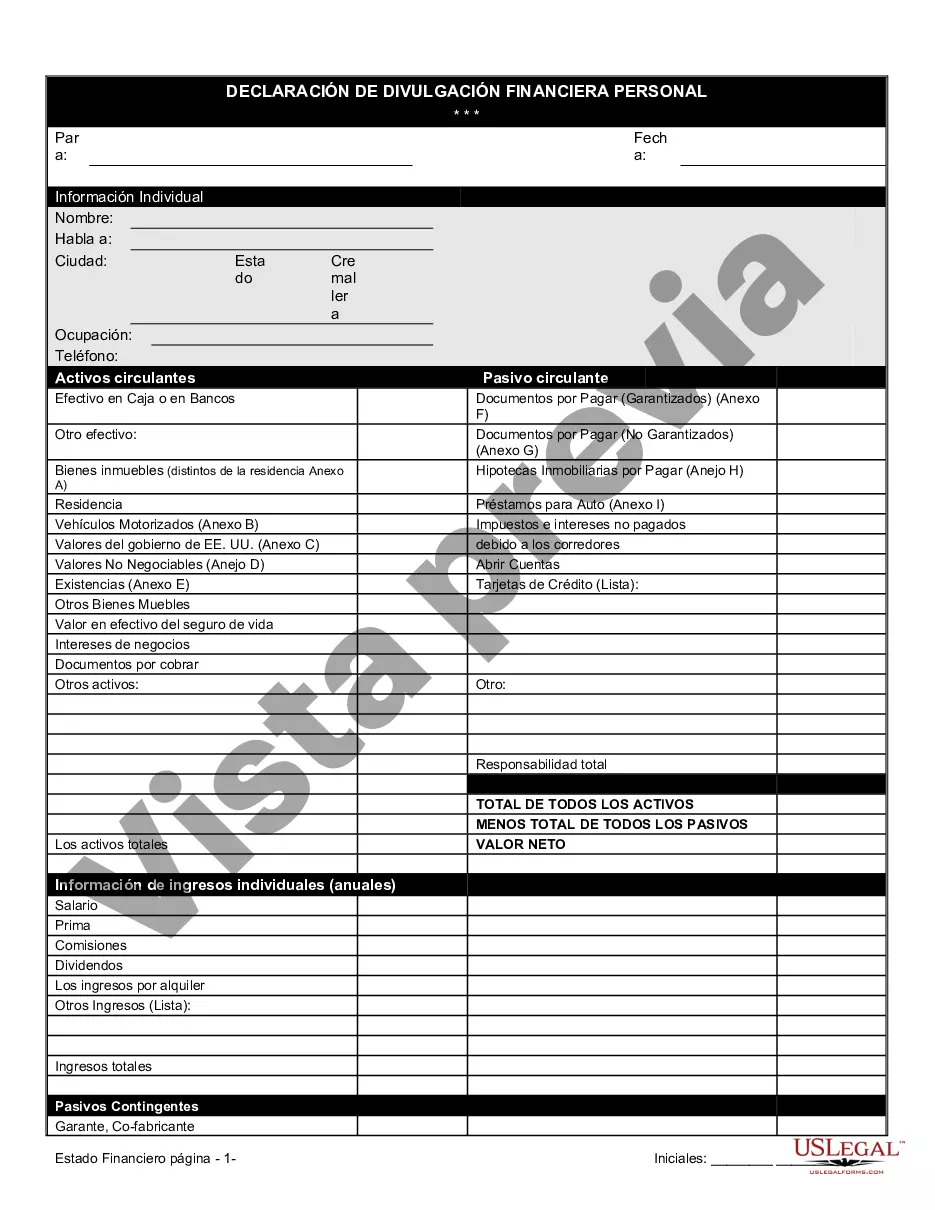

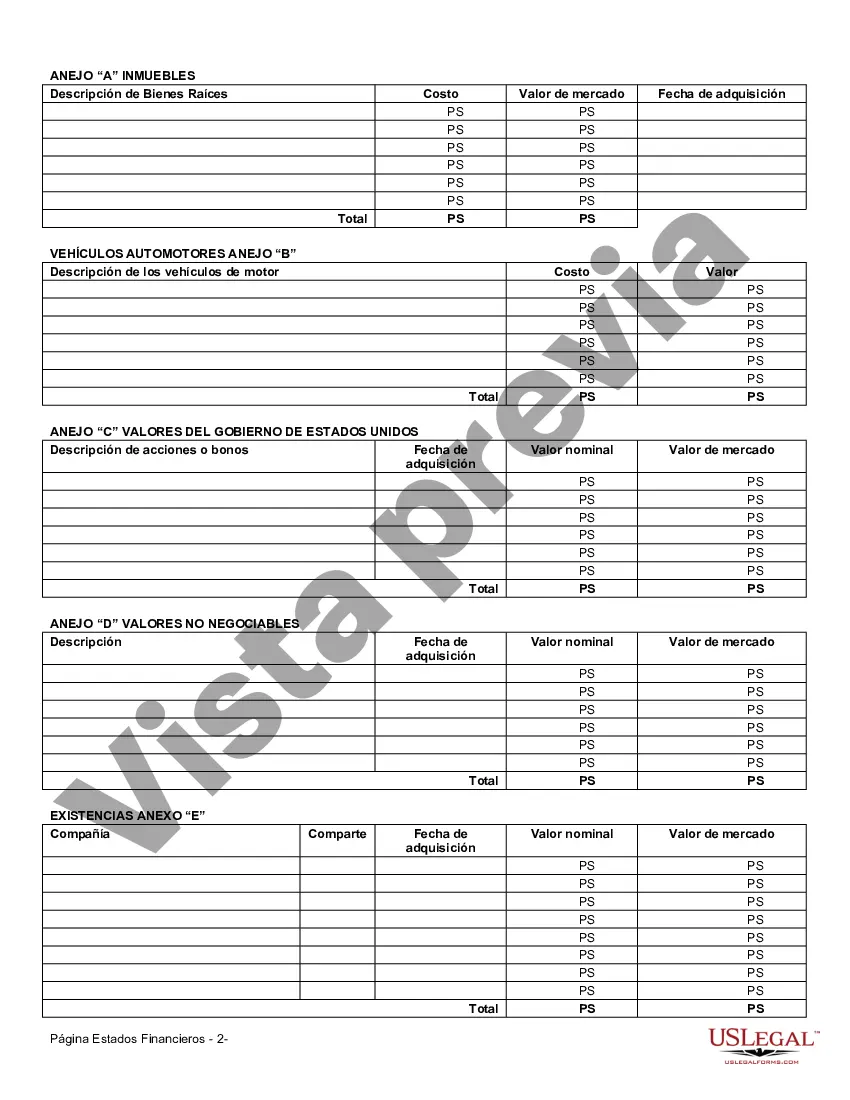

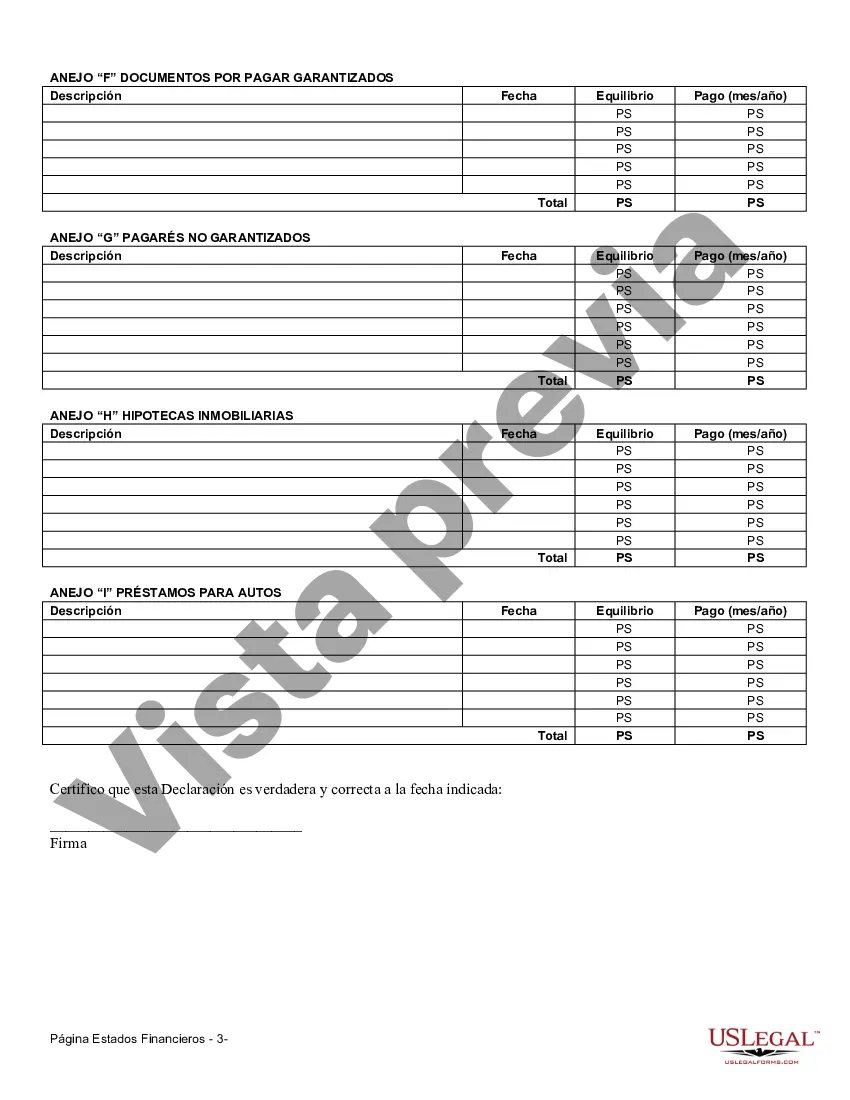

The Pennsylvania Financial Statement Form — Individual is an important document utilized in legal proceedings and financial assessment processes. This form enables individuals to provide a comprehensive snapshot of their financial status, aiding in determining their ability to repay debts, assess their net worth, and plan for their financial future. The Pennsylvania Financial Statement Form — Individual is typically requested in various scenarios, including divorce proceedings, child support calculations, personal injury claims, bankruptcy proceedings, and loan applications. By completing this form, individuals can disclose their income, expenses, assets, liabilities, and other relevant financial details required by the court or financial institution. This financial statement form ensures transparency and accuracy in financial disclosures, allowing all parties involved to make informed decisions. The completion of this form requires detailed information about the individual's income sources, such as employment wages, self-employment earnings, rental incomes, and investments. Additionally, it requires the declaration of expenses, including housing costs, utilities, transportation expenses, medical bills, and loan repayments. Furthermore, the form requires individuals to list their valuable assets, such as real estate properties, vehicles, investments, retirement accounts, and personal belongings of significant value. It also necessitates the declaration of liabilities, such as mortgages, loans, credit card debts, and other outstanding financial obligations. Different types of the Pennsylvania Financial Statement Form — Individual may exist to cater to specific legal or financial requirements. However, some common variants of this form include: 1. Pennsylvania Financial Statement Form — Individual for Divorce Proceedings: This form satisfies the legal requirements in divorce cases, enabling the proper division of assets, resolution of spousal support, and calculation of child support. 2. Pennsylvania Financial Statement Form — Individual for Bankruptcy: This particular form is designed for individuals undergoing bankruptcy proceedings, providing comprehensive financial information necessary for bankruptcy trustees and attorneys to assess an individual's eligibility and potential repayment plans. 3. Pennsylvania Financial Statement Form — Individual for Loan Applications: Financial institutions often request this form when individuals apply for loans, enabling the lender to evaluate an individual's financial standing and ability to repay the loan. Completing the Pennsylvania Financial Statement Form — Individual requires accuracy, honesty, and meticulous attention to detail. It is crucial to consult a legal professional or financial advisor when completing this form to ensure compliance with the specific requirements of each unique circumstance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out Pennsylvania Formulario De Estados Financieros - Individuo?

Choosing the right authorized record template might be a struggle. Naturally, there are tons of themes available on the Internet, but how can you find the authorized develop you need? Utilize the US Legal Forms site. The service offers a large number of themes, for example the Pennsylvania Financial Statement Form - Individual, which you can use for organization and personal demands. Each of the types are examined by pros and meet up with federal and state requirements.

When you are previously registered, log in to the accounts and then click the Acquire switch to find the Pennsylvania Financial Statement Form - Individual. Make use of your accounts to check throughout the authorized types you might have purchased in the past. Visit the My Forms tab of the accounts and obtain another duplicate from the record you need.

When you are a new user of US Legal Forms, here are easy directions that you should comply with:

- Initially, be sure you have chosen the correct develop for your personal town/region. You are able to look over the shape utilizing the Preview switch and look at the shape outline to make certain it is the best for you.

- When the develop does not meet up with your expectations, use the Seach field to find the proper develop.

- When you are certain that the shape is suitable, click the Acquire now switch to find the develop.

- Select the pricing program you need and enter the needed information. Design your accounts and buy the transaction making use of your PayPal accounts or Visa or Mastercard.

- Pick the submit formatting and down load the authorized record template to the device.

- Total, revise and produce and sign the acquired Pennsylvania Financial Statement Form - Individual.

US Legal Forms will be the biggest local library of authorized types for which you can see various record themes. Utilize the service to down load expertly-created files that comply with status requirements.