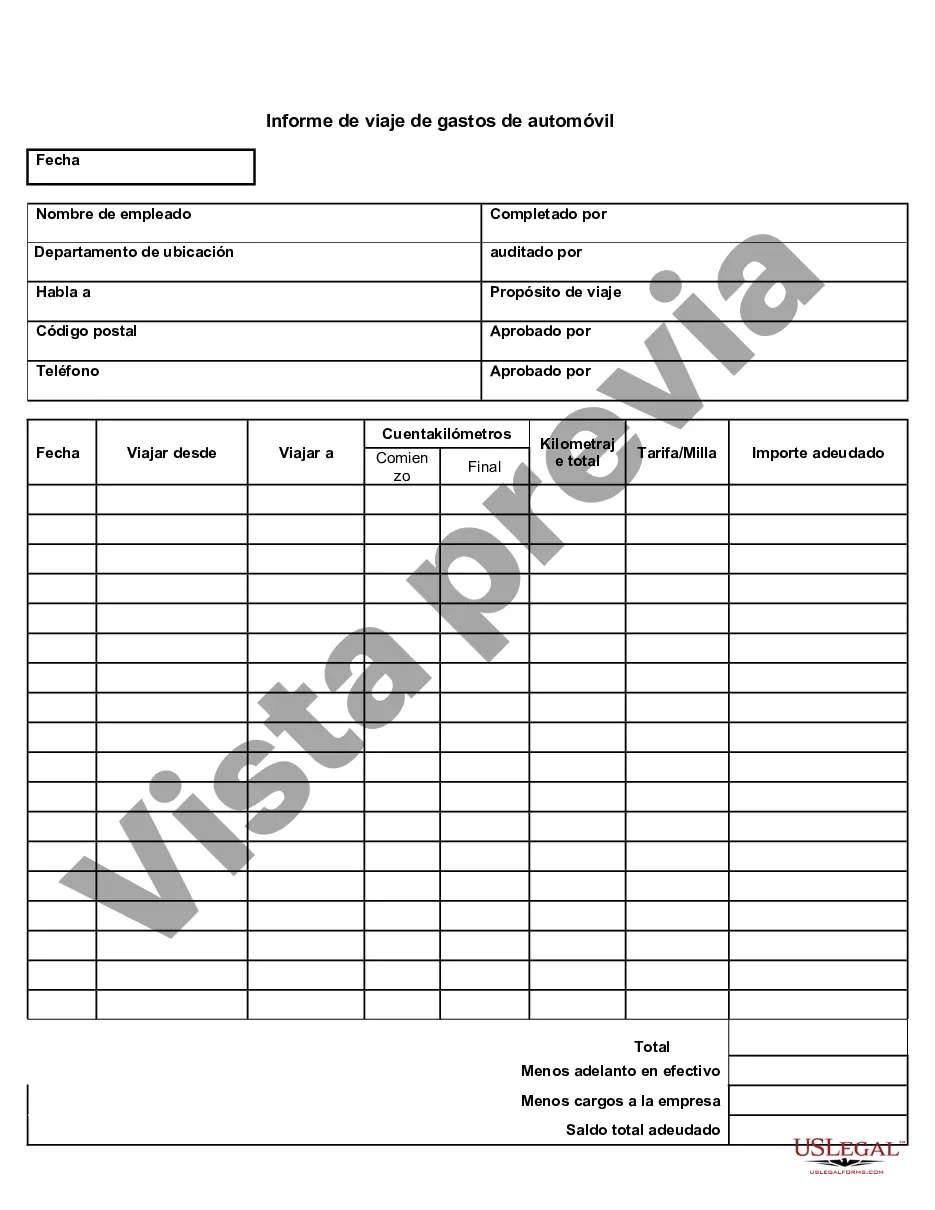

Pennsylvania Auto Expense Travel Report is a document used to record and report travel-related expenses incurred while using personal vehicles for official purposes in Pennsylvania. This report helps individuals or organizations track and claim reimbursement for transportation costs associated with business travel. By accurately documenting all expenses, it ensures transparency and accountability while complying with financial and tax regulations. Here are some relevant keywords associated with Pennsylvania Auto Expense Travel Report: 1. Pennsylvania: Refers to the state where the travel took place and where the report needs to be filed. 2. Auto: Indicates the usage of personal vehicles for transportation purposes during travel. 3. Expense: All costs related to the trip, including fuel, tolls, parking fees, repairs, maintenance, insurance, and other vehicle-related expenses. 4. Travel: Implies that the report specifically relates to business or official travel. 5. Report: The formal documentation prepared to summarize and detail the auto-related expenses incurred during the trip. 6. Reimbursement: The process of getting compensated for the out-of-pocket expenses through an authorized reimbursement mechanism. 7. Transportation: Refers to the mode of travel and all related costs incurred during the journey. 8. Business: Indicates the purpose of the travel, primarily for work-related activities, meetings, conferences, or site visits. 9. Personal vehicles: Specifies that the report focuses on expenses associated with privately-owned cars, vans, or trucks. 10. Financial Regulations: The rules and guidelines that dictate how the expenses should be reported and reimbursed, ensuring compliance with relevant financial and tax laws. The types of Pennsylvania Auto Expense Travel Reports can vary based on the purpose, duration, and category of travel. Some possible variations may include: 1. Short-term Business Travel Report: Specifically for business trips that last for a relatively shorter duration, typically less than a week. 2. Long-term Business Travel Report: Pertains to extended business trips that span several weeks or months, often requiring more comprehensive expense tracking. 3. Mileage Expense Report: Focuses on recording and reimbursing mileage-based expenses for using personal vehicles, usually capturing the number of miles traveled and multiplying it by a fixed or variable reimbursement rate. 4. Fleet Vehicle Expense Report: Relevant for individuals or organizations that own multiple company vehicles, allowing them to keep track of expenses associated with the entire fleet. 5. Emergency Travel Expense Report: Used in situations where travel is undertaken due to unforeseen circumstances or emergencies, enabling individuals to document and claim necessary expenses related to transportation. 6. Fixed Per Diem Travel Report: In some cases, instead of reporting individual expenses, a fixed per diem rate is provided to cover all travel costs, and this report is used to record and verify that the per diem rate was sufficient. By using a Pennsylvania Auto Expense Travel Report, individuals can accurately document, summarize, and claim reimbursement for auto-related expenses associated with official travel, ensuring compliance with financial regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Informe de viaje de gastos de automóvil - Auto Expense Travel Report

Description

How to fill out Pennsylvania Informe De Viaje De Gastos De Automóvil?

If you have to comprehensive, acquire, or produce legal papers layouts, use US Legal Forms, the biggest assortment of legal varieties, which can be found online. Utilize the site`s simple and convenient research to obtain the papers you will need. Different layouts for company and personal purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to obtain the Pennsylvania Auto Expense Travel Report with a number of click throughs.

When you are presently a US Legal Forms buyer, log in to the profile and click the Down load button to have the Pennsylvania Auto Expense Travel Report. You can also entry varieties you formerly delivered electronically inside the My Forms tab of your profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for your proper city/country.

- Step 2. Make use of the Review option to examine the form`s articles. Do not neglect to learn the information.

- Step 3. When you are not happy with the form, take advantage of the Lookup field on top of the display to find other versions from the legal form format.

- Step 4. When you have discovered the shape you will need, select the Purchase now button. Opt for the prices program you prefer and add your credentials to register on an profile.

- Step 5. Procedure the deal. You can utilize your charge card or PayPal profile to finish the deal.

- Step 6. Find the format from the legal form and acquire it on your gadget.

- Step 7. Total, revise and produce or sign the Pennsylvania Auto Expense Travel Report.

Every single legal papers format you get is yours permanently. You may have acces to every form you delivered electronically in your acccount. Click on the My Forms portion and select a form to produce or acquire once more.

Be competitive and acquire, and produce the Pennsylvania Auto Expense Travel Report with US Legal Forms. There are many specialist and state-distinct varieties you can utilize for your personal company or personal demands.