The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Oregon Nonemployee Director Stock Option Plan

Description

How to fill out Nonemployee Director Stock Option Plan?

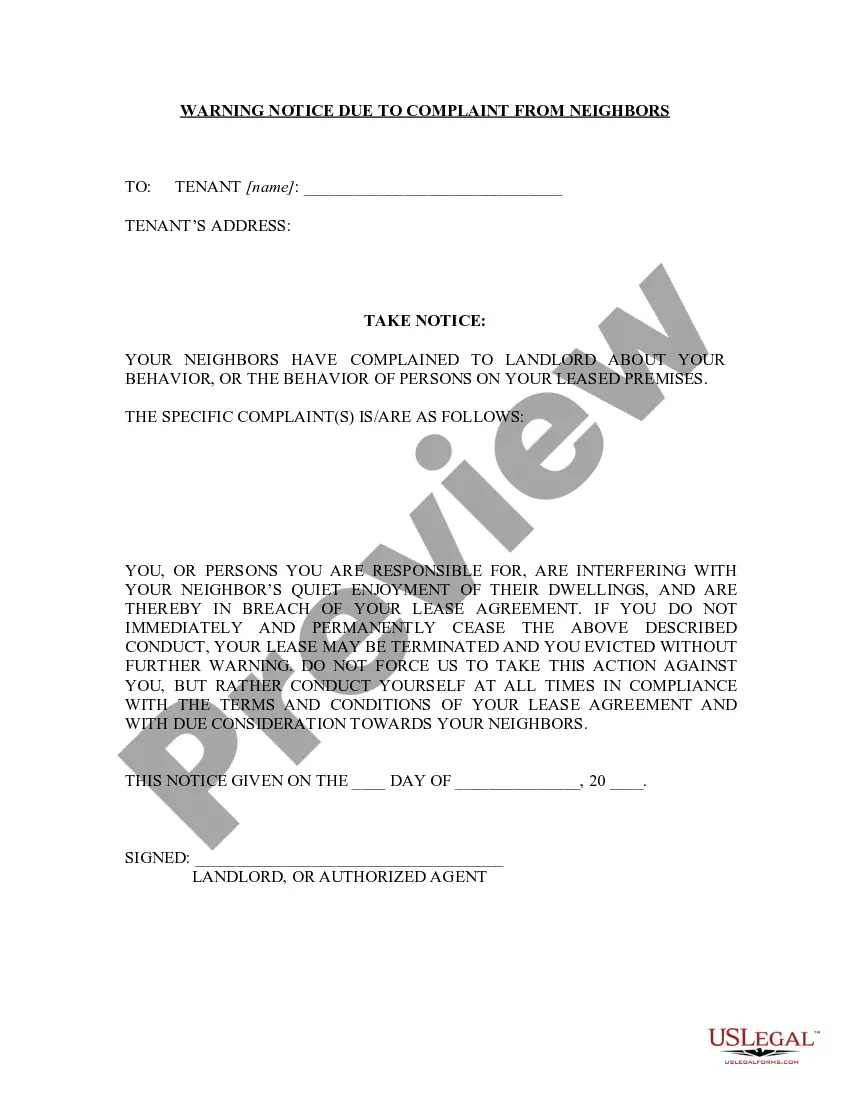

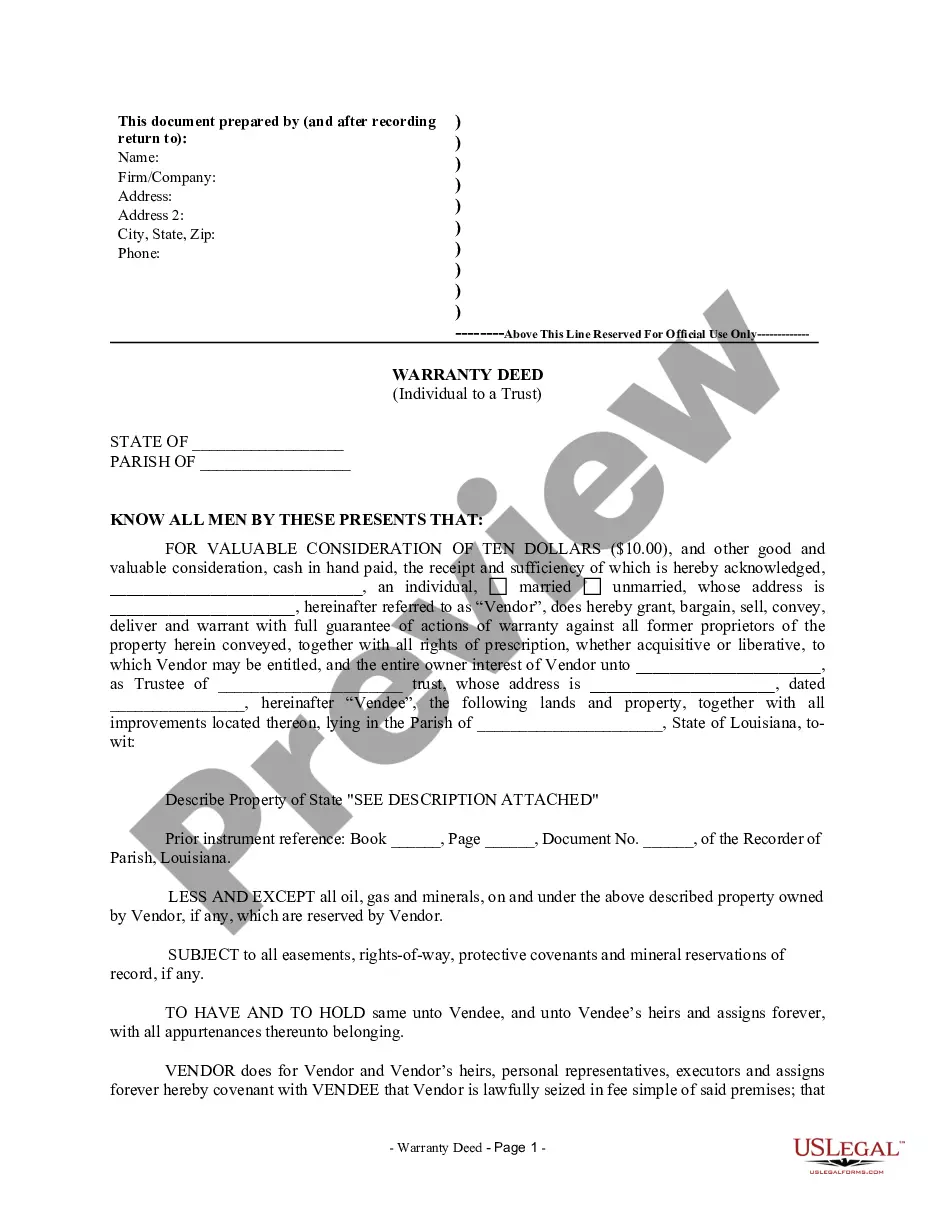

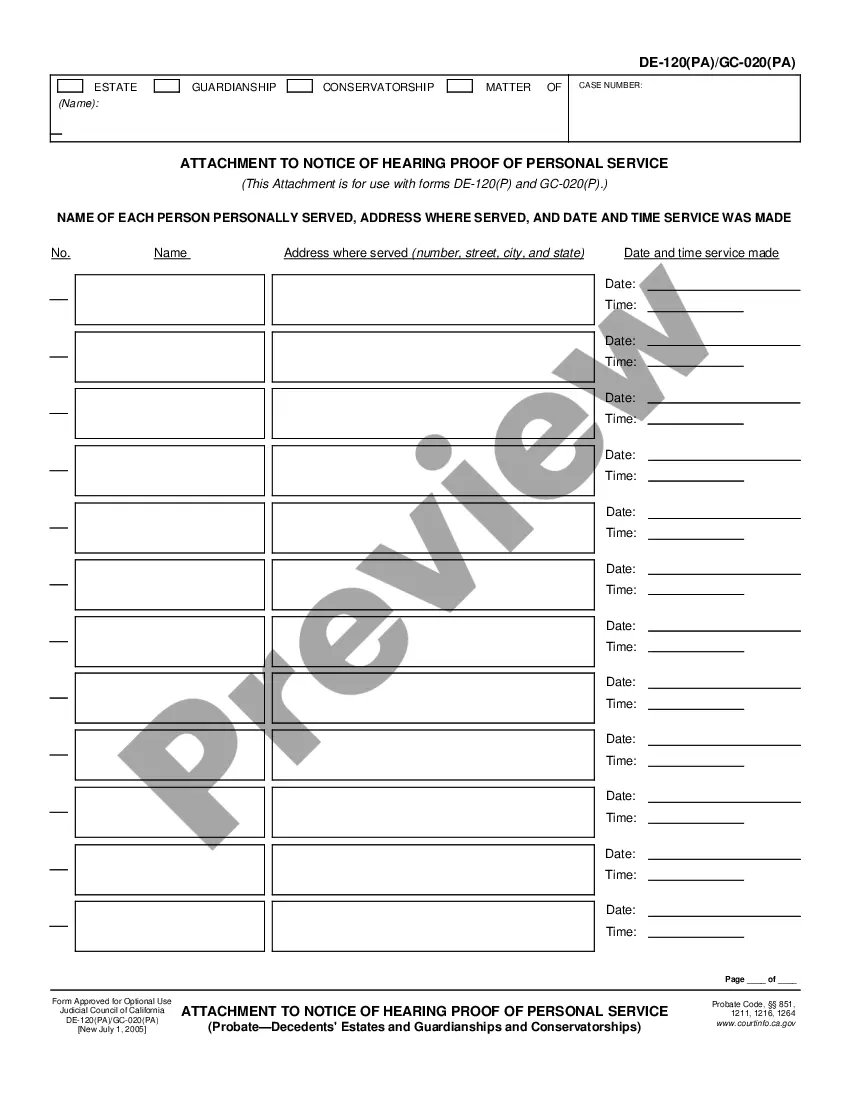

Are you presently inside a placement in which you need documents for either business or person reasons virtually every time? There are tons of legal papers themes available online, but getting versions you can rely on isn`t easy. US Legal Forms delivers thousands of kind themes, much like the Oregon Nonemployee Director Stock Option Plan, which are written to meet federal and state needs.

Should you be presently knowledgeable about US Legal Forms internet site and get your account, merely log in. Following that, it is possible to download the Oregon Nonemployee Director Stock Option Plan web template.

Unless you offer an profile and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you require and ensure it is for your correct metropolis/state.

- Make use of the Review key to examine the shape.

- Look at the description to actually have chosen the proper kind.

- If the kind isn`t what you`re seeking, utilize the Lookup field to obtain the kind that meets your needs and needs.

- Whenever you find the correct kind, simply click Purchase now.

- Select the pricing program you need, complete the required information to produce your bank account, and purchase your order making use of your PayPal or charge card.

- Pick a handy document format and download your copy.

Discover all the papers themes you possess purchased in the My Forms food list. You can get a extra copy of Oregon Nonemployee Director Stock Option Plan any time, if needed. Just select the required kind to download or produce the papers web template.

Use US Legal Forms, the most extensive variety of legal types, to conserve some time and avoid errors. The assistance delivers appropriately made legal papers themes which can be used for an array of reasons. Generate your account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

Yes, companies can absolutely offer stock options to their contractors, but contractors need to consider how the vesting, taxation, financial planning, and investment management related to the stock options fit into their personal financial plan.

Up to this point, generally speaking, with teams of less than 12 people, the average granted equity for startup employees is 1%. This number can be as high as 2% for the first hires, and in some circumstances, the first hire(s) can be considered founders and their equity share could be even greater.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Here is one rule of thumb: directors should be awarded 0.5% of the fully-diluted equity of the company for each year of service, typically 1.5% for 3 years in the form of options on common shares with a strike price set at the fair market value (this is important for tax reasons and may be a requirement of a ...

It has historically been common for board members to be compensated through an annual cash retainer, annual equity retainer (whether in stock options or full value grants), and a variety of committee and meeting fees.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

For example, Directors of Sales at companies that have raised Over 30M typically get between 0 and 250K+ shares. However, smaller companies that have raised Under 1M are more generous with their stock compensation as it ranges between . 1 and 1%+ for Directors of Sales.