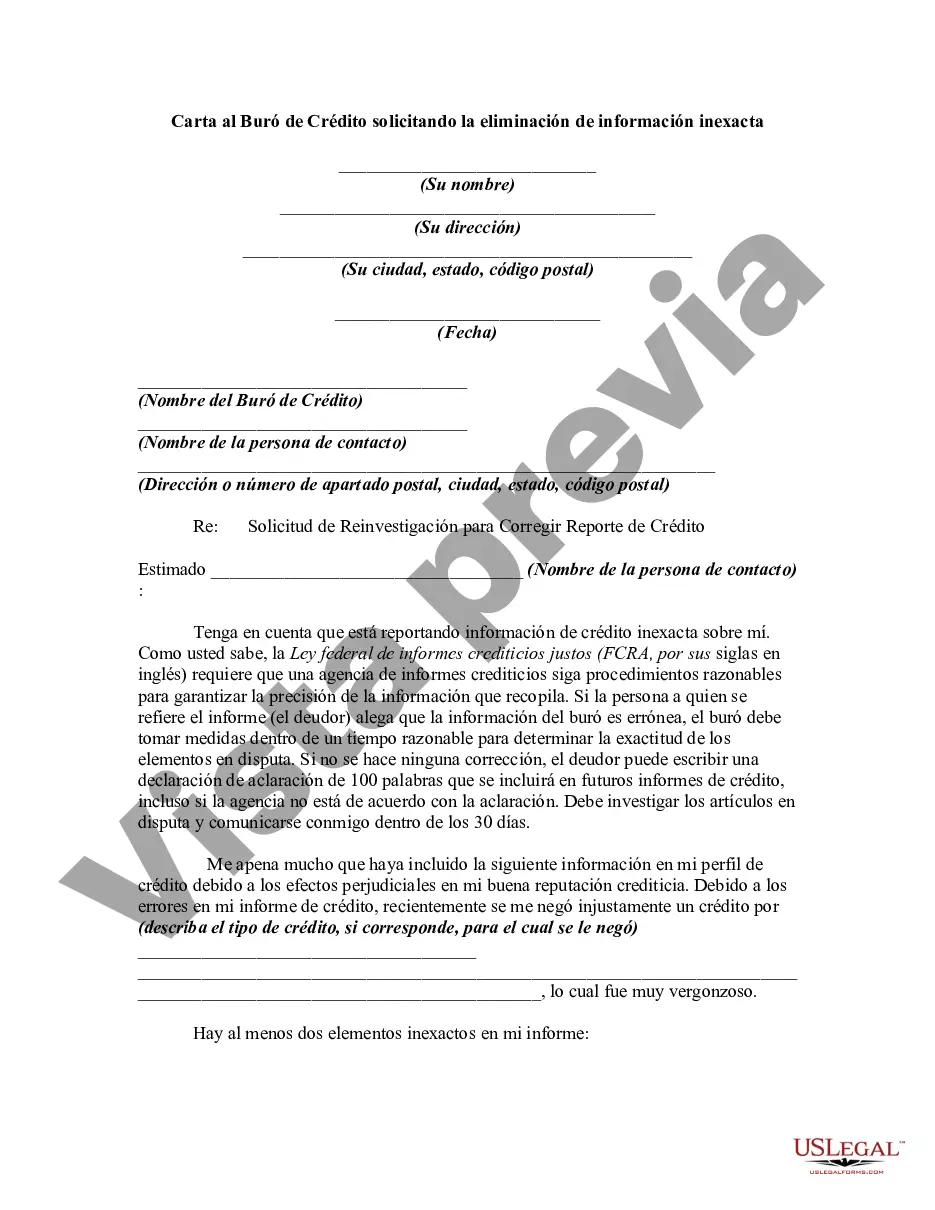

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Title: Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: Writing a Pennsylvania letter to a credit bureau is an effective way to address inaccuracies in your credit report. Such inaccuracies can negatively impact your credit score and financial opportunities. By sending a formal letter, you can request the removal of any erroneous information and ensure that your credit report reflects accurate and updated data for your financial well-being. Types of Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Pennsylvania Letter disputing inaccurate account information 2. Pennsylvania Letter disputing duplicate accounts or erroneous charges 3. Pennsylvania Letter requesting the removal of outdated negative information 4. Pennsylvania Letter addressing identity theft or fraudulent accounts 5. Pennsylvania Letter requesting the removal of a paid-off or settled debt Key Components of a Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Your Contact Information: Include your full name, current address, phone number, and email address for easy identification. 2. Credit Bureau Information: Clearly state the names and addresses of the credit bureaus you are writing to — such as Equifax, Experian, or TransUnion. 3. Account Details: Mention the specific account(s) in question, providing accurate and detailed information — such as account numbers, dates, and any supporting documents. 4. Identify Inaccuracies: Clearly state what information is inaccurate and explain the reasons behind your dispute, providing any evidence or supporting documents that prove the inaccuracies. 5. Formal Request for Removal: Specifically request the credit bureau to remove the inaccurate information from your credit report, emphasizing the importance of accurate reporting for your financial opportunities. 6. Supporting Documentation: Include copies of any relevant documents that support your claim, such as billing statements, payment receipts, or official correspondence. 7. Request Confirmation: Politely ask the credit bureau to confirm in writing that the disputed information has been removed or updated within the appropriate time frame, per the Fair Credit Reporting Act (FCRA). 8. Enclosure and Copy: State the documents enclosed with the letter and keep a copy of the letter and supporting documents for your records. 9. Professional Tone: Maintain a polite and professional tone throughout the letter, avoiding emotional language or unnecessary accusations. 10. Sender's Signature and Date: Sign the letter using your legal name and include the date to provide authenticity. Conclusion: Writing a well-crafted Pennsylvania letter to a credit bureau is an essential step in rectifying any inaccuracies that may affect your credit report. By including the necessary details and adhering to a professional tone, you increase the chances of having the disputed information removed or corrected promptly, ensuring your credit report reflects accurate and fair information.Title: Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information Introduction: Writing a Pennsylvania letter to a credit bureau is an effective way to address inaccuracies in your credit report. Such inaccuracies can negatively impact your credit score and financial opportunities. By sending a formal letter, you can request the removal of any erroneous information and ensure that your credit report reflects accurate and updated data for your financial well-being. Types of Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Pennsylvania Letter disputing inaccurate account information 2. Pennsylvania Letter disputing duplicate accounts or erroneous charges 3. Pennsylvania Letter requesting the removal of outdated negative information 4. Pennsylvania Letter addressing identity theft or fraudulent accounts 5. Pennsylvania Letter requesting the removal of a paid-off or settled debt Key Components of a Pennsylvania Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. Your Contact Information: Include your full name, current address, phone number, and email address for easy identification. 2. Credit Bureau Information: Clearly state the names and addresses of the credit bureaus you are writing to — such as Equifax, Experian, or TransUnion. 3. Account Details: Mention the specific account(s) in question, providing accurate and detailed information — such as account numbers, dates, and any supporting documents. 4. Identify Inaccuracies: Clearly state what information is inaccurate and explain the reasons behind your dispute, providing any evidence or supporting documents that prove the inaccuracies. 5. Formal Request for Removal: Specifically request the credit bureau to remove the inaccurate information from your credit report, emphasizing the importance of accurate reporting for your financial opportunities. 6. Supporting Documentation: Include copies of any relevant documents that support your claim, such as billing statements, payment receipts, or official correspondence. 7. Request Confirmation: Politely ask the credit bureau to confirm in writing that the disputed information has been removed or updated within the appropriate time frame, per the Fair Credit Reporting Act (FCRA). 8. Enclosure and Copy: State the documents enclosed with the letter and keep a copy of the letter and supporting documents for your records. 9. Professional Tone: Maintain a polite and professional tone throughout the letter, avoiding emotional language or unnecessary accusations. 10. Sender's Signature and Date: Sign the letter using your legal name and include the date to provide authenticity. Conclusion: Writing a well-crafted Pennsylvania letter to a credit bureau is an essential step in rectifying any inaccuracies that may affect your credit report. By including the necessary details and adhering to a professional tone, you increase the chances of having the disputed information removed or corrected promptly, ensuring your credit report reflects accurate and fair information.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.