federal and state demands.

Should you be currently authorized, log in in your account and click the Acquire option to find the Oregon Final Notice of Past Due Account. Make use of account to search throughout the lawful varieties you might have ordered previously. Go to the My Forms tab of your own account and acquire an additional version of your record you require.

Should you be a fresh user of US Legal Forms, listed below are simple directions for you to follow:

- Initial, ensure you have selected the appropriate type to your city/area. You are able to check out the shape making use of the Review option and browse the shape explanation to guarantee it will be the right one for you.

- In case the type will not satisfy your expectations, use the Seach discipline to get the right type.

- When you are positive that the shape is acceptable, go through the Buy now option to find the type.

- Opt for the pricing prepare you want and enter the necessary info. Design your account and pay money for the transaction using your PayPal account or credit card.

- Choose the data file file format and download the lawful record web template in your device.

- Complete, modify and print and signal the attained Oregon Final Notice of Past Due Account.

US Legal Forms is definitely the greatest library of lawful varieties where you can find various record themes. Use the service to download expertly-created papers that follow express demands.