Pennsylvania International Independent Contractor Agreement

Description

How to fill out International Independent Contractor Agreement?

Are you currently in a situation that requires documentation for particular company or specific purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Pennsylvania International Independent Contractor Agreement, designed to meet state and federal regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you wish, fill in the required details to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Pennsylvania International Independent Contractor Agreement template.

- If you do not have an account and are looking to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is suitable for your specific area/county.

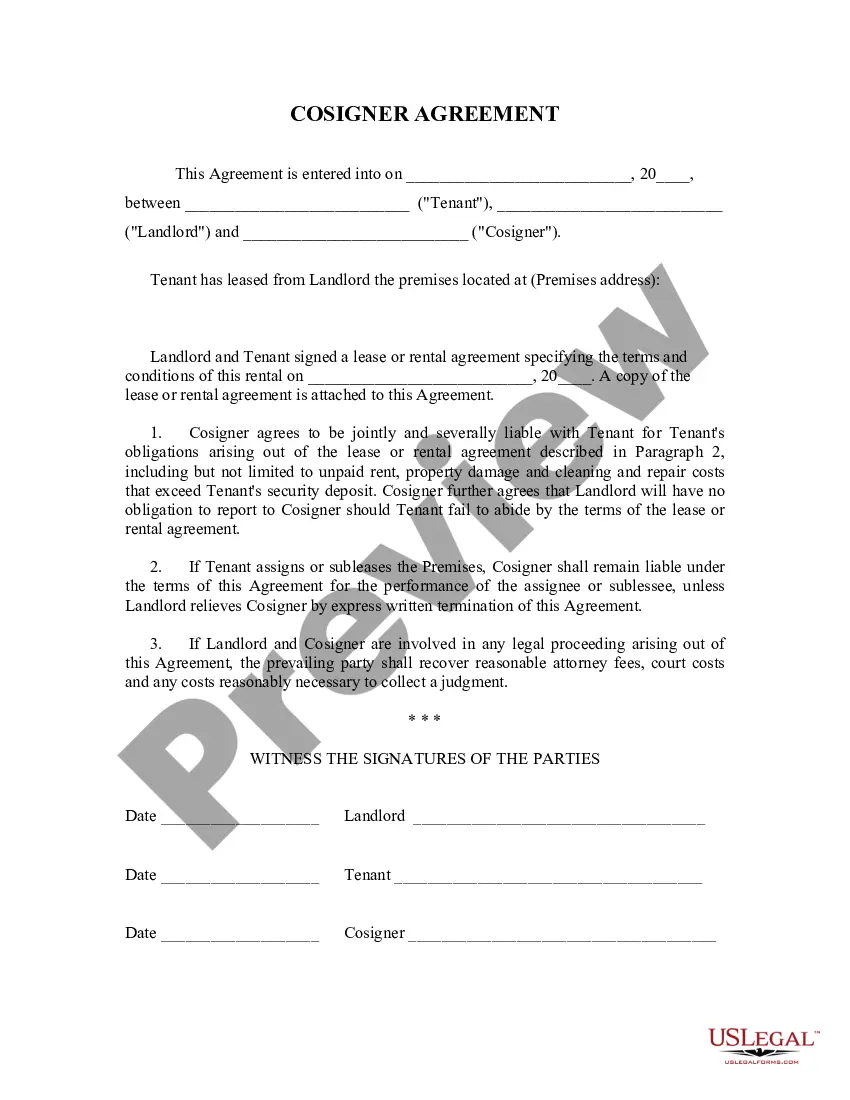

- Use the Review button to evaluate the form.

- Check the description to ensure you have chosen the right document.

- If the form isn't what you're looking for, use the Search box to find the form that meets your needs.

Form popularity

FAQ

US company hiring a US citizen living abroad US citizens are subject to the same tax rules regardless of their location. The IRS will still consider an independent contractor as a US citizen if they perform the service abroad, even if the contractor is technically a tax resident of another country.

Independent contractors are subject to Self-Employment Tax. Companies hiring them don't have to withhold income taxes or pay Social Security, Medicare, or Unemployment tax.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.

No, a person who has no immigration status is not permitted to work in the U.S. as an independent contractor.

Usually, it is illegal to hire only U.S. citizens. In fact, the Immigration and Nationality Act (INA) forbids employers from requiring U.S. citizenship for employment, unless specifically instructed to by law or federal government contract.

How to approach paying foreign contractors. There is no requirement for U.S. companies to file an IRS 1099 Form to pay a foreign contractor. But as noted above, the company should require the contractor file IRS Form W-8BEN, which formally certifies the worker's foreign status.

You have no obligation to withhold taxes for your foreign independent contractors. However, even without tax withholding, tax reporting is still necessary if the income from foreign contracts is US-sourced.

Federal law prohibits employers from hiring undocumented immigrants, but there is no law prohibiting an undocumented immigrant from starting his or her own business or becoming an independent contractor.

Yes! Classify nonresident aliens as either an independent contractor or an employee using the same rules as you use for U.S. Citizens who work for you. Check out the Independent Contractor (Self-Employed) or Employee page on IRS.gov for details.