Pennsylvania Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you're looking to obtain, download, or print official legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's user-friendly and convenient search feature to locate the documents you need. Various templates for business and personal purposes are organized by categories and jurisdictions or keywords.

Leverage US Legal Forms to find the Pennsylvania Shareholder and Corporation agreement for issuing additional stock to a third party to raise capital with just a few clicks.

Every legal document template you purchase is yours to keep permanently. You have access to every form you downloaded within your account. Visit the My documents section to select a form to print or download again.

Stay ahead and download and print the Pennsylvania Shareholder and Corporation agreement for issuing additional stock to a third party to raise capital with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and press the Acquire button to download the Pennsylvania Shareholder and Corporation agreement for issuing additional stock to a third party to raise capital.

- You can also access forms you previously downloaded through the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

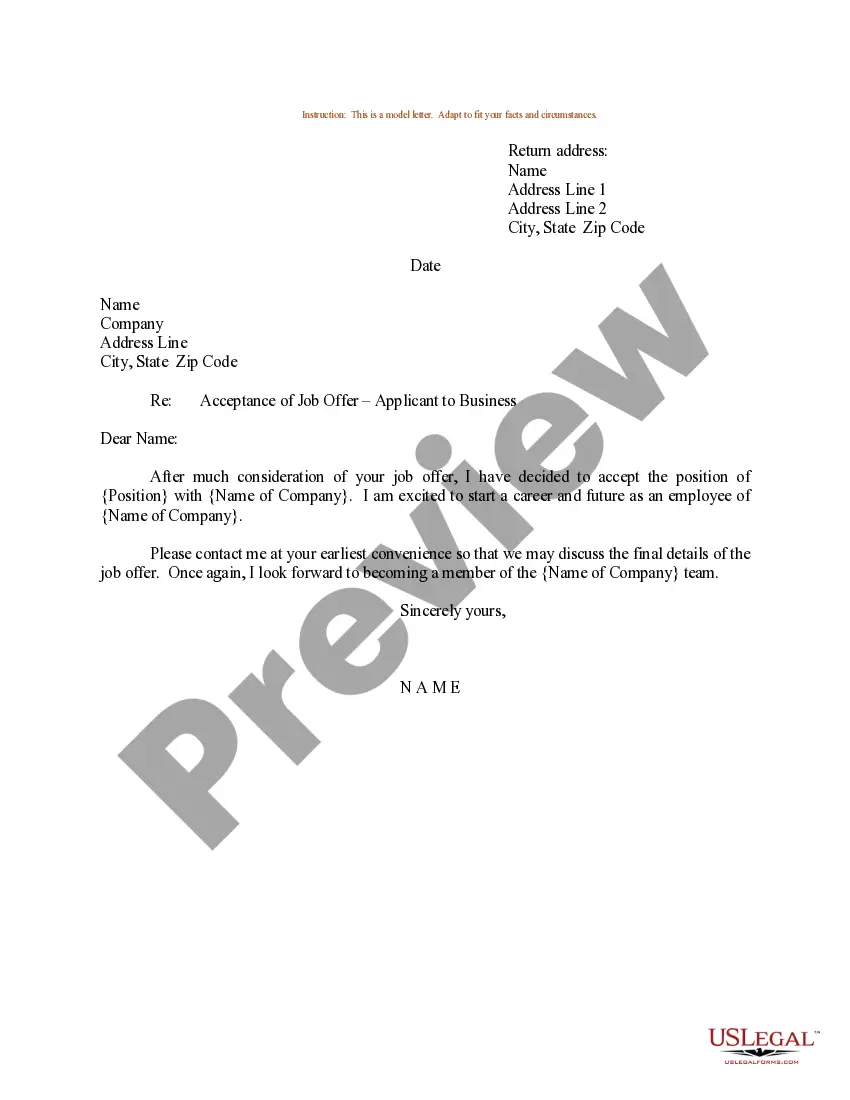

- Step 2. Use the Review option to examine the form's details. Be sure to read the information carefully.

- Step 3. If you are unsatisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you locate the necessary form, click on the Buy now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Pennsylvania Shareholder and Corporation agreement for issuing additional stock to a third party to raise capital.

Form popularity

FAQ

Make Key Decisions About Your StockDecide how much capital to raise.Decide how many shares to issue.Set the value of each share.Determine whether your corporation will be public or private.Choose what types of stock your corporation will issue.

What information must a corporate charter include regarding the company's stock? Par value; Classes and series; Number of shares.

Unless you indicate differently in your articles of incorporation or by-laws, your corporation's board of directors can generally issue shares whenever it wishes, to whomever it chooses, and for whatever value it decides.

How to Issue Stock: Method 2 Issuing StockCalculate the amount of capital that is needed.Review the number of authorized shares that are available.Calculate the total value of the shares that will be issued.Determine if preferred or common shares should be issued.Calculate the total number of shares to issue.More items...

What information must a corporate charter include regarding the company's stock? Par value; Classes and series; Number of shares.

Typical corporation's bylaws will cover and contain the following: The corporation's identifying information, which typically includes the corporation'sname, address, and principal place of business. A count of authorized directors and corporate officers.

The corporation must be a domestic corporation. The corporation must have at least one nonresident alien as a shareholder. The corporation must operate in more than one state. The corporation cannot have more than 100 shareholders.

Here are eight key things to include when writing bylaws.Basic Corporate Information. The bylaws should include your corporation's formal name and the address of its main place of business.Board of Directors.Officers.Shareholders.Committees.Meetings.Conflicts of Interest.Amendment.

What are Corporate Bylaws? Corporate Bylaws are a set of written rules used by a corporation to organize its internal management. Company bylaws also outline the policies and responsibilities for the shareholders, directors, and officers of a corporation.

Corporate bylaws are an important part of corporate governance because they detail how the company will be run. Bylaws will include rules about the management structure, meeting requirements, stock issuance, and other important company policies. Corporate bylaws can be thought of as the operating manual for a company.