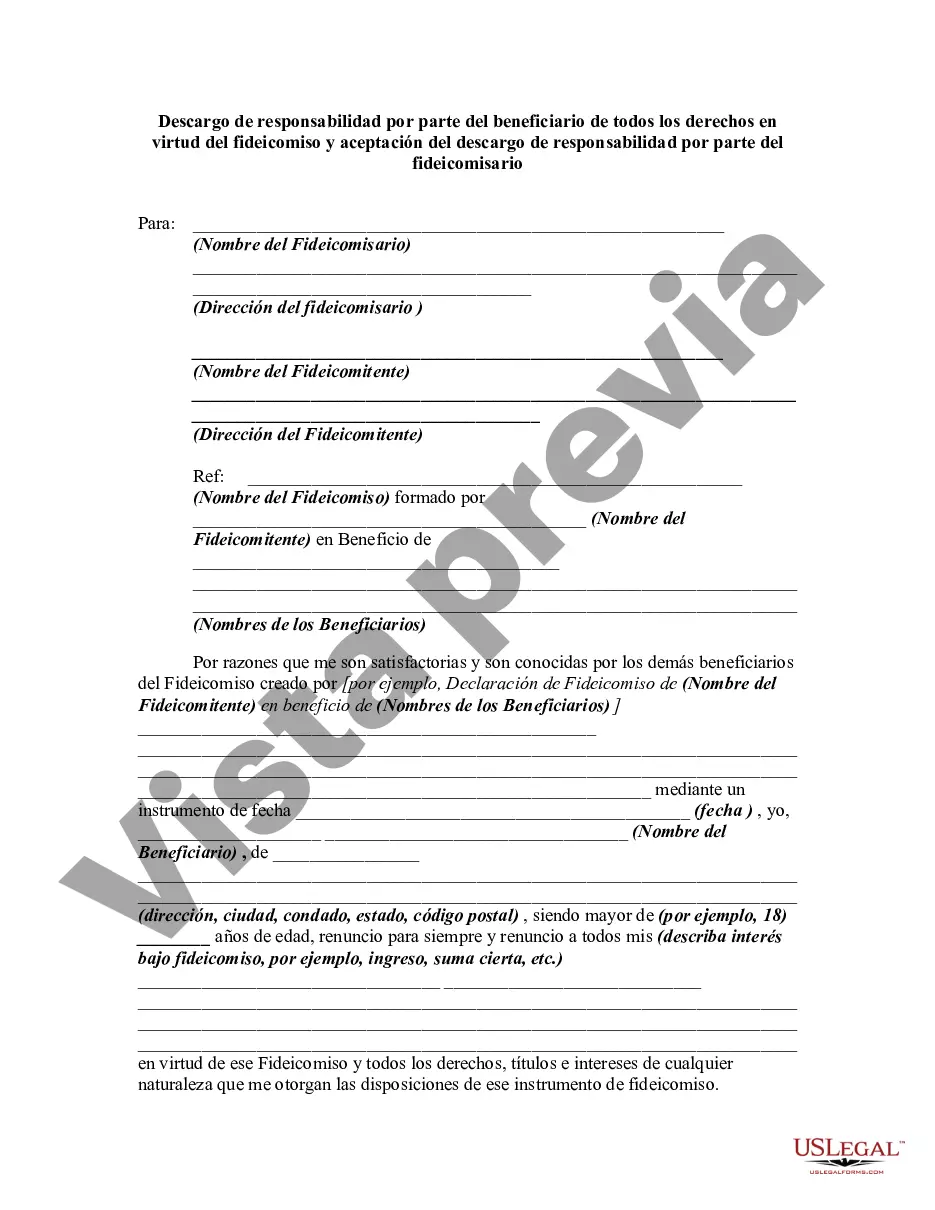

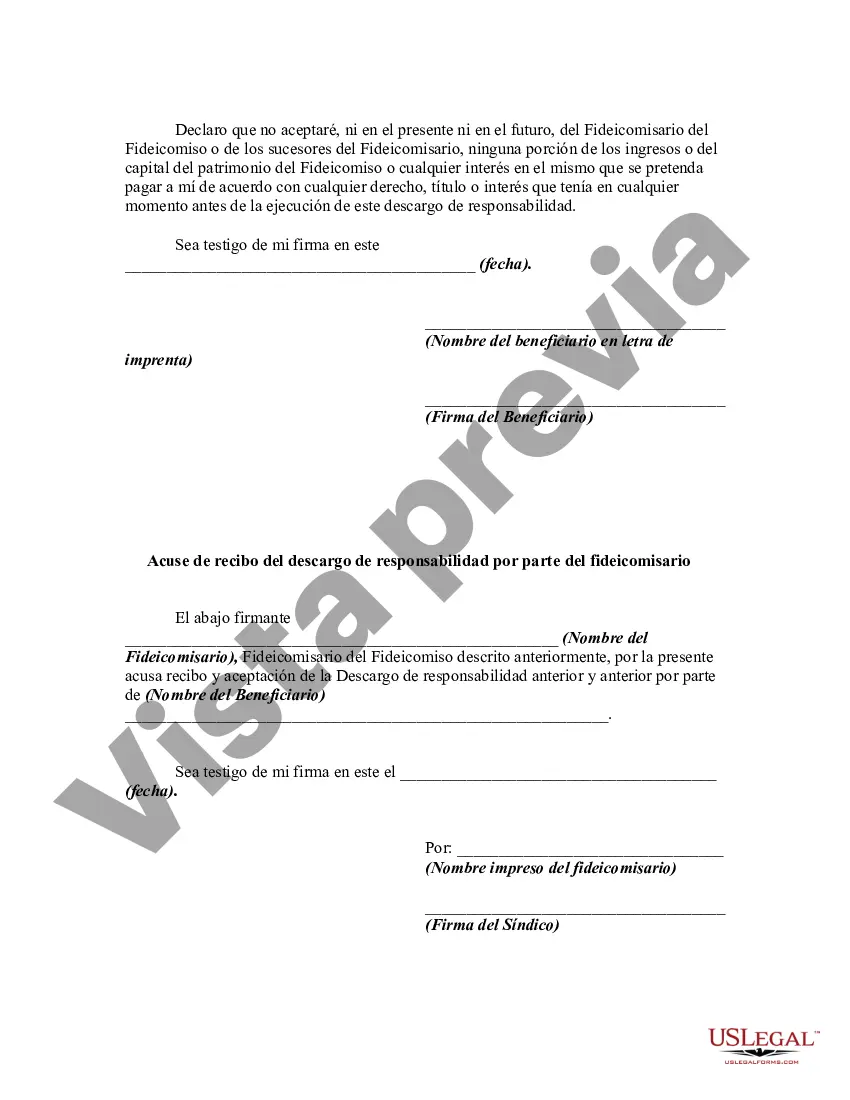

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

Pennsylvania Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: In Pennsylvania, a beneficiary of a trust has the option to disclaim or renounce all of their interest or rights in the trust. This disclaimer releases the beneficiary from any obligation or responsibility associated with the trust, allowing them to avoid potential liabilities or unwanted assets. When a beneficiary decides to disclaim their rights under a trust, they must do so by following specific procedures and fulfilling certain requirements. The disclaimer must be in writing and signed by the beneficiary, clearly stating their intention to disclaim all rights, powers, and benefits derived from the trust. The disclaimer document should include relevant keywords such as "Pennsylvania", "Disclaimer", "Beneficiary", "Rights under Trust", "Acceptance", and "Trustee" to ensure its authenticity and visibility in legal proceedings. It is essential to consult with an experienced attorney familiar with Pennsylvania trust laws to ensure compliance with all legal formalities and to protect the beneficiary's interests. Upon accepting the disclaimer, the trustee assumes the released rights and assets of the disclaiming beneficiary. The trustee is responsible for carrying out the terms and provisions of the trust document without the participation or interference of the disclaiming beneficiary. There are different types of Pennsylvania Disclaimer by Beneficiary of all Rights under Trust, including: 1. Partial Disclaimer: This type of disclaimer allows the beneficiary to disclaim only a portion of their interest in the trust, rather than the entire trust. This can be useful when the beneficiary wants to avoid specific assets or liabilities while still maintaining some involvement with the trust. 2. Qualified Disclaimer: A qualified disclaimer is a strategic option when a beneficiary wants to redirect their interest or rights in the trust to another person or entity. By disclaiming in a qualified manner, the beneficiary ensures that the designated alternative recipient receives their share of the trust assets according to the trust's provisions. 3. Time Limitations: It is crucial to note that beneficiaries must disclaim their rights within a specific timeframe. In Pennsylvania, this timeframe is generally nine months from either the date the trust comes into effect or the date the beneficiary turns 21, whichever is later. However, certain circumstances may allow for a longer period, so it's important to consult an attorney to determine the applicable time limits. In summary, the Pennsylvania Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a legal mechanism for beneficiaries to renounce their interest in a trust. It safeguards beneficiaries from potential liabilities while enabling the smooth administration of the trust by the trustee. Consulting with a knowledgeable attorney is advised to ensure compliance with Pennsylvania laws and to protect the beneficiary's interests.Pennsylvania Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee: In Pennsylvania, a beneficiary of a trust has the option to disclaim or renounce all of their interest or rights in the trust. This disclaimer releases the beneficiary from any obligation or responsibility associated with the trust, allowing them to avoid potential liabilities or unwanted assets. When a beneficiary decides to disclaim their rights under a trust, they must do so by following specific procedures and fulfilling certain requirements. The disclaimer must be in writing and signed by the beneficiary, clearly stating their intention to disclaim all rights, powers, and benefits derived from the trust. The disclaimer document should include relevant keywords such as "Pennsylvania", "Disclaimer", "Beneficiary", "Rights under Trust", "Acceptance", and "Trustee" to ensure its authenticity and visibility in legal proceedings. It is essential to consult with an experienced attorney familiar with Pennsylvania trust laws to ensure compliance with all legal formalities and to protect the beneficiary's interests. Upon accepting the disclaimer, the trustee assumes the released rights and assets of the disclaiming beneficiary. The trustee is responsible for carrying out the terms and provisions of the trust document without the participation or interference of the disclaiming beneficiary. There are different types of Pennsylvania Disclaimer by Beneficiary of all Rights under Trust, including: 1. Partial Disclaimer: This type of disclaimer allows the beneficiary to disclaim only a portion of their interest in the trust, rather than the entire trust. This can be useful when the beneficiary wants to avoid specific assets or liabilities while still maintaining some involvement with the trust. 2. Qualified Disclaimer: A qualified disclaimer is a strategic option when a beneficiary wants to redirect their interest or rights in the trust to another person or entity. By disclaiming in a qualified manner, the beneficiary ensures that the designated alternative recipient receives their share of the trust assets according to the trust's provisions. 3. Time Limitations: It is crucial to note that beneficiaries must disclaim their rights within a specific timeframe. In Pennsylvania, this timeframe is generally nine months from either the date the trust comes into effect or the date the beneficiary turns 21, whichever is later. However, certain circumstances may allow for a longer period, so it's important to consult an attorney to determine the applicable time limits. In summary, the Pennsylvania Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee provides a legal mechanism for beneficiaries to renounce their interest in a trust. It safeguards beneficiaries from potential liabilities while enabling the smooth administration of the trust by the trustee. Consulting with a knowledgeable attorney is advised to ensure compliance with Pennsylvania laws and to protect the beneficiary's interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.