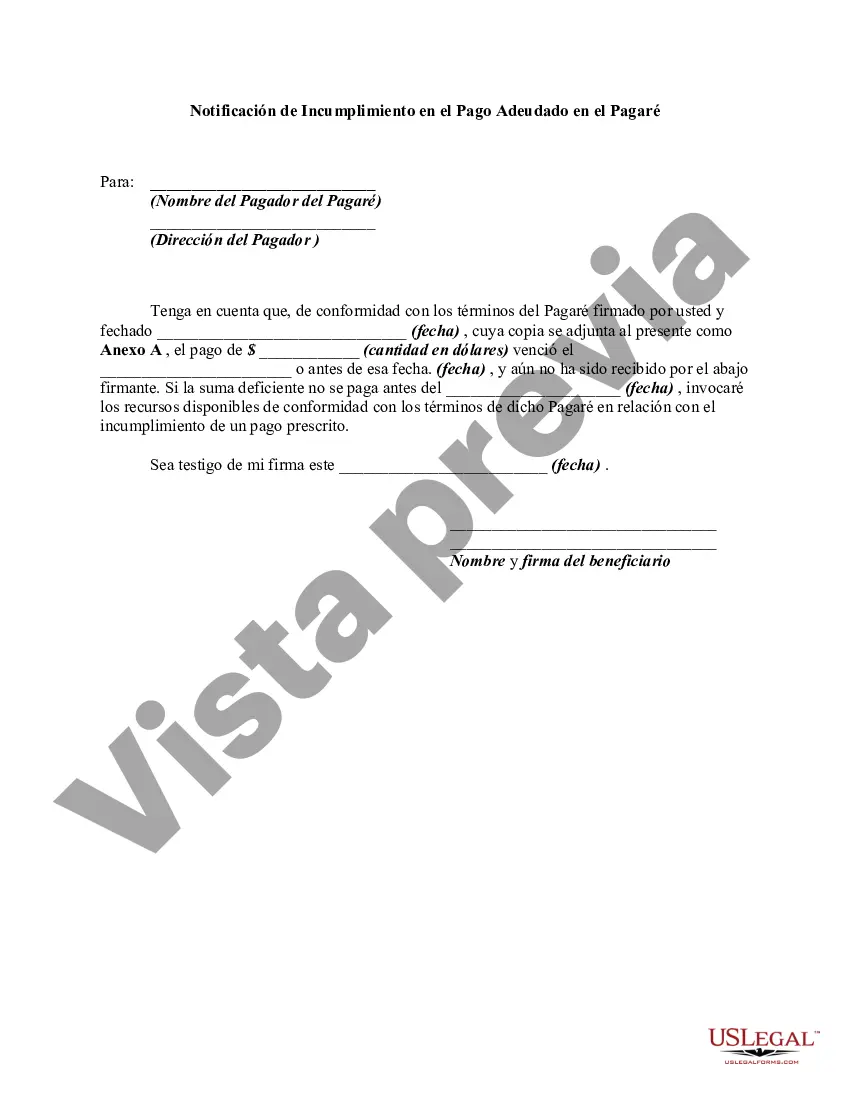

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Pennsylvania Notice of Default in Payment Due on Promissory Note A Pennsylvania Notice of Default in Payment Due on Promissory Note is a legal document that alerts a borrower of their failure to make payments according to the terms stated in a promissory note. This notice is typically sent by the lender or creditor to inform the borrower that they are in default and must take immediate action to rectify the situation. In Pennsylvania, there may be different types of Notice of Default in Payment Due on Promissory Note, depending on the specific circumstances. Some of these may include: 1. Pennsylvania Residential Promissory Note Default Notice: This type of notice is used when a borrower fails to make timely payments on a residential property loan. It outlines the specifics of the default, such as the overdue amount, due date, and the consequences of non-payment. 2. Pennsylvania Commercial Promissory Note Default Notice: In commercial transactions, when a borrower defaults on the payment obligations outlined in a promissory note related to a commercial property loan, this notice is issued. It highlights the breach of contract and the repercussions for non-payment. 3. Pennsylvania Student Loan Promissory Note Default Notice: This notice applies to borrowers who fail to meet their obligations under a student loan promissory note. It includes details about the default, such as the outstanding balance, late fees, and the steps that will be taken if the borrower doesn't resolve the default promptly. A Pennsylvania Notice of Default in Payment Due on Promissory Note typically consists of the following key information: 1. Identification of Parties: The notice identifies the lender or creditor, as well as the borrower or debtor involved in the promissory note. 2. Description of Default: The notice outlines the specific default, including the amount due, the due date, and any interest or penalties accrued as a result of the missed payment. 3. Timeframe for Cure: It provides a timeframe in which the borrower must remedy the default and bring the account up to date. This timeframe is usually based on the terms of the promissory note and any applicable state laws. 4. Consequences of Non-Payment: The notice explicitly states the consequences that may occur if the default is not rectified within the given timeframe. These consequences may include legal action, foreclosure (in the case of a property loan), or other remedies available to the lender. 5. Contact Information: The notice includes the lender's contact details, such as their name, address, phone number, and email, so that the borrower can get in touch to discuss the default and potential options for resolution. In conclusion, a Pennsylvania Notice of Default in Payment Due on Promissory Note is a critical legal document that notifies a borrower of their failure to meet payment obligations set forth in a promissory note. It aims to prompt the borrower to take immediate action to rectify the default and avoid further legal consequences.Pennsylvania Notice of Default in Payment Due on Promissory Note A Pennsylvania Notice of Default in Payment Due on Promissory Note is a legal document that alerts a borrower of their failure to make payments according to the terms stated in a promissory note. This notice is typically sent by the lender or creditor to inform the borrower that they are in default and must take immediate action to rectify the situation. In Pennsylvania, there may be different types of Notice of Default in Payment Due on Promissory Note, depending on the specific circumstances. Some of these may include: 1. Pennsylvania Residential Promissory Note Default Notice: This type of notice is used when a borrower fails to make timely payments on a residential property loan. It outlines the specifics of the default, such as the overdue amount, due date, and the consequences of non-payment. 2. Pennsylvania Commercial Promissory Note Default Notice: In commercial transactions, when a borrower defaults on the payment obligations outlined in a promissory note related to a commercial property loan, this notice is issued. It highlights the breach of contract and the repercussions for non-payment. 3. Pennsylvania Student Loan Promissory Note Default Notice: This notice applies to borrowers who fail to meet their obligations under a student loan promissory note. It includes details about the default, such as the outstanding balance, late fees, and the steps that will be taken if the borrower doesn't resolve the default promptly. A Pennsylvania Notice of Default in Payment Due on Promissory Note typically consists of the following key information: 1. Identification of Parties: The notice identifies the lender or creditor, as well as the borrower or debtor involved in the promissory note. 2. Description of Default: The notice outlines the specific default, including the amount due, the due date, and any interest or penalties accrued as a result of the missed payment. 3. Timeframe for Cure: It provides a timeframe in which the borrower must remedy the default and bring the account up to date. This timeframe is usually based on the terms of the promissory note and any applicable state laws. 4. Consequences of Non-Payment: The notice explicitly states the consequences that may occur if the default is not rectified within the given timeframe. These consequences may include legal action, foreclosure (in the case of a property loan), or other remedies available to the lender. 5. Contact Information: The notice includes the lender's contact details, such as their name, address, phone number, and email, so that the borrower can get in touch to discuss the default and potential options for resolution. In conclusion, a Pennsylvania Notice of Default in Payment Due on Promissory Note is a critical legal document that notifies a borrower of their failure to meet payment obligations set forth in a promissory note. It aims to prompt the borrower to take immediate action to rectify the default and avoid further legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.