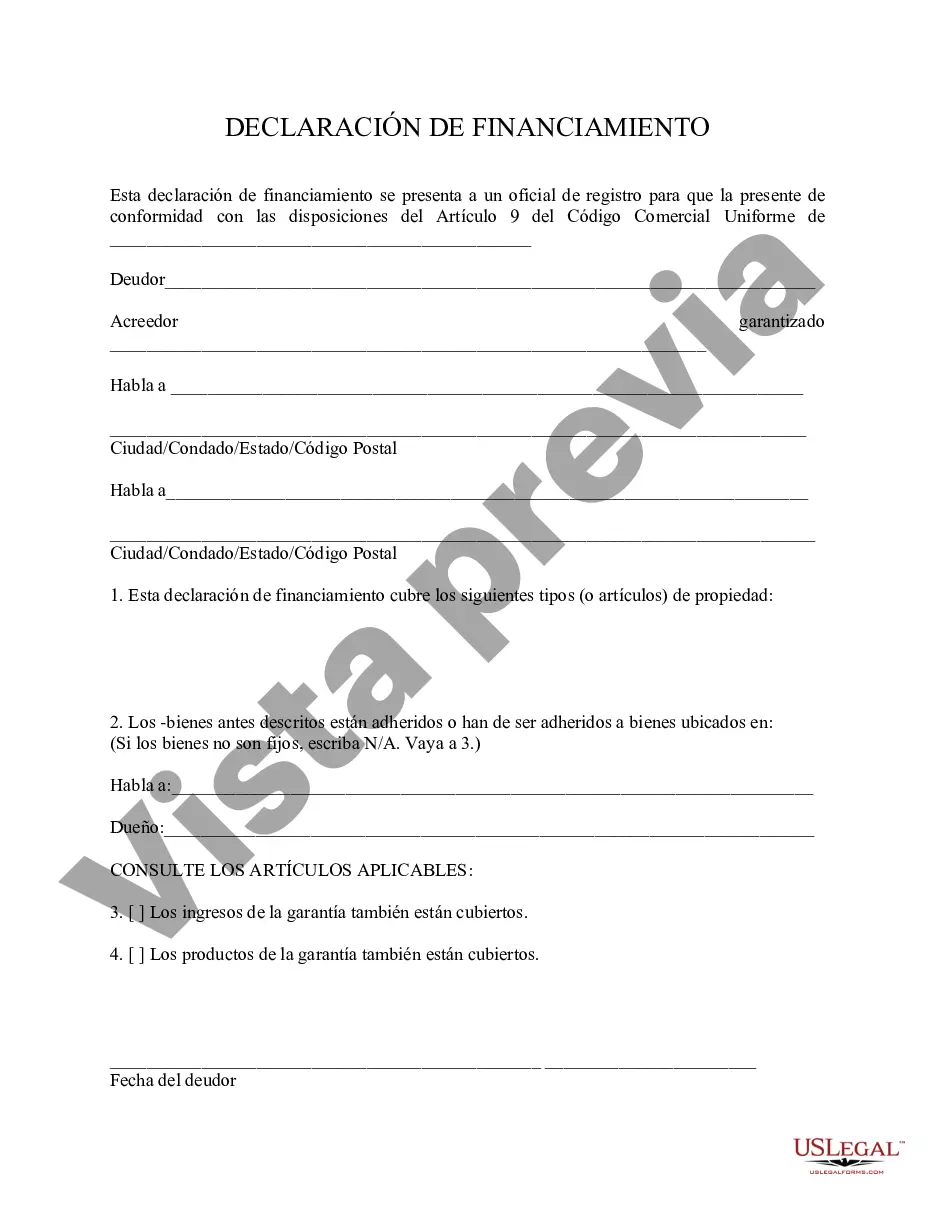

Pennsylvania Financing Statement is a legal document that plays a crucial role in the realm of secured transactions. It is filed by individuals, businesses, or other entities to publicly record their interest in collateral or assets that they have or will have an interest in. This statement is governed by the Uniform Commercial Code (UCC) and is typically used to ensure the priority of a secured party's claim in case of debtor default or bankruptcy. A Pennsylvania Financing Statement is designed to provide notice to other potential creditors or interested parties regarding the existence of a lien or security interest on particular collateral. By filing this statement with the Pennsylvania Secretary of State's office or any other authorized filing office, it serves as a public record and alerts others about the secured party's claim on the listed collateral. The Pennsylvania Financing Statement includes various essential details that accurately identify the debtor, secured party, and collateral. Some key information typically found in a financing statement may include: 1. Debtor Information: The name and address of the debtor or debtors must be clearly stated. It is crucial to provide accurate details to ensure proper identification. 2. Secured Party Information: The name and address of the secured party or parties should be provided. This allows for easy identification and contact. 3. Collateral Description: A detailed description of the collateral is required. The description must be accurate and specific, identifying the assets or property subject to the security interest. 4. Additional Provisions: The financing statement may contain additional provisions or clauses related to any special terms or agreements between the debtor and secured party. It is important to note that Pennsylvania Financing Statement requires a filing fee, which may vary depending on the number of pages and the type of collateral being filed. The fees are typically set by the Pennsylvania Secretary of State. Pennsylvania has various types of Financing Statements depending on the nature of the transaction and collateral involved. Some commonly used types include: 1. Security Agreement: This financing statement is used when a debtor grants a security interest to a secured party in specific collateral as a form of lateralization for a loan or credit facility. 2. Fixture Filing: It is used when a security interest is claimed in goods that are considered fixtures, meaning they are attached to the real estate and are typically part of the property. 3. Agricultural Lien: This type of financing statement is specific to agricultural transactions and covers agricultural products, animals, and crops. 4. Transmitting Utilities: It is applicable to transactions involving the sale or lease of assets owned by utility companies, such as power plants, transmission lines, and distribution systems. In summary, a Pennsylvania Financing Statement is a legal document filed to establish and prioritize a secured party's claim against collateral. By providing comprehensive information about debtors, secured parties, and collateral, it ensures proper notice to potential creditors and interested parties. Different types of financing statements exist to cater to specific transactions and collateral types, such as security agreements, fixture filings, agricultural liens, and transmitting utilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Declaración de Financiamiento - Financing Statement

Description

How to fill out Pennsylvania Declaración De Financiamiento?

Are you presently inside a situation where you will need paperwork for possibly company or person functions nearly every day? There are a lot of legal record themes accessible on the Internet, but locating kinds you can rely on is not straightforward. US Legal Forms gives 1000s of type themes, such as the Pennsylvania Financing Statement, that happen to be written to fulfill state and federal specifications.

If you are currently acquainted with US Legal Forms internet site and get an account, basically log in. After that, you are able to down load the Pennsylvania Financing Statement web template.

If you do not come with an profile and need to start using US Legal Forms, adopt these measures:

- Find the type you need and ensure it is to the correct town/state.

- Use the Review option to check the form.

- See the explanation to actually have selected the right type.

- When the type is not what you are searching for, make use of the Search area to obtain the type that meets your requirements and specifications.

- Whenever you discover the correct type, click on Get now.

- Pick the rates plan you would like, submit the desired information and facts to make your account, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Select a convenient document format and down load your backup.

Locate all the record themes you have bought in the My Forms menus. You may get a additional backup of Pennsylvania Financing Statement whenever, if necessary. Just go through the needed type to down load or produce the record web template.

Use US Legal Forms, one of the most substantial variety of legal types, to save some time and steer clear of faults. The support gives appropriately produced legal record themes which you can use for a range of functions. Generate an account on US Legal Forms and initiate creating your life easier.