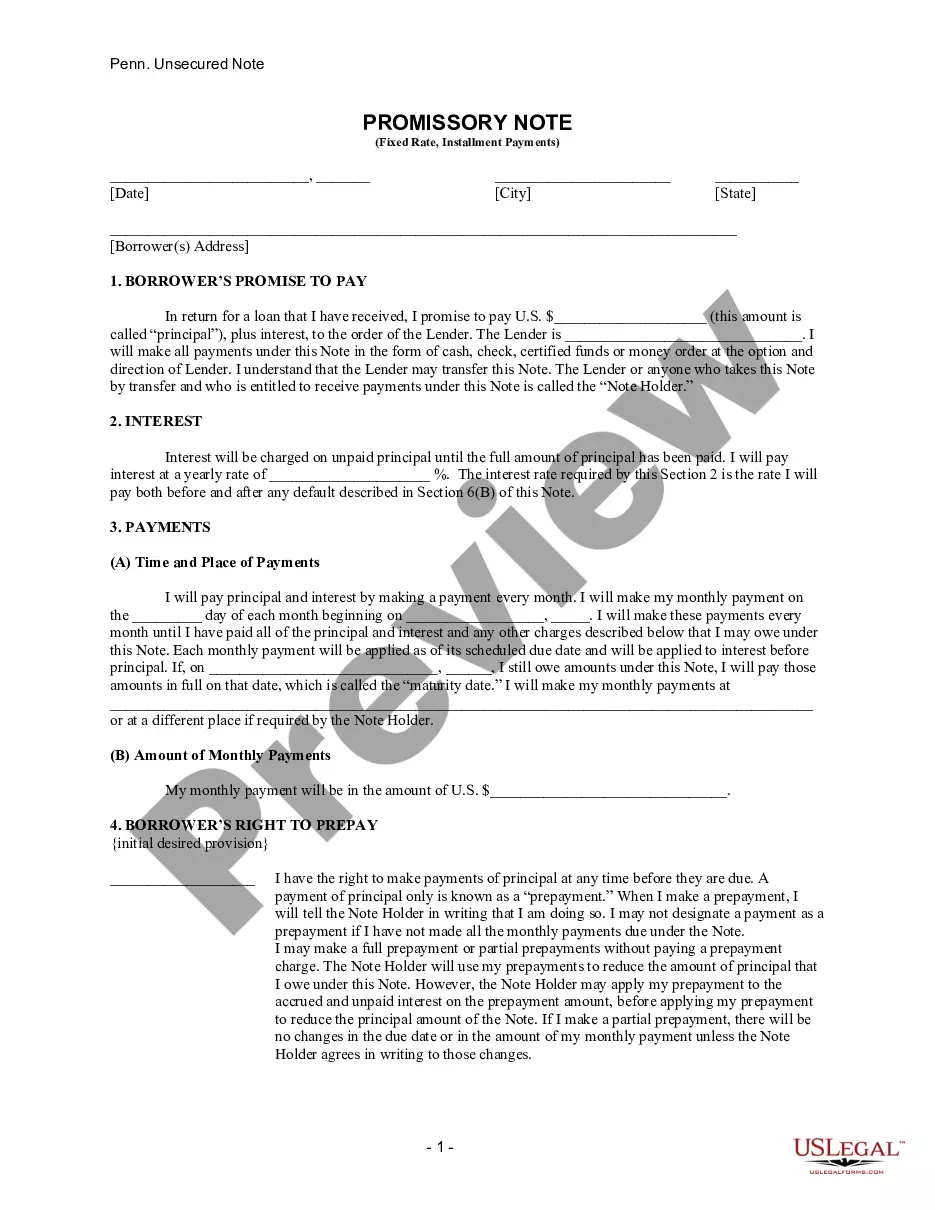

Oregon Section 262 of the Delaware General Corporation Law, commonly referred to as the "appraisal rights statute," is a crucial provision that protects shareholders' rights in the state of Delaware when a merger or consolidation takes place. Under this statute, shareholders of a corporation who dissent from a proposed merger or consolidation have the right to have their shares appraised by the court. The purpose of this provision is to ensure that shareholders receive fair value for their shares, even if they do not support or agree with the merger or consolidation. The appraisal process starts with the dissenting shareholder providing written notice to the corporation before the shareholder vote on the proposed transaction. Then, after the transaction is approved, the dissenting shareholder must follow certain procedures to perfect their appraisal rights, including filing a petition for appraisal within a specified timeframe. Once the petition is filed, the court determines whether the shareholder is entitled to an appraisal and proceeds with the valuation process. The court has the authority to engage appraisers, experts, and other professionals to assist in determining the fair value of the dissenting shareholder's shares. The court considers various factors in determining fair value, including the company's intrinsic value, market value, and any other factors it deems relevant. The court's valuation may differ from the merger price, providing protection to dissenting shareholders who believe their shares are undervalued in the transaction. Different types of Oregon Section 262 of the Delaware General Corporation Law include: 1. Pre-merger appraisal rights: Shareholders have the right to dissent from a proposed merger or consolidation before the shareholder vote and demand an appraisal. 2. Petition for appraisal: After the event, dissenting shareholders must formally petition the court for appraisal within the specified timeframe. 3. Valuation process: The court engages appraisers and professionals to determine the fair value of the dissenting shareholder's shares, considering various factors relevant to the valuation. 4. Judicial review: The court's valuation may differ from the merger price, providing an opportunity for shareholders to challenge the fairness of the transaction and seek appropriate compensation. In summary, Oregon Section 262 of the Delaware General Corporation Law safeguards shareholders' appraisal rights during a merger or consolidation. It allows dissenting shareholders to demand an appraisal, navigate a valuation process, and potentially receive fair value for their shares, establishing a mechanism that ensures their protection and enhances corporate governance transparency.

Oregon Section 262 of the Delaware General Corporation Law

Description

How to fill out Section 262 Of The Delaware General Corporation Law?

Finding the right lawful papers format can be a battle. Of course, there are tons of templates accessible on the Internet, but how do you find the lawful develop you require? Use the US Legal Forms website. The service gives a huge number of templates, like the Oregon Section 262 of the Delaware General Corporation Law, that you can use for business and personal requirements. All of the types are checked by professionals and satisfy federal and state demands.

Should you be already signed up, log in for your bank account and click on the Download switch to find the Oregon Section 262 of the Delaware General Corporation Law. Make use of your bank account to look with the lawful types you may have purchased previously. Check out the My Forms tab of your respective bank account and obtain an additional copy from the papers you require.

Should you be a whole new consumer of US Legal Forms, listed below are easy guidelines so that you can adhere to:

- Initially, ensure you have chosen the appropriate develop for your area/state. You are able to check out the shape using the Review switch and browse the shape information to guarantee it is the right one for you.

- In case the develop does not satisfy your requirements, utilize the Seach field to find the correct develop.

- Once you are sure that the shape is suitable, select the Get now switch to find the develop.

- Select the costs plan you desire and enter the needed information and facts. Design your bank account and buy your order utilizing your PayPal bank account or charge card.

- Choose the data file file format and obtain the lawful papers format for your system.

- Complete, change and produce and signal the obtained Oregon Section 262 of the Delaware General Corporation Law.

US Legal Forms will be the largest library of lawful types where you will find various papers templates. Use the company to obtain skillfully-created documents that adhere to state demands.

Form popularity

FAQ

Section 265 - Conversion of other entities to a domestic corporation (a) As used in this section, the term "other entity" means a limited liability company, statutory trust, business trust or association, real estate investment trust, common-law trust or any other unincorporated business including a partnership ( ...

(a) Any 1 or more corporations of this State may merge or consolidate with 1 or more limited liability companies, unless the laws of the jurisdiction or jurisdictions under which such limited liability company or limited liability companies are formed prohibit such merger or consolidation.

The Delaware General Corporation Law (Title 8, Chapter 1 of the Delaware Code) is the statute of the Delaware Code that governs corporate law in the U.S. state of Delaware. The statute was adopted in 1899. Since then, Delaware has become the most prevalent jurisdiction in United States corporate law.

Any stockholder entitled to appraisal rights may, within 20 days after the date of mailing of such notice, demand in writing from the surviving or resulting corporation the appraisal of such holder's shares.

(a) Whenever stockholders are required or permitted to take any action at a meeting, a notice of the meeting in the form of a writing or electronic transmission shall be given which shall state the place, if any, date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy ...

§ 312. Revival of certificate of incorporation. (a) As used in this section, the term ?certificate of incorporation? includes the charter of a corporation organized under any special act or any law of this State.

A bylaw amendment adopted by stockholders which specifies the votes that shall be necessary for the election of directors shall not be further amended or repealed by the board of directors.