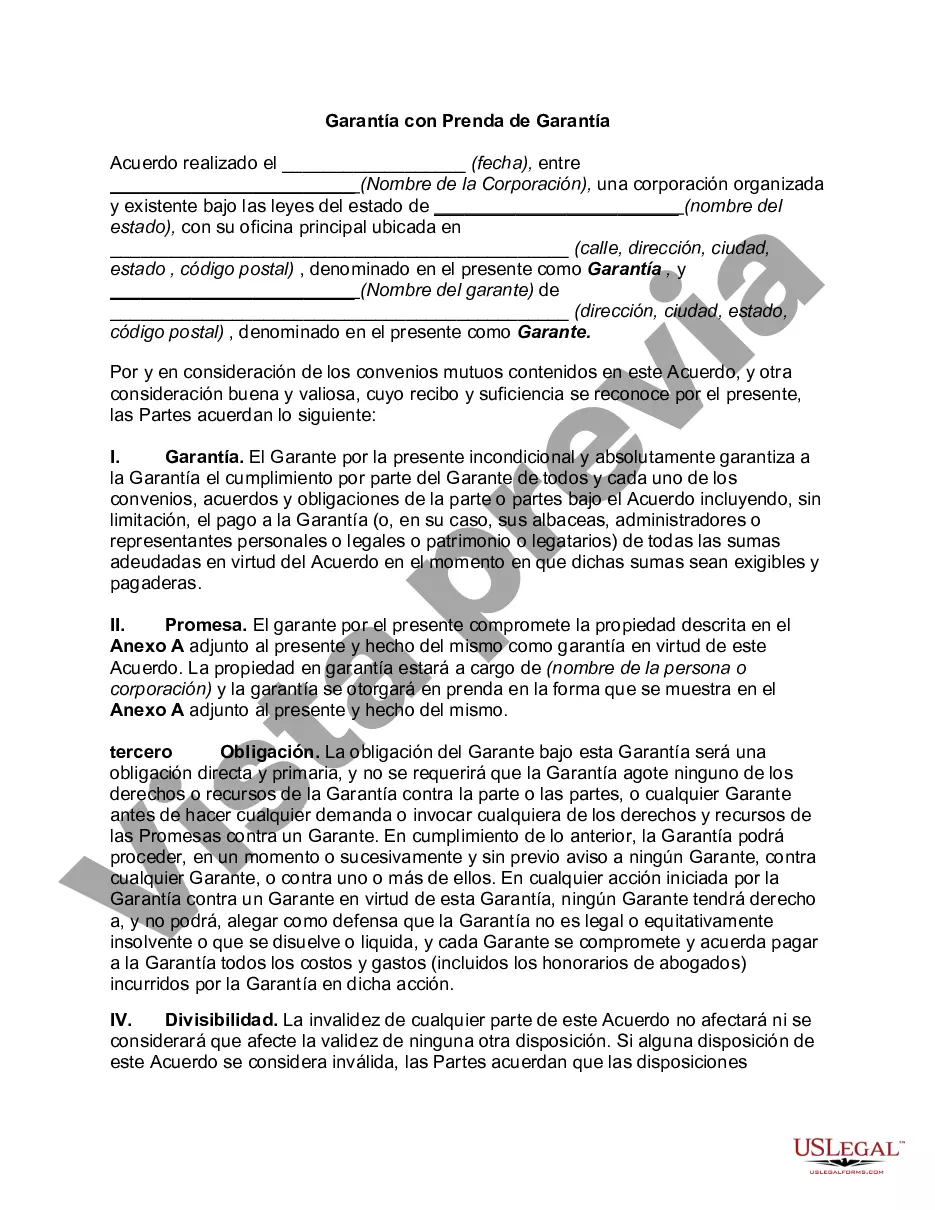

Oregon Guaranty with Pledged Collateral refers to a form of guarantee provided by a guarantor in the state of Oregon, in which the guarantor pledges collateral to secure a loan or obligation for a borrower. This type of guarantee is designed to provide additional assurance to lenders that their financial interests will be protected in case the borrower defaults on their loan repayment. The Oregon Guaranty with Pledged Collateral is a legally binding agreement that outlines the terms and conditions of the guarantee, including the specific collateral being pledged. The collateral can be any valuable assets owned by the guarantor, such as real estate, vehicles, equipment, or any other tangible or intangible property that holds financial value. By pledging collateral, the guarantor offers the lender an additional source of repayment in case the borrower fails to fulfill their obligations. In the event of default or non-payment, the lender has the right to seize and sell the pledged collateral to recover the outstanding loan amount or any other obligations owed to them. It's important to note that there may be various types of Oregon Guaranty with Pledged Collateral, depending on the specific loan or obligation for which the guarantee is being provided. These types could include: 1. Real Estate Pledge: In this scenario, the guarantor pledges their real estate property as collateral for the loan or obligation. This can include residential properties, commercial properties, or vacant land. 2. Vehicle Pledge: The guarantor may pledge their vehicles, such as cars, trucks, motorcycles, or any other registered vehicles, to secure the loan or obligation. 3. Equipment Pledge: In certain cases, the guarantor may pledge valuable equipment, machinery, or other business assets as collateral for the loan or obligation. 4. Investment Pledge: This type of Oregon Guaranty with Pledged Collateral involves the guarantor pledging their investment holdings, such as stocks, bonds, mutual funds, or any other financial securities. It is essential for all parties involved to fully understand and abide by the terms and conditions outlined in the Oregon Guaranty with Pledged Collateral agreement. Both the guarantor and the borrower should consult with legal professionals to ensure they comprehend the potential risks, responsibilities, and legal implications associated with pledging collateral for the loan or obligation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Garantía con Prenda de Garantía - Guaranty with Pledged Collateral

Description

How to fill out Oregon Garantía Con Prenda De Garantía?

Finding the right authorized document design might be a have a problem. Needless to say, there are a variety of templates available online, but how will you get the authorized develop you want? Use the US Legal Forms site. The assistance provides a huge number of templates, including the Oregon Guaranty with Pledged Collateral, which you can use for company and private needs. All of the varieties are checked by professionals and meet up with federal and state specifications.

If you are currently listed, log in in your account and click on the Acquire option to get the Oregon Guaranty with Pledged Collateral. Utilize your account to search throughout the authorized varieties you may have ordered in the past. Go to the My Forms tab of your account and obtain yet another version of the document you want.

If you are a whole new consumer of US Legal Forms, allow me to share basic recommendations that you can follow:

- Initial, be sure you have selected the proper develop for the area/county. You are able to look through the shape making use of the Preview option and look at the shape description to make certain it is the right one for you.

- In the event the develop is not going to meet up with your requirements, make use of the Seach field to obtain the right develop.

- When you are certain that the shape is suitable, click on the Buy now option to get the develop.

- Select the pricing plan you need and type in the required info. Create your account and buy your order making use of your PayPal account or bank card.

- Opt for the submit structure and obtain the authorized document design in your system.

- Complete, change and print out and signal the attained Oregon Guaranty with Pledged Collateral.

US Legal Forms is definitely the biggest catalogue of authorized varieties that you can see various document templates. Use the company to obtain expertly-made papers that follow condition specifications.