Pennsylvania Equity Share Agreement is a legal document that outlines the terms and conditions regarding the ownership rights and financial obligations of individuals or entities who agree to share equity in a business or property located in the state of Pennsylvania. This agreement specifically applies to equity sharing arrangements in Pennsylvania and ensures transparency and fairness among the parties involved. In Pennsylvania, there are various types of Equity Share Agreements that cater to different situations and industries. Some common types include: 1. Real Estate Equity Share Agreement: This type of agreement is commonly used when multiple parties invest in a property together, such as a residential or commercial building. It outlines the proportion of equity each party has in the property, their financial responsibilities, and any profit-sharing arrangements. 2. Business Equity Share Agreement: It is used when individuals or entities invest in a Pennsylvania-based business. This agreement establishes the equity percentages of each investor, their roles and responsibilities, voting rights, and how profits or losses will be distributed. 3. Start-up Equity Share Agreement: This type of agreement is specifically designed for start-ups or early-stage businesses in Pennsylvania. It outlines the allocation of equity among founders, investors, and possibly key employees. Additionally, it may include vesting schedules, buyout options, and intellectual property rights. 4. Venture Equity Share Agreement: In cases where a business in Pennsylvania receives venture capital funding, a Venture Equity Share Agreement is commonly used. This agreement details the equity arrangement between the business and the venture capital firm, including any special provisions or conditions related to the investment. 5. Joint Venture Equity Share Agreement: When two or more parties decide to collaborate on a specific project in Pennsylvania, a Joint Venture Equity Share Agreement is employed. This agreement defines the equity distribution, decision-making rights, and profit-sharing arrangements among the joint venture partners. Pennsylvania Equity Share Agreements encompass both the legal aspects and financial aspects of equity sharing agreements, ensuring that all parties involved have a clear understanding of their rights, obligations, and potential returns. It is important to consult with a qualified attorney familiar with Pennsylvania law to draft or review any Equity Share Agreement to ensure compliance with state regulations and protection of one's interests.

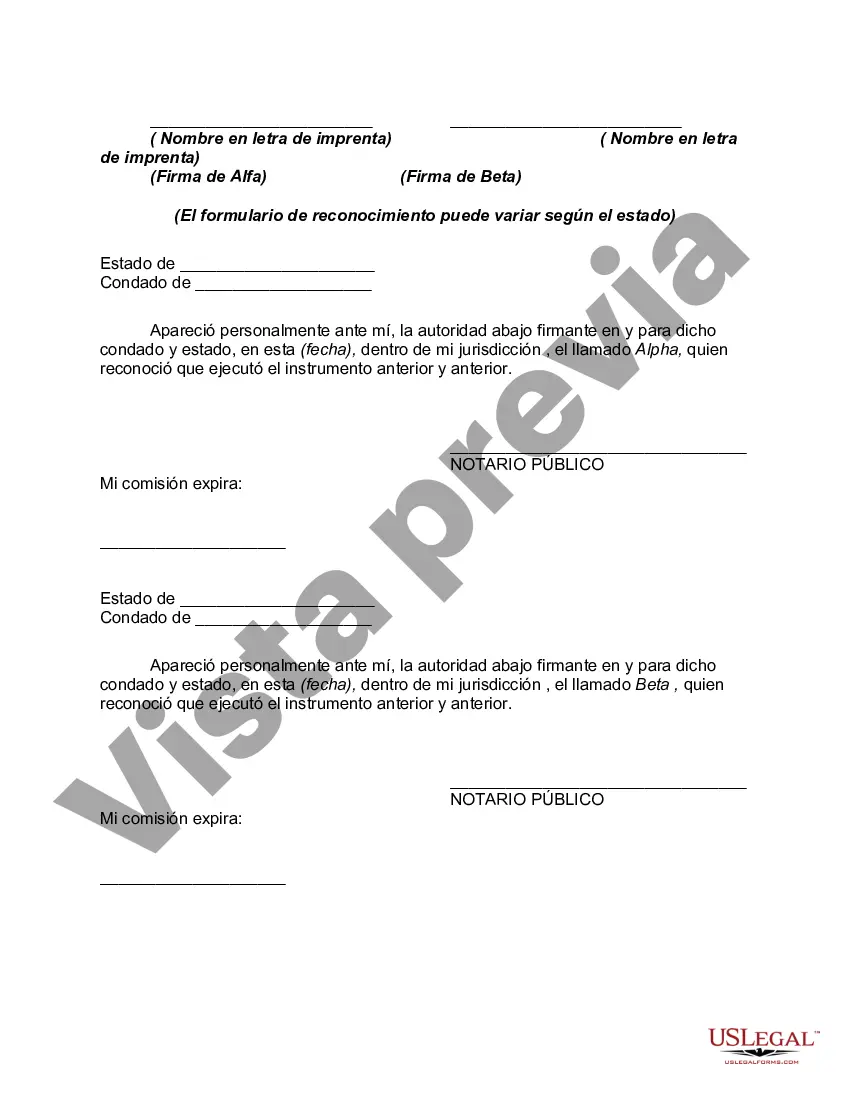

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Acuerdo de acciones de capital - Equity Share Agreement

Description

How to fill out Pennsylvania Acuerdo De Acciones De Capital?

If you need to complete, acquire, or print out legitimate document templates, use US Legal Forms, the largest collection of legitimate forms, that can be found on the Internet. Take advantage of the site`s simple and convenient research to discover the documents you require. Various templates for enterprise and personal purposes are categorized by groups and suggests, or keywords. Use US Legal Forms to discover the Pennsylvania Equity Share Agreement in a couple of click throughs.

Should you be currently a US Legal Forms customer, log in to your accounts and then click the Acquire key to get the Pennsylvania Equity Share Agreement. You can also access forms you earlier acquired inside the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your correct city/land.

- Step 2. Take advantage of the Review choice to look through the form`s information. Don`t forget to read the description.

- Step 3. Should you be unhappy with all the type, utilize the Search area towards the top of the display to find other models of the legitimate type web template.

- Step 4. After you have located the shape you require, go through the Get now key. Choose the pricing strategy you prefer and include your accreditations to register to have an accounts.

- Step 5. Process the transaction. You should use your charge card or PayPal accounts to complete the transaction.

- Step 6. Choose the file format of the legitimate type and acquire it in your system.

- Step 7. Comprehensive, change and print out or signal the Pennsylvania Equity Share Agreement.

Each legitimate document web template you buy is yours for a long time. You may have acces to every type you acquired inside your acccount. Click on the My Forms portion and pick a type to print out or acquire yet again.

Be competitive and acquire, and print out the Pennsylvania Equity Share Agreement with US Legal Forms. There are millions of expert and express-specific forms you can utilize to your enterprise or personal demands.