Dear [Partner's Name], I hope this letter finds you in good health and high spirits. I am writing to discuss a matter of utmost importance that has been on my mind for quite some time now — the buyout of our partnership in [Company Name]. As we both know, a partnership buyout refers to the process of one partner purchasing the ownership interest of another partner in a business entity. In our case, I have carefully considered the future prospects of our partnership and have come to the conclusion that a buyout would serve our mutual best interests. Pennsylvania, being the state where our company is headquartered and operates, has specific regulations and guidelines that should be adhered to in such situations. Therefore, it is vital for both of us to be aware of the legal and procedural requirements involved in a partnership buyout in Pennsylvania. First and foremost, it is important to understand that a partnership buyout can be structured in various ways to accommodate the unique circumstances and goals of both parties. Some commonly practiced types of partnership buyouts in Pennsylvania include: 1. Equity Buyout: In this type of buyout, the purchasing partner acquires the equity interest of the selling partner. This may involve a cash payment, or a combination of cash and other assets, as determined through negotiation or valuation methods. 2. Installment Payments: If the purchasing partner cannot afford to pay the full buyout amount upfront, an agreement can be reached to allow for installment payments over a specified period. This enables a smooth transition while providing financial flexibility for both parties. 3. Asset Transfer: Instead of a direct equity buyout, the assets of the partnership can be transferred to the remaining partner(s). This may involve assigning contracts, licenses, property, or other tangible and intangible assets of the business. To initiate the partnership buyout process in Pennsylvania, it is advisable for us to draft a formal buyout agreement that outlines the terms and conditions of the transaction. This document should cover crucial details such as the purchase price, payment terms, effective date of the buyout, and any other relevant provisions to safeguard the interests of both parties. Additionally, it is essential to consult with legal and financial professionals who specialize in partnership buyouts in Pennsylvania. They will help ensure compliance with the state's laws and regulations, assist in the valuation of the partnership, and guide us through the necessary documentation and filings. I propose that we schedule a meeting at the earliest convenience to discuss this matter further. We can address any concerns or questions you may have, and work together to finalize the terms of the partnership buyout agreement in accordance with Pennsylvania's laws. I value the partnership we have built over the years and want this buyout process to be fair and amicable for both parties. Together, we can navigate the complexities of a partnership buyout in Pennsylvania, ensuring a smooth transition while preserving the goodwill and legacy of our business. I eagerly await your response and look forward to discussing the partnership buyout in detail. Yours sincerely, [Your Name]

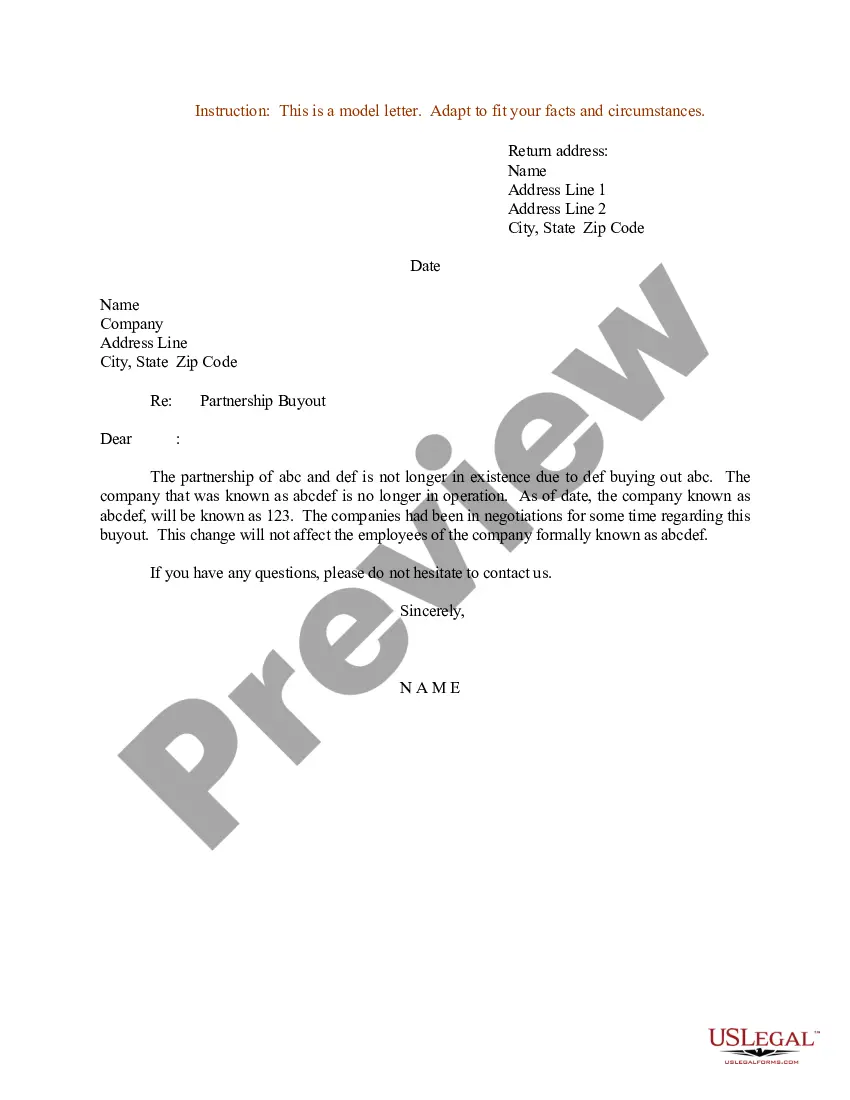

Pennsylvania Sample Letter for Partnership Buyout

Description

How to fill out Sample Letter For Partnership Buyout?

Are you presently in a situation where you need documentation for either professional or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast selection of form templates, like the Pennsylvania Sample Letter for Partnership Buyout, designed to meet federal and state regulations.

Once you find the right form, click on Acquire now.

Select a suitable document format and download your version.

- If you are familiar with the US Legal Forms site and possess an account, just sign in.

- Then, you can download the Pennsylvania Sample Letter for Partnership Buyout template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the required form and confirm it is for the correct city/region.

- Use the Review button to evaluate the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you're looking for, utilize the Lookup field to find a form that matches your needs.

Form popularity

FAQ

The document for a buyout typically includes the buyout agreement, detailing the terms, conditions, and all involved parties' responsibilities. This contract serves as a formal record that outlines financial transactions and partnership dissolution. A Pennsylvania Sample Letter for Partnership Buyout can offer a useful template to ensure that this document meets legal standards and captures all necessary information.

To convince your manager to allow a buyout of the notice period, present your case logically and respectfully. Share your reasons, such as needing to pursue a new opportunity or personal goals that require immediate action. It may be beneficial to prepare a Pennsylvania Sample Letter for Partnership Buyout as a formal way to express your request and outline the mutual benefits.

When writing a buyout, outline the specific terms and conditions agreed upon by all parties. Ensure to communicate the value of the partnership, and how the buyout process will be structured. Utilizing a Pennsylvania Sample Letter for Partnership Buyout can provide a clear template to follow, enhancing the legitimacy and professionalism of your approach.

To write a buyout letter, start by clearly stating the intention of the buyout, mentioning the parties involved. Include the reasons for the buyout, along with any relevant details regarding the terms. It can be helpful to refer to a Pennsylvania Sample Letter for Partnership Buyout for guidance to ensure all essential elements are included.

All individuals and businesses that earn income in Pennsylvania must file a state tax return. This includes partnerships, single-member LLCs, and individuals who receive income from Pennsylvania sources. When dealing with a Pennsylvania Sample Letter for Partnership Buyout, knowing your state's filing requirements can help you manage your tax liability efficiently.

Partnerships in Pennsylvania are required to file Form PA-41 as well as any applicable schedules that disclose business income and deductions. It is essential to report all partners' share of income and expenses accurately. In the context of preparing a Pennsylvania Sample Letter for Partnership Buyout, comprehending these requirements will enable a more effective and transparent negotiation process.

The PA-20S PA-65 Schedule NRK 1 is a form used by S-corporations and partnerships in Pennsylvania to report non-resident partners' income. This form details the income allocation to non-resident partners and allows for proper tax calculations. When drafting a Pennsylvania Sample Letter for Partnership Buyout, familiarize yourself with the relevant forms so that you can accurately report all income.

Partnerships in Pennsylvania must file an annual return using Form PA-41. This filing outlines the partnership's income, deductions, and other relevant information. If you are arranging a Pennsylvania Sample Letter for Partnership Buyout, remember that timely filing is crucial to avoid penalties and to ensure a smooth transition.

Partnerships in Pennsylvania are subject to the Personal Income Tax rate, which is currently set at 3.07%. This rate applies to the income distributed to the partners. For those engaged in a Pennsylvania Sample Letter for Partnership Buyout, understanding the tax implications can aid in the decision-making process regarding your partnership's financial dealings.

In Pennsylvania, Form PA 41 must be filed by partnerships that conduct business in the state. This includes partnerships that have income, losses, or deductions to report for the taxable year. If you are considering a Pennsylvania Sample Letter for Partnership Buyout, it's important to ensure that all necessary filings, including the PA 41, are completed on time.

Interesting Questions

More info

D. Purdue Center for Writing, is Purdue's flagship academic writing center. Based on the University's unique location, the writing center is within the Institute for Creative Arts and the William B. Purdue University School of Business and offers an environment where you can gain professional-level knowledge and skills in academic composition and business communication, as well as receive excellent instruction for writing that engages the needs of today's business world. It also offers services, including academic advising and resources. About W.D. Purdue Center for Writing W.D. Purdue's center for writing is a national leader in the development of professional-level course materials that enhance student learning.