The Oregon Self-Employed Independent Contractor Employment Agreement is a legally binding contract that outlines the terms and conditions of the relationship between a self-employed individual and a hiring party. It specifically pertains to the work, services, and/or materials to be provided by the independent contractor. This employment agreement in Oregon covers a wide range of industries and professions, including but not limited to construction, creative arts, consulting, IT services, marketing, and more. It is crucial to draft a specific agreement that accurately reflects the nature of the work and the unique requirements of each respective industry. The agreement typically includes key provisions such as: 1. Scope of Work: Clearly defines the nature and extent of the services or tasks to be performed by the independent contractor. It outlines the project's objectives, timelines, and deliverables. 2. Compensation: Details the payment terms, including the agreed-upon rate, payment frequency, and any additional expenses or reimbursements. It may also include provisions regarding late payments or penalties. 3. Independent Contractor Status: Specifies that the individual is not an employee but rather an independent contractor, highlighting the absence of employee benefits and the contractor's responsibility for taxes and insurance. 4. Ownership of Work/Product: Clarifies who retains the intellectual property rights or ownership of any work, materials, or products created during the course of the engagement. 5. Confidentiality: Includes obligations to maintain the confidentiality of any proprietary information or trade secrets shared during the project. 6. Term and Termination: Outlines the duration of the agreement, including start and end dates, renewal terms, as well as provisions for early termination by either party and the associated consequences. 7. Indemnification and Liability: Allocates responsibilities for injuries, damages, or losses incurred during the project, including insurance requirements and liability limitations. 8. Dispute Resolution: Specifies the preferred method of resolving any disputes that may arise during the contract period, such as mediation, arbitration, or litigation. It is worth noting that the specific contents and structure of the Oregon Self-Employed Independent Contractor Employment Agreement can vary depending on the nature of the work, services, and/or materials involved. Different industries may require additional clauses or terms tailored to their specific needs. Hence, it is recommended to consult with an attorney or legal expert to ensure compliance with relevant Oregon laws and regulations.

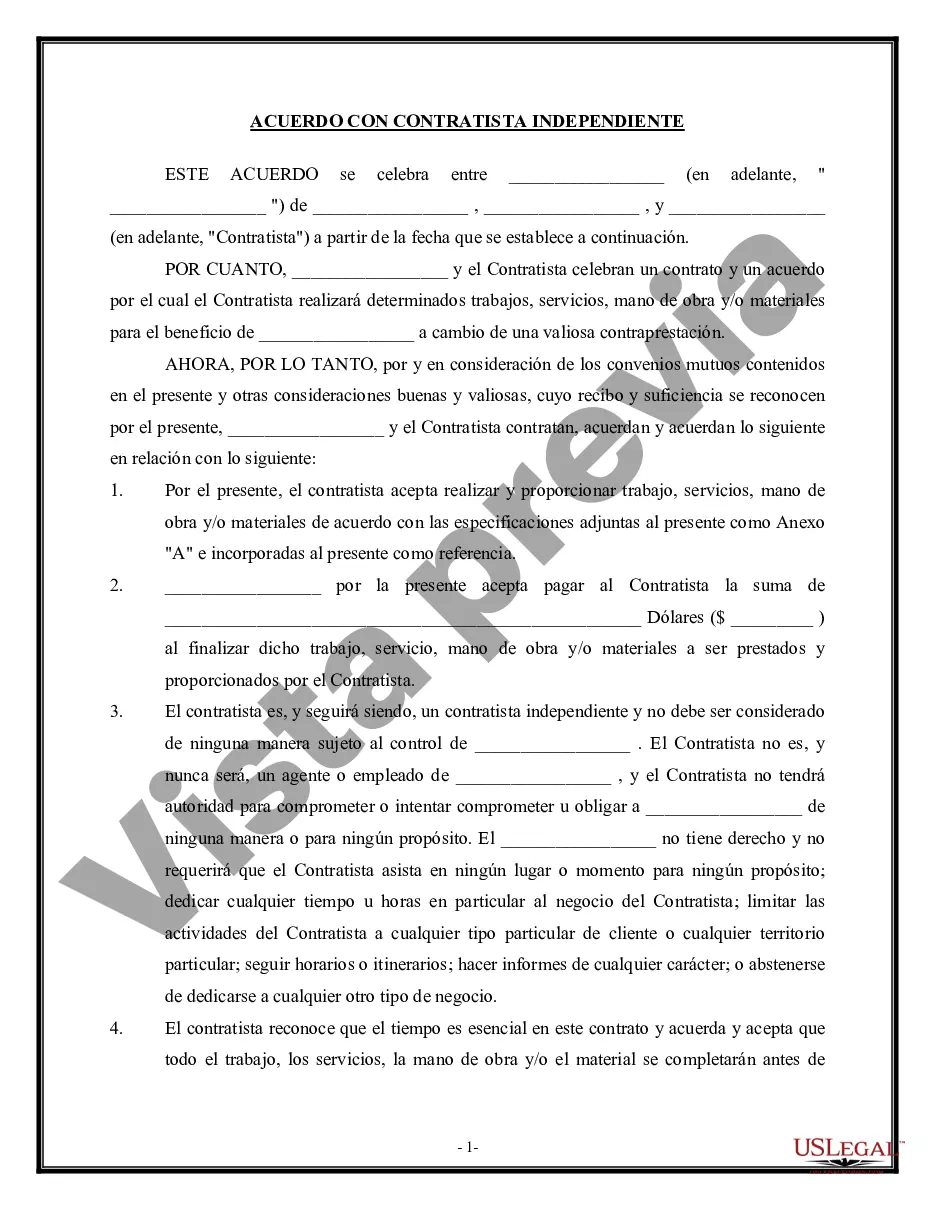

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oregon Contrato de Trabajo de Contratista Independiente para Trabajadores por Cuenta Propia - trabajo, servicios y/o materiales - Self-Employed Independent Contractor Employment Agreement - work, services and / or materials

Description

How to fill out Oregon Contrato De Trabajo De Contratista Independiente Para Trabajadores Por Cuenta Propia - Trabajo, Servicios Y/o Materiales?

Are you presently within a situation where you need documents for both enterprise or individual reasons just about every day time? There are plenty of legal papers web templates available on the net, but getting ones you can trust is not effortless. US Legal Forms gives thousands of kind web templates, much like the Oregon Self-Employed Independent Contractor Employment Agreement - work, services and / or materials, which can be created to fulfill federal and state demands.

When you are presently informed about US Legal Forms website and have a merchant account, just log in. Next, you can download the Oregon Self-Employed Independent Contractor Employment Agreement - work, services and / or materials template.

Should you not provide an account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you need and ensure it is to the right area/state.

- Take advantage of the Preview switch to examine the form.

- Browse the description to actually have chosen the correct kind.

- In case the kind is not what you`re seeking, use the Search discipline to discover the kind that meets your requirements and demands.

- Once you find the right kind, simply click Buy now.

- Opt for the costs prepare you desire, fill out the necessary information and facts to create your money, and pay for an order making use of your PayPal or credit card.

- Select a practical file file format and download your backup.

Discover each of the papers web templates you may have bought in the My Forms menu. You can aquire a additional backup of Oregon Self-Employed Independent Contractor Employment Agreement - work, services and / or materials at any time, if possible. Just click on the required kind to download or print the papers template.

Use US Legal Forms, one of the most considerable variety of legal types, to save lots of efforts and stay away from blunders. The assistance gives appropriately created legal papers web templates that you can use for a selection of reasons. Create a merchant account on US Legal Forms and start producing your daily life easier.