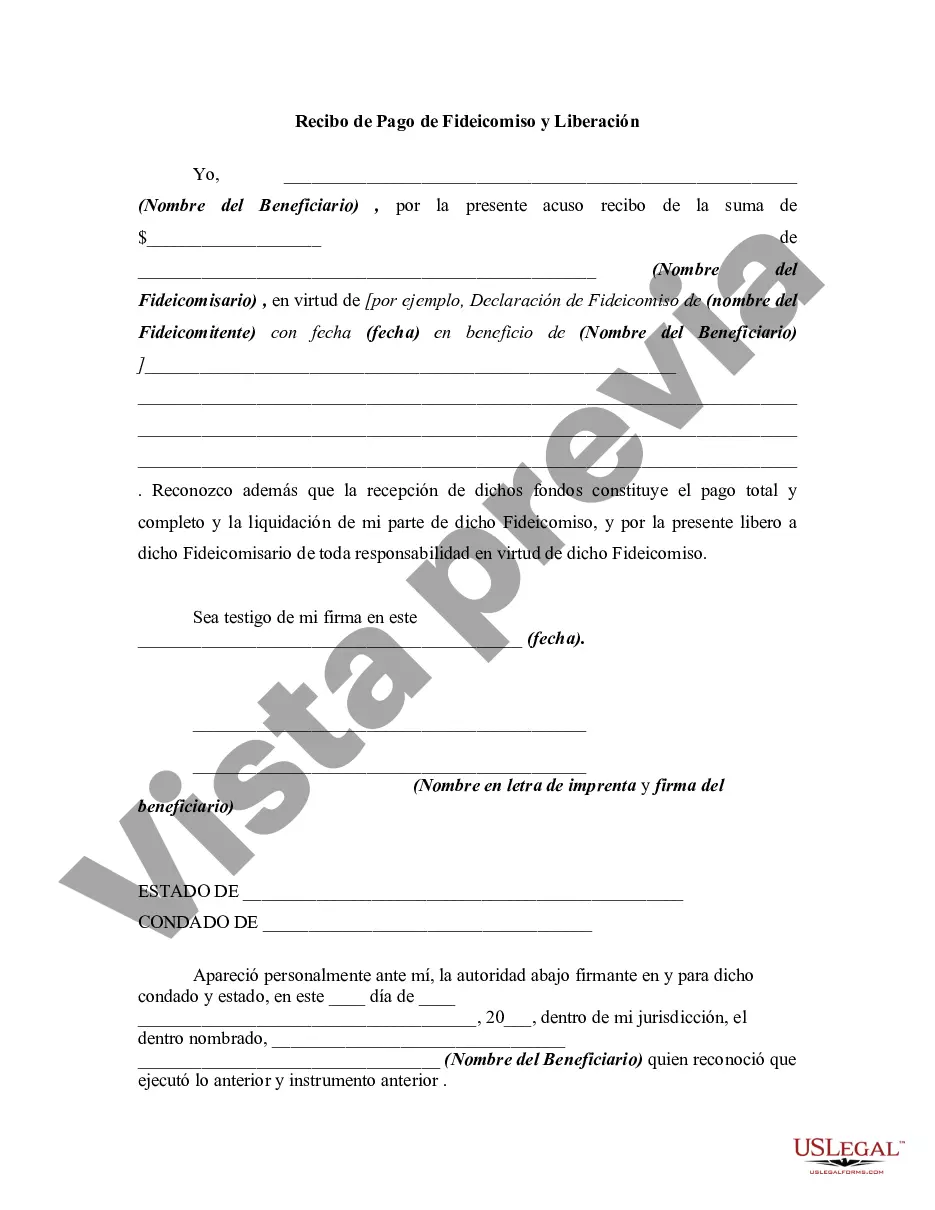

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Pennsylvania Receipt for Payment of Trust Fund and Release is a legal document that establishes proof of payment and releases the payer from any further liability regarding a trust fund. It serves as a formal acknowledgment that the recipient has received the designated payment and agrees to release the payer from any claims or demands related to the trust fund. This receipt document plays a crucial role in Pennsylvania's legal and financial systems, providing transparency and accountability in trust fund transactions. It ensures that payments made towards a trust fund are properly recorded and acknowledged by both parties involved. Key elements typically included in a Pennsylvania Receipt for Payment of Trust Fund and Release are: 1. Date of the payment: This refers to the exact day when the payment towards the trust fund was made. 2. Parties involved: It includes the names and contact information of the payer and the recipient of the payment. 3. Amount paid: The total sum paid towards the trust fund, often mentioned both in numerical and written forms for clarity. 4. Description of the trust fund: This section outlines the purpose and details of the trust fund, helping to specify the reason for the payment. 5. Release of liability: By signing the document, the recipient agrees to release the payer from any future claims, demands, or legal actions related to the trust fund. 6. Witness signatures: In some cases, witnesses might be required to sign the receipt, adding a layer of credibility to the document. 7. Notarization: Depending on the circumstances or stakeholders involved, notarizing the receipt may be necessary to ensure its validity and enforceability. Different types of Pennsylvania Receipts for Payment of Trust Fund and Release may include specific variations based on the nature of the trust fund, such as: 1. Real Estate Trust Fund Receipt: This type of receipt would be applicable when dealing with payments related to real estate trust funds, such as rental income or property sales. 2. Investment Trust Fund Receipt: Used when payments are made towards an investment trust fund, handling assets like stocks, bonds, or mutual funds. 3. Charitable Trust Fund Receipt: Relevant when payments are collected for a charitable trust fund, supporting various philanthropic causes or organizations. 4. Educational Trust Fund Receipt: In situations involving educational trust funds, this type of receipt would be drafted to track payments made for educational purposes, such as scholarships or grants. 5. Legal Trust Fund Receipt: This receipt type is used for payments made towards trust funds established for legal and fiduciary purposes, including settlements, court-ordered funds, or attorney-client agreements. Overall, a Pennsylvania Receipt for Payment of Trust Fund and Release is a vital document that provides a comprehensive record of trust fund payments, ensuring transparency, compliance, and legal protection for parties involved in these transactions.A Pennsylvania Receipt for Payment of Trust Fund and Release is a legal document that establishes proof of payment and releases the payer from any further liability regarding a trust fund. It serves as a formal acknowledgment that the recipient has received the designated payment and agrees to release the payer from any claims or demands related to the trust fund. This receipt document plays a crucial role in Pennsylvania's legal and financial systems, providing transparency and accountability in trust fund transactions. It ensures that payments made towards a trust fund are properly recorded and acknowledged by both parties involved. Key elements typically included in a Pennsylvania Receipt for Payment of Trust Fund and Release are: 1. Date of the payment: This refers to the exact day when the payment towards the trust fund was made. 2. Parties involved: It includes the names and contact information of the payer and the recipient of the payment. 3. Amount paid: The total sum paid towards the trust fund, often mentioned both in numerical and written forms for clarity. 4. Description of the trust fund: This section outlines the purpose and details of the trust fund, helping to specify the reason for the payment. 5. Release of liability: By signing the document, the recipient agrees to release the payer from any future claims, demands, or legal actions related to the trust fund. 6. Witness signatures: In some cases, witnesses might be required to sign the receipt, adding a layer of credibility to the document. 7. Notarization: Depending on the circumstances or stakeholders involved, notarizing the receipt may be necessary to ensure its validity and enforceability. Different types of Pennsylvania Receipts for Payment of Trust Fund and Release may include specific variations based on the nature of the trust fund, such as: 1. Real Estate Trust Fund Receipt: This type of receipt would be applicable when dealing with payments related to real estate trust funds, such as rental income or property sales. 2. Investment Trust Fund Receipt: Used when payments are made towards an investment trust fund, handling assets like stocks, bonds, or mutual funds. 3. Charitable Trust Fund Receipt: Relevant when payments are collected for a charitable trust fund, supporting various philanthropic causes or organizations. 4. Educational Trust Fund Receipt: In situations involving educational trust funds, this type of receipt would be drafted to track payments made for educational purposes, such as scholarships or grants. 5. Legal Trust Fund Receipt: This receipt type is used for payments made towards trust funds established for legal and fiduciary purposes, including settlements, court-ordered funds, or attorney-client agreements. Overall, a Pennsylvania Receipt for Payment of Trust Fund and Release is a vital document that provides a comprehensive record of trust fund payments, ensuring transparency, compliance, and legal protection for parties involved in these transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.