Pennsylvania Prevailing Wage Certificate

Description

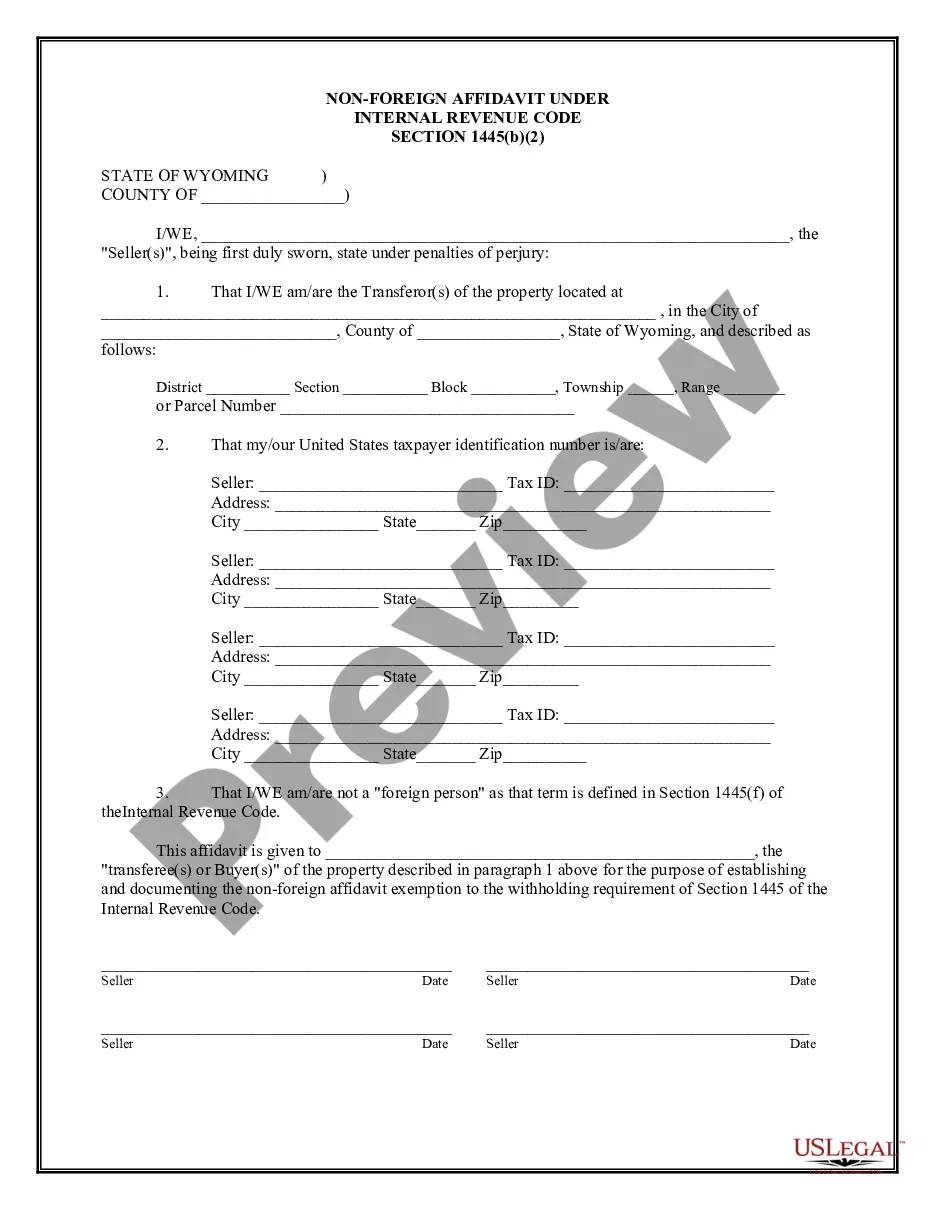

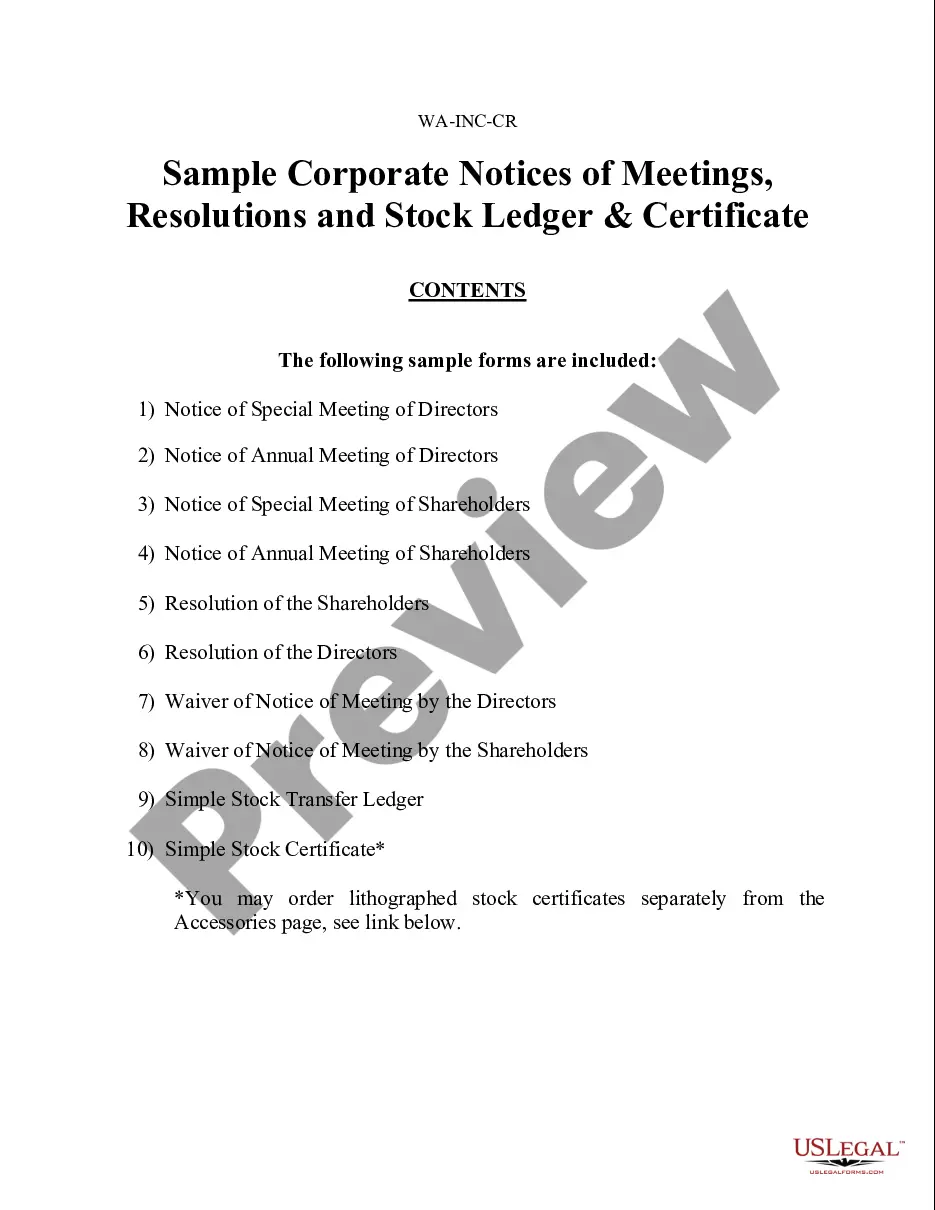

How to fill out Pennsylvania Prevailing Wage Certificate?

Creating papers isn't the most simple task, especially for people who rarely deal with legal papers. That's why we advise making use of correct Pennsylvania Prevailing Wage Certificate templates created by professional lawyers. It gives you the ability to stay away from problems when in court or dealing with formal organizations. Find the templates you want on our site for top-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the template webpage. Soon after accessing the sample, it will be saved in the My Forms menu.

Users without an activated subscription can easily get an account. Utilize this short step-by-step guide to get your Pennsylvania Prevailing Wage Certificate:

- Be sure that file you found is eligible for use in the state it’s necessary in.

- Verify the file. Use the Preview feature or read its description (if offered).

- Click Buy Now if this file is the thing you need or utilize the Search field to get another one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these easy actions, you can complete the sample in a preferred editor. Recheck completed info and consider asking a legal representative to examine your Pennsylvania Prevailing Wage Certificate for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Type the word "Final" when the last payroll is submitted for the project. The last day of the payroll period. The name and location of project. The prime contractor should include the project number as listed in the loan Indicate the days and dates of the pay period.

Go to the Reports menu. Choose Employees & Payroll. Go to More Payroll Reports in Excel, then choose New! Certified Payroll Report. Follow the on-screen instructions to create the report.

Certified payroll reports are special payroll reports that contractors who work on public works or government funded construction projects must file on a weekly basis. This type of payroll requires a specialized process involving the input of a date and job code with each entry.

22.20 was the lowest minimum wages (in the State of Karnataka ) and Rs. 319.00 was the highest minimum wages (in the state of Kerala).

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

ADP clients can implement the Certified Payroll Reporting solution powered by Time Bank2122 to quickly, accurately, and reliably generate these reports. The automated solution is a simple three-step process that you run at the end of each pay cycle.This automated solution is sold, serviced, and supported by ADP.

Local governments frequently defer routine repair and construction projects because they exceed the $25,000 prevailing wage threshold, making them too expensive.

Minimum Davis-Bacon wages are based on the wages the Secretary of Labor determines to be prevailing for the corresponding classes of laborers and mechanics employed on projects of a character similar to the contract work in that local area (40 U.S.C. 3142).

Select Reports menu. Select Employees & Payroll. Select More Payroll Reports in Excel. Select Certified Payroll Report. For all excel based reports, you must Enable Macros. Select Continue then enter the Pay Date needed for the report. Select Get QuickBooks Data.