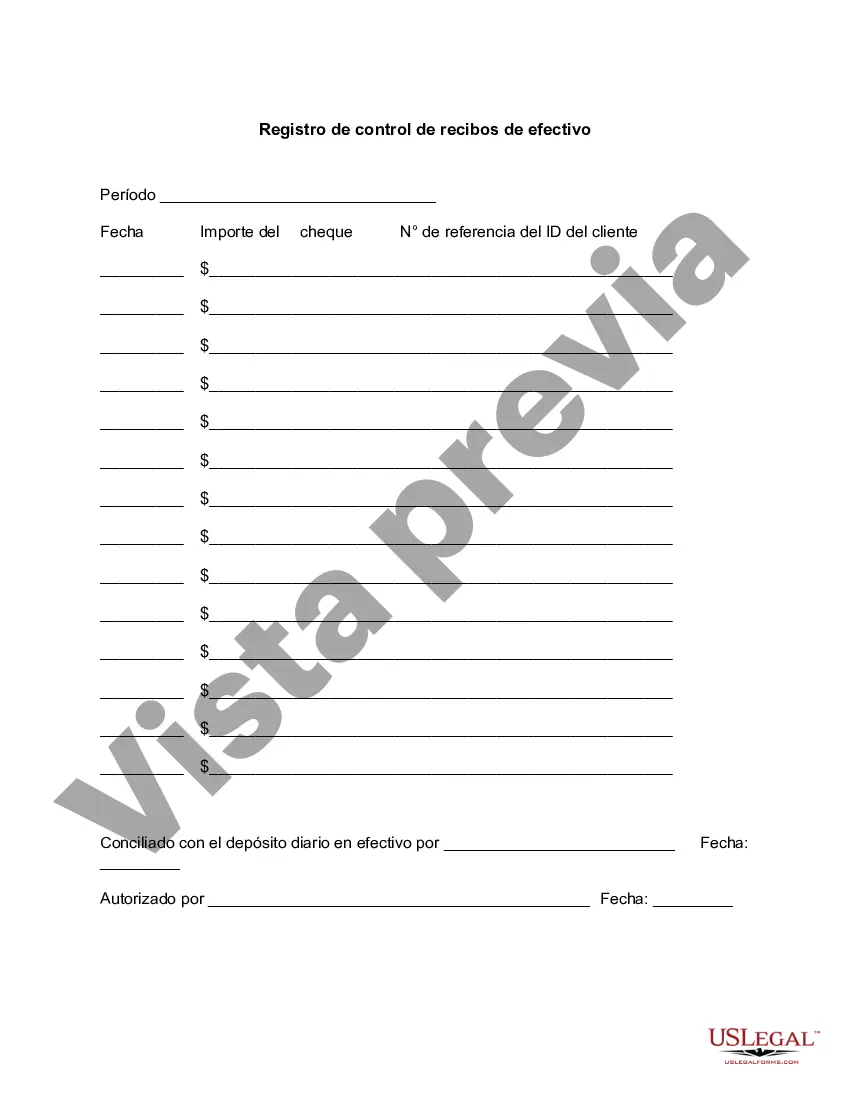

Pennsylvania Cash Receipts Control Log is an essential financial tool used by businesses and organizations in Pennsylvania to monitor and track all cash transactions systematically. This log provides a detailed record of cash receipts, ensuring transparency, accuracy, and proper internal control over funds. The primary purpose of the Pennsylvania Cash Receipts Control Log is to maintain a comprehensive overview of all incoming cash flows. It serves as a centralized repository to record every cash transaction, such as sales, donations, rental income, fees, or any form of cash income. By diligently capturing each transaction on the log, it minimizes the risk of mishandling or misplacing funds. Key features and sections commonly found in the Pennsylvania Cash Receipts Control Log include: 1. Date: Each entry includes the date when the cash transaction occurred, allowing for chronological organization and reference. 2. Description: A brief explanation or purpose of the cash inflow is recorded to provide context. For instance, if the transaction is a product sale, the product name and quantity may be mentioned. 3. Amount: This section documents the exact cash amount involved in the transaction, ensuring accurate tracking of financial resources. 4. Source: The source of the cash receipt is specified to identify the origin of the funds, whether it was from a customer, grant, rental payment, or another source. 5. Check/Credit Card/PayPal/Routing Number, etc.: If the transaction involves any of these payment methods, the pertinent information related to that method is recorded in this section. 6. Receipt Number: A unique identifier, typically generated by the business, is used to link cash receipts to corresponding receipts issued to customers. This aids in resolving customer queries and simplifies the reconciliation process. It is important to note that there might be variations or customized versions of the Pennsylvania Cash Receipts Control Log based on the specific needs of different businesses or organizations. Some variations may include additional sections such as department or account number, employee responsible for the transaction, or any other information that enhances internal control and reporting processes. Overall, the Pennsylvania Cash Receipts Control Log is a vital tool in ensuring accurate financial tracking, maintaining accountability, promoting transparency, and facilitating effective management of cash inflows for organizations operating in the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pennsylvania Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out Pennsylvania Registro De Control De Recibos De Efectivo?

You may devote time on the web attempting to find the legal file format that fits the federal and state needs you require. US Legal Forms offers thousands of legal kinds that are analyzed by pros. You can easily download or produce the Pennsylvania Cash Receipts Control Log from the assistance.

If you currently have a US Legal Forms account, it is possible to log in and click the Down load switch. After that, it is possible to full, change, produce, or indicator the Pennsylvania Cash Receipts Control Log. Every single legal file format you purchase is yours eternally. To obtain yet another copy of the bought kind, check out the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site initially, keep to the easy recommendations beneath:

- Initial, make sure that you have chosen the right file format for your county/area of your choosing. See the kind explanation to make sure you have picked out the correct kind. If available, use the Preview switch to search throughout the file format also.

- If you want to get yet another variation of the kind, use the Research industry to discover the format that meets your requirements and needs.

- After you have identified the format you need, click on Acquire now to carry on.

- Select the rates plan you need, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You may use your bank card or PayPal account to cover the legal kind.

- Select the file format of the file and download it for your system.

- Make changes for your file if possible. You may full, change and indicator and produce Pennsylvania Cash Receipts Control Log.

Down load and produce thousands of file web templates utilizing the US Legal Forms web site, that provides the biggest variety of legal kinds. Use skilled and condition-specific web templates to deal with your company or individual requires.