The Oregon Writ of Execution is a legal document issued by the court to enforce the judgment of a creditor against a debtor. This writ allows the creditor to pursue the collection of the owed amount by seizing and selling the debtor's property or assets sufficient to satisfy the debt. The writ authorizes law enforcement or a qualified third party, such as a sheriff or a process server, to execute the judgment and execute the necessary steps to implement the judgment. Keywords: Oregon, writ of execution, legal document, court, enforce, judgment, creditor, debtor, collection, owed amount, seize, sell, property, assets, satisfy, debt, law enforcement, sheriff, process server. Different types of Oregon Writ of Execution: 1. Personal Property Writ of Execution: This type of writ authorizes the seizure and sale of personal items owned by the debtor, such as vehicles, furniture, jewelry, or electronics. The sale proceeds are then applied towards the debt. 2. Real Property Writ of Execution: When the debtor owns real estate property, this writ allows the creditor to place a lien on the property or request its sale through a foreclosure process. The proceeds from the sale are applied towards the debt, usually after the settlement of any existing mortgages or liens. 3. Bank Account Writ of Execution: In cases where the debtor has funds held in a bank account, this type of writ enables the creditor to request a freeze on the account or seize the funds to satisfy the debt. The bank is notified of the writ and required to cooperate with the execution process. 4. Earnings Writ of Execution: If the debtor is employed, this writ allows the creditor to collect a portion of the debtor's wages or salary directly from their employer. The employer is legally bound to withhold the requested amount and forward it to the creditor until the judgment is fully satisfied. 5. Receivables Writ of Execution: In situations where the debtor has accounts receivable or is owed money by others, this writ enables the creditor to collect the owed amount directly from the debtor's customers or clients. It compels the third party to redirect the payment to the creditor until the debt is repaid. 6. Judgment Lien Writ of Execution: When a judgment is entered against a debtor, this writ creates a lien against all the debtor's non-exempt property within the state. It acts as a security interest, ensuring that the creditor can recover their debt from the debtor's property when it is sold or transferred. 7. Certificate of Judgment Writ of Execution: This writ is used when the creditor needs to enforce a foreign judgment in Oregon. It allows the creditor to obtain a certificate of judgment from the Oregon court to initiate collection proceedings within the state, making the foreign judgment enforceable in Oregon. By utilizing the Oregon Writ of Execution process, creditors have the legal means to pursue the collection of their debt by leveraging the various types of writs to target the debtor's applicable assets or income streams.

Oregon Writ of Execution

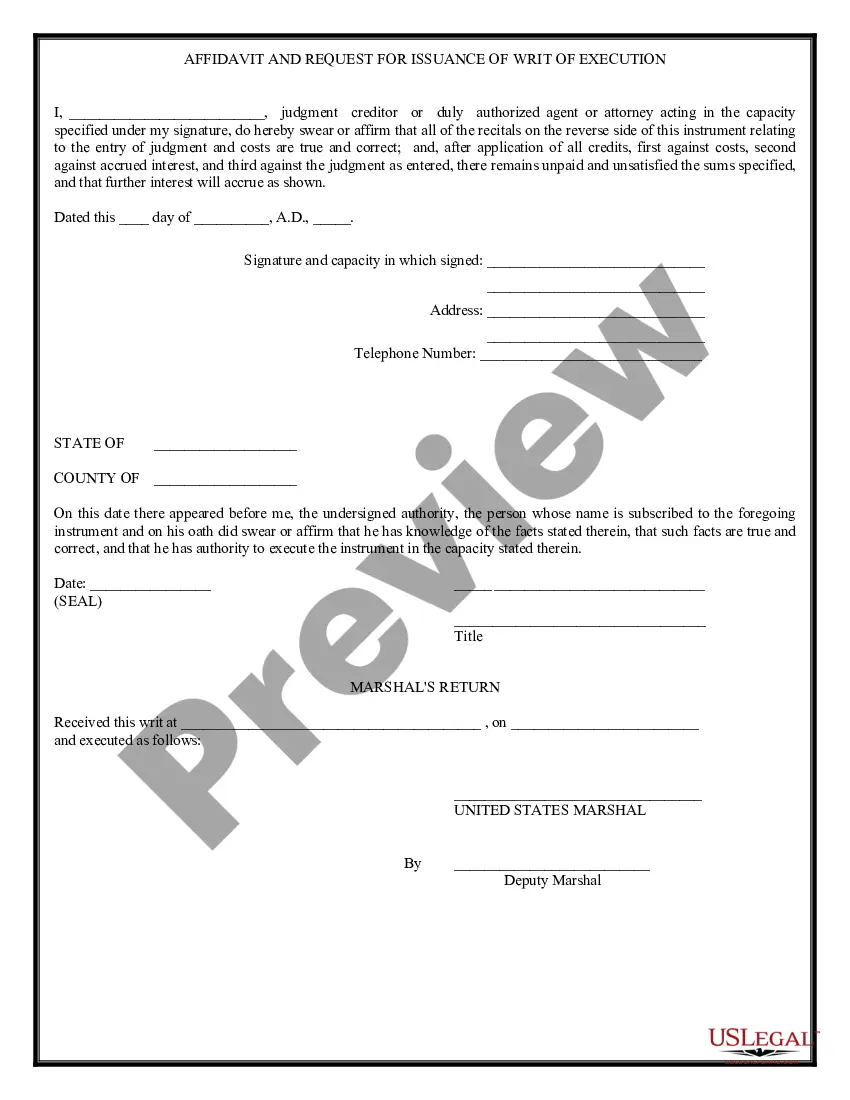

Description

How to fill out Oregon Writ Of Execution?

If you want to total, obtain, or print out lawful document layouts, use US Legal Forms, the largest variety of lawful forms, which can be found on-line. Utilize the site`s simple and easy handy lookup to obtain the papers you will need. Different layouts for business and personal uses are categorized by categories and suggests, or keywords. Use US Legal Forms to obtain the Oregon Writ of Execution with a number of clicks.

When you are already a US Legal Forms buyer, log in to your bank account and then click the Down load switch to get the Oregon Writ of Execution. Also you can gain access to forms you in the past acquired inside the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your proper metropolis/nation.

- Step 2. Use the Review solution to look through the form`s content material. Don`t overlook to learn the description.

- Step 3. When you are not satisfied with the type, utilize the Search area towards the top of the monitor to discover other variations from the lawful type web template.

- Step 4. Once you have discovered the form you will need, select the Acquire now switch. Select the pricing prepare you choose and put your qualifications to sign up to have an bank account.

- Step 5. Method the deal. You can utilize your credit card or PayPal bank account to complete the deal.

- Step 6. Pick the structure from the lawful type and obtain it on your gadget.

- Step 7. Total, modify and print out or indication the Oregon Writ of Execution.

Every single lawful document web template you get is the one you have permanently. You possess acces to every single type you acquired within your acccount. Click the My Forms segment and choose a type to print out or obtain yet again.

Be competitive and obtain, and print out the Oregon Writ of Execution with US Legal Forms. There are thousands of professional and state-particular forms you may use to your business or personal demands.