Pennsylvania Stock Dividend — Resolution For— - Corporate Resolutions is a legal document used by Pennsylvania corporations to officially declare and approve the payment of dividends to stockholders in the form of additional shares of stock. This resolution is a crucial step in managing the financial affairs of a corporation and ensuring that stockholders receive their rightful dividends. The purpose of the Pennsylvania Stock Dividend — Resolution For— - Corporate Resolutions is to outline the details of the stock dividend, such as the number of shares to be issued, the record date (the date on which stockholders must hold shares to be eligible for the dividend), and the payment date (when the dividend will be distributed). This form also includes the approval and signatures of the corporation's officers or board of directors, indicating their agreement and authorization for the stock dividend. Pennsylvania's corporations may have different types of stock dividend resolutions, depending on their specific needs and goals. Some examples include: 1. Cash Dividend Resolution: This type of resolution declares the payment of a cash dividend to stockholders, where the dividends are distributed in the form of money rather than additional shares of stock. The Pennsylvania Stock Dividend — Resolution Form would vary slightly to reflect the cash payout. 2. Stock Split Resolution: In some cases, a corporation may opt to split its existing shares to increase liquidity and make them more affordable for investors. This resolution outlines the split ratio, such as a 2-for-1 split, which means each existing share will be divided into two new shares. The Pennsylvania Stock Dividend — Resolution Form would indicate the share split details and authorization for the issuance of the additional shares. 3. Bonus Share Resolution: This resolution approves the issuance of bonus shares to stockholders as a form of dividend. Bonus shares are additional shares given to existing stockholders proportional to their current holdings. The Pennsylvania Stock Dividend — Resolution Form would specify the number of bonus shares to be issued and the record and payment dates. 4. Property Dividend Resolution: Instead of issuing additional shares or cash, a corporation may choose to distribute assets or properties as dividends to stockholders. This resolution authorizes the transfer of specific properties, such as real estate or intellectual property, to stockholders. The Pennsylvania Stock Dividend — Resolution Form would outline the details of the property dividend and the necessary corporate actions. In summary, Pennsylvania Stock Dividend — Resolution For— - Corporate Resolutions is a legal document used by Pennsylvania corporations to declare and approve dividends in the form of additional shares of stock or other assets. Different types of resolutions may include cash dividends, stock splits, bonus shares, and property dividends. These resolutions play a vital role in maintaining good corporate governance and ensuring stockholders receive their fair share of corporate profits.

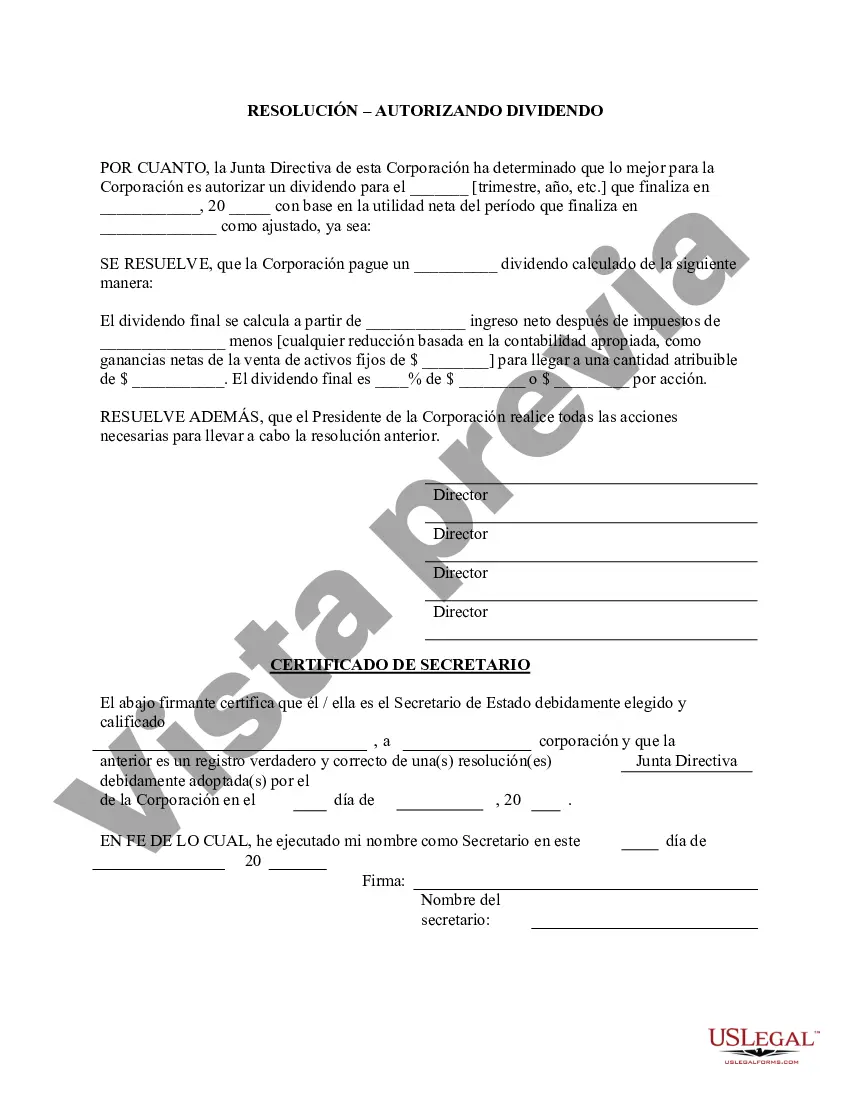

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Pennsylvania Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

If you want to comprehensive, download, or print legitimate record themes, use US Legal Forms, the greatest assortment of legitimate forms, which can be found on the Internet. Utilize the site`s simple and practical search to obtain the files you require. A variety of themes for business and individual purposes are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the Pennsylvania Stock Dividend - Resolution Form - Corporate Resolutions with a number of mouse clicks.

Should you be already a US Legal Forms consumer, log in to your profile and then click the Obtain switch to get the Pennsylvania Stock Dividend - Resolution Form - Corporate Resolutions. You can even access forms you formerly downloaded from the My Forms tab of your profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Make sure you have selected the form to the right town/nation.

- Step 2. Make use of the Review solution to examine the form`s content material. Do not overlook to read the information.

- Step 3. Should you be not happy with all the type, use the Lookup field at the top of the monitor to find other variations from the legitimate type web template.

- Step 4. When you have found the form you require, click the Acquire now switch. Select the costs plan you prefer and add your qualifications to register on an profile.

- Step 5. Method the deal. You may use your credit card or PayPal profile to finish the deal.

- Step 6. Pick the structure from the legitimate type and download it in your gadget.

- Step 7. Total, revise and print or indicator the Pennsylvania Stock Dividend - Resolution Form - Corporate Resolutions.

Each legitimate record web template you get is your own permanently. You possess acces to every type you downloaded in your acccount. Click on the My Forms area and choose a type to print or download again.

Contend and download, and print the Pennsylvania Stock Dividend - Resolution Form - Corporate Resolutions with US Legal Forms. There are millions of expert and state-specific forms you can utilize for your personal business or individual requirements.