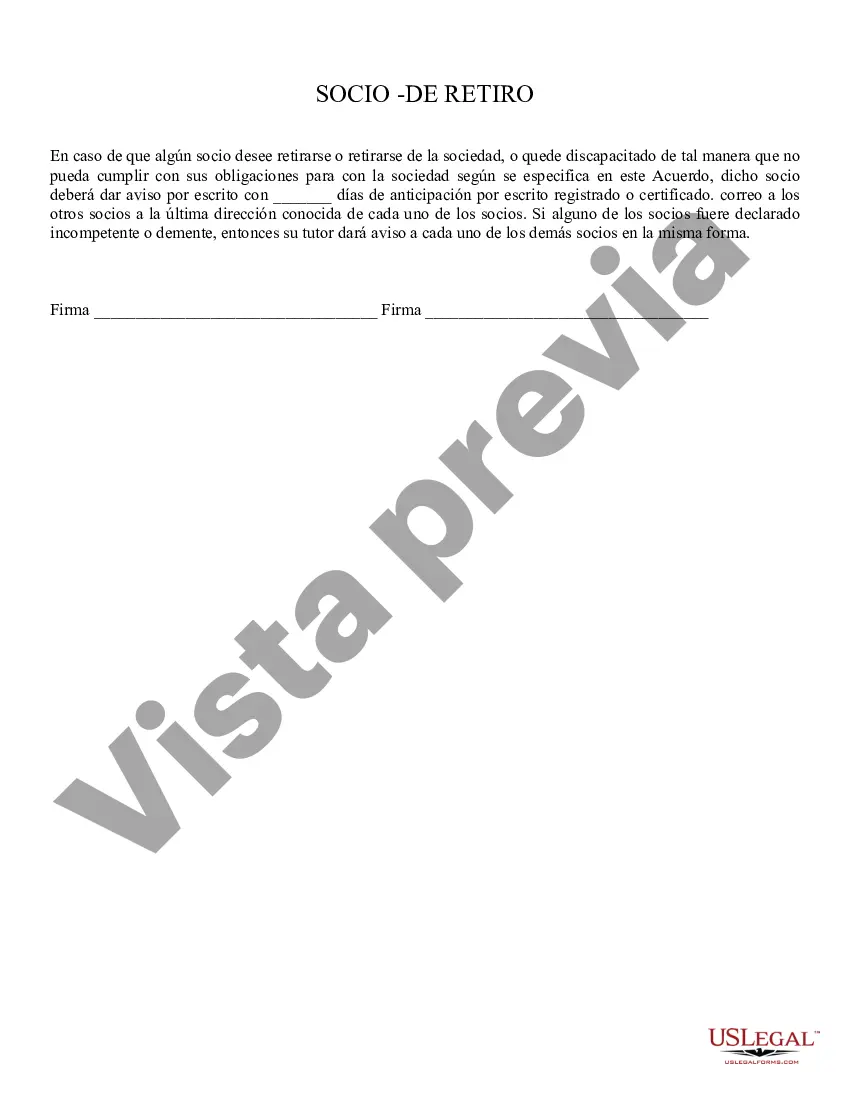

Title: Pennsylvania Withdrawal of Partner — A Comprehensive Guide to Dissolving Business Partnerships Introduction: Pennsylvania Withdrawal of Partner refers to the legal process of ending a partner's involvement in a business entity registered in the state of Pennsylvania. Whether a partnership operated under a general partnership, limited partnership, or limited liability partnership (LLP) structure, dissolving the partnership requires careful adherence to Pennsylvania's specific laws and regulations. This article aims to provide a detailed insight into Pennsylvania's Withdrawal of Partner procedures, covering essential legal aspects and key considerations. Types of Pennsylvania Withdrawal of Partner: 1. Withdrawal of Partner in a General Partnership: — General partners in a general partnership have unlimited personal liability for the partnership's actions. When a partner decides to withdraw, they must adhere to the terms laid out in the partnership agreement or the Pennsylvania Uniform Partnership Act (UPA). 2. Withdrawal of Partner in a Limited Partnership: — Limited partnerships comprise general partners (with unlimited liability) and limited partners (with limited liability). Removing a limited partner typically has less legal complexities, but it is crucial to consult the partnership agreement and the Pennsylvania Revised Uniform Limited Partnership Act (RULE) for proper procedures. 3. Withdrawal of Partner in a Limited Liability Partnership (LLP): — In an LLP, partners enjoy limited liability protection, shielding their personal assets from business liabilities. The procedures for withdrawal may vary depending on the partnership agreement, the Revised Uniform Partnership Act (RPA), or other applicable regulations. Key Steps in Pennsylvania Withdrawal of Partner Process: 1. Review Partnership Agreement: Carefully examine the partnership agreement governing the withdrawal process, if any, and ascertain any restrictions, notification requirements, or distribution of assets upon withdrawal. 2. Assemble Necessary Documentation: Prepare and gather essential documents, including the partnership agreement, withdrawal notice, written consent from the remaining partners, and any necessary forms provided by the Pennsylvania Department of State. 3. Communicate with Partners: Notify all partners involved in the partnership about the departing partner's intention to withdraw, preferably in writing. Consult the partnership agreement for any specified methods of communication or duration of notice required. 4. File Appropriate Forms: Submit the completed withdrawal notice and any other relevant forms to the Pennsylvania Department of State, as per the instructions provided. Pay any applicable fees associated with the withdrawal process. 5. Liquidation and Distribution of Assets: Depending on the partnership agreement and Pennsylvania partnership laws, partners may need to liquidate partnership assets and settle any outstanding debts or obligations. Distribution of remaining assets should be in accordance with the partnership agreement or state laws. 6. Update Relevant Authorities and Contracts: Notify relevant entities, such as banks, creditors, vendors, and regulatory bodies, about the withdrawal of the partner. Amend any contracts, licenses, permits, or agreements that mention the withdrawing partner. Conclusion: Pennsylvania Withdrawal of Partner involves a structured legal process that must be followed accurately to protect the rights and interests of all parties involved. Depending on the partnership structure, compliance with the partnership agreement and applicable Pennsylvania partnership laws is crucial. Seeking professional legal assistance and adhering to the specific requirements outlined in the respective acts mentioned above serve as vital steps toward a seamless withdrawal process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Retiro de socio - Withdrawal of Partner

Description

How to fill out Pennsylvania Retiro De Socio?

You can invest hrs on the Internet attempting to find the legal record template that fits the state and federal demands you need. US Legal Forms provides thousands of legal forms that happen to be analyzed by professionals. You can actually download or print out the Pennsylvania Withdrawal of Partner from our support.

If you have a US Legal Forms account, you are able to log in and click the Acquire button. After that, you are able to full, edit, print out, or sign the Pennsylvania Withdrawal of Partner. Each legal record template you purchase is the one you have for a long time. To get another backup for any bought develop, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms website the first time, keep to the easy directions listed below:

- Very first, make sure that you have chosen the best record template to the area/area that you pick. Read the develop information to make sure you have chosen the proper develop. If offered, make use of the Review button to check through the record template as well.

- If you want to locate another version of the develop, make use of the Lookup industry to find the template that fits your needs and demands.

- Once you have located the template you would like, click Acquire now to move forward.

- Select the costs strategy you would like, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal account to fund the legal develop.

- Select the structure of the record and download it to the product.

- Make modifications to the record if possible. You can full, edit and sign and print out Pennsylvania Withdrawal of Partner.

Acquire and print out thousands of record templates utilizing the US Legal Forms web site, which provides the most important assortment of legal forms. Use specialist and express-specific templates to take on your company or personal requirements.