The Oregon Notice of Assignment of Accounts is a legal document serving as a formal notification of an account assignment to a third party. It is a crucial document used to establish that one party (assignor) is transferring their rights and interest in an account to another party (assignee). This notice ensures transparency and helps protect the rights and interests of all parties involved. When drafting an Oregon Notice of Assignment of Accounts, it is important to include specific details to ensure its validity and effectiveness. Relevant keywords that should be incorporated in the document include: 1. Assignor: The party transferring their rights and interest in the account. Provide the assignor's legal name, address, and contact details to identify them accurately. 2. Assignee: The party to whom the rights and interest in the account are being assigned. Include the assignee's legal name, address, and contact details to establish their identity. 3. Account Information: The account details should be mentioned explicitly, ensuring clarity. Include the account number, account type, and any other relevant information associated with the account. 4. Effective Date: This specifies the date when the assignment of the account will come into effect. Clearly indicate the day, month, and year for a precise understanding. 5. Governing Law: Specify that the notice of assignment of accounts is governed by the laws of the state of Oregon. This ensures standardization and legality according to the state's regulations. 6. Financial Institution: Mention the name and address of the financial institution holding the account. This helps identify the account and its responsible institution accurately. Types of Oregon Notice of Assignment of Accounts: 1. Notice of Assignment of Accounts Receivable: This type of notice is commonly used in business and commercial transactions when accounts receivable are being assigned from one party to another. It outlines the transfer of outstanding invoices or future payment obligations. 2. Notice of Assignment of Bank Account: In situations where an individual or entity wants to transfer their rights and interest in a specific bank account to another party, this notice is used. It clarifies the assignment of all funds, rights, and obligations associated with the bank account. 3. Notice of Assignment of Debt: When a debtor owes a specific amount of money to a creditor, the creditor may choose to assign their rights to collect the debt to another party. This notice clarifies the transfer of debt and the subsequent responsibilities of the new assignee. In conclusion, an Oregon Notice of Assignment of Accounts is an important legal document used to formalize the transfer of rights and interest in an account to another party. By including relevant keywords and information, such as assignor, assignee, account details, effective date, governing law, and financial institution, this notice ensures clarity, lawfulness, and protection for all parties involved. Different types of notices include accounts receivable, bank account, and debt assignment notices.

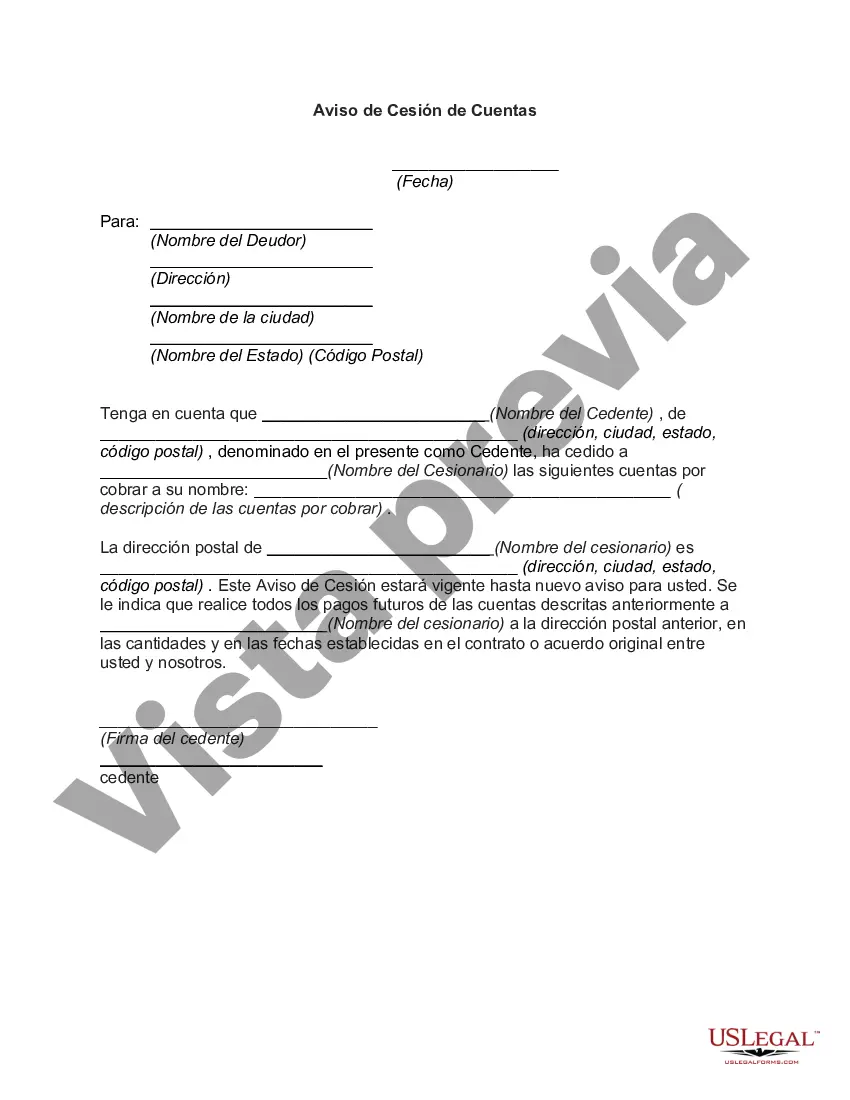

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Aviso de Cesión de Cuentas - Notice of Assignment of Accounts

Description

How to fill out Oregon Aviso De Cesión De Cuentas?

You are able to commit several hours on the web looking for the lawful document template which fits the state and federal specifications you need. US Legal Forms gives a huge number of lawful kinds which are reviewed by pros. It is possible to acquire or print out the Oregon Notice of Assignment of Accounts from the service.

If you currently have a US Legal Forms profile, it is possible to log in and click on the Acquire button. After that, it is possible to comprehensive, revise, print out, or sign the Oregon Notice of Assignment of Accounts. Each lawful document template you buy is yours for a long time. To acquire yet another backup for any bought form, check out the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms web site the very first time, stick to the simple recommendations under:

- First, make sure that you have chosen the right document template for that state/city of your choosing. Browse the form information to ensure you have selected the appropriate form. If offered, utilize the Preview button to search from the document template also.

- If you want to get yet another variation of the form, utilize the Research industry to obtain the template that meets your requirements and specifications.

- After you have discovered the template you need, just click Purchase now to carry on.

- Choose the costs plan you need, key in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your Visa or Mastercard or PayPal profile to pay for the lawful form.

- Choose the structure of the document and acquire it to the product.

- Make adjustments to the document if needed. You are able to comprehensive, revise and sign and print out Oregon Notice of Assignment of Accounts.

Acquire and print out a huge number of document layouts while using US Legal Forms web site, that provides the biggest assortment of lawful kinds. Use expert and state-specific layouts to handle your business or personal demands.